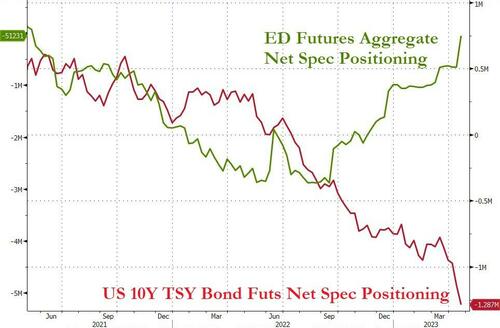

Extreme positioning (bonds record short) meets macro weakness (sentiment and soft data crashing) meets liquidity suck (M2 collapsing) meets systemic threats (debt ceiling) meets idiosyncratic problems (FRC – banking system, and UPS – consumer) – quite a day!!

The world and his pet rabbit started the day off short Treasuries…

An ugly day for US macro didn’t help (aside from new home sales which jumped on giant subsidies)…

Source: Bloomberg

And liquidity is collapsing more (M2 down over 4% YoY)…

Source: Bloomberg

FRC reported far worse than expected deposit outflows and yesterday’s gains were eviscerated to take the stock down 50% back to record lows (and reignite banking crisis fears), accelerated to the downside by talk of asset sales (which if they can actually pull off would be a good thing)…

For some more context, FRC was trading $120 just six weeks ago… and is now below $8…

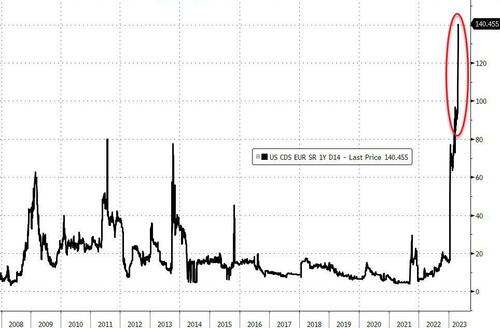

USA Sovereign risk soared once again to a new record as the X-Date looms closer amid dismal tax receipts…

Source: Bloomberg

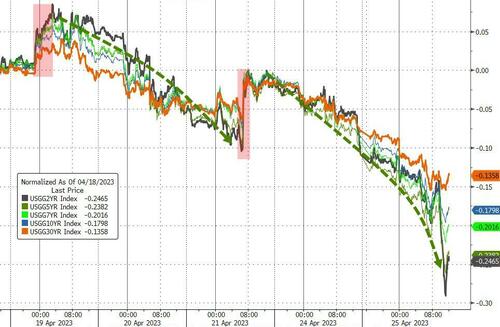

Treasury yields tumbled today with the short-end dramatically outperforming (2Y -14bps, 30Y -6bps) extending the short-squeeze from last Tuesday…

Source: Bloomberg

2Y yields tumbled below 4.00%

Source: Bloomberg

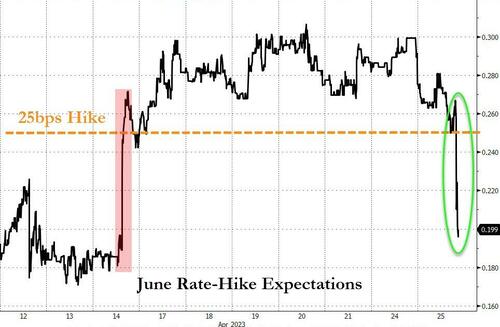

The market has now priced out a full 25bps rate-hike this year…

Source: Bloomberg

The yield curve (3m10Y) flattened notably today (-12bps to -167bps)…

Source: Bloomberg

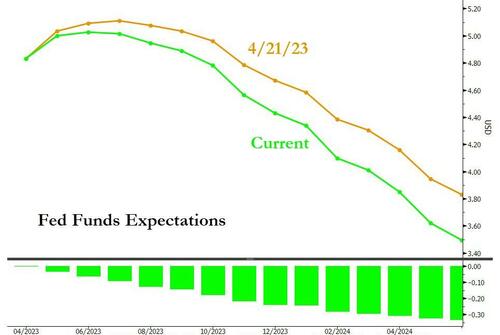

The Fed Funds curve has tumbled notably this week…

Source: Bloomberg

Small Caps were the ugliest horse in the glue factory today, followed by Nasdaq (-1.9%) and the S&P (down 1.6%). The Dow was the least bad of the majors, down 1% on the day…

This is the first close down more than 1% for the S&P in over a month

The S&P held at critical support, with the next stop down to its 50DMA at around 4033…

1-Day VIX exploded higher today, from an 8 handle to above 16, compressing its spread to VIX…

Source: Bloomberg

Turns out VVIX was right after all…

Source: Bloomberg

The dollar surged back to recent highs today (which looks like safe-haven bid as STIRs dived dovishly)…

Source: Bloomberg

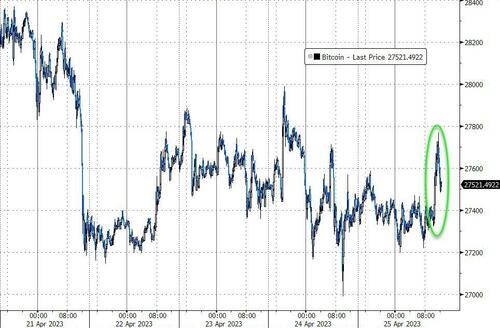

Crypto was quiet for a change with Bitcoin very modestly higher, holding around $27,500…

Source: Bloomberg

Spot Gold rallied back above $2,000 twice today but was unable to hold it…

Source: Bloomberg

Oil prices clipped lower with WTI briefly back to a $76 handle…

Finally, worsening liquidity conditions and significant event risk coming ever closer is a decidedly negative set of circumstances. Yet despite this, there seems to be a general consensus that a) the debt ceiling will be avoided; and b) the uncertainty in the run up to X-Day is unlikely to have a notable market impact.

However, today’s price action – especially in 0DTE, where there was a regime-shift from fading market trends to becoming an ‘accelerant flow’ – suggests fear is starting to mount that both a) and b) reflect too much complacency after all…

Source: SpotGamma

The debt ceiling – coming in the wake of banking stress and a slowing economy – may just be the proverbial straw that breaks the camel’s back.

Can MSFT and GOOGL change that sentiment back tonight?

Loading…