While consensus expectations for retail sales data this morning were expected to contract (headline) or grow very modestly (core); BofA’s seemingly omnipotent analysts warned that numbers could be considerably hotter than expected – perhaps due to the recent near-record surge in credit card debt, or maybe it’s just because stocks have caught a bid rising and Americans are looking at their rising 401k balances and feeling wealthier.

Brace For Red-Hot Retail Sales: Just What Powell Does Not Want To See https://t.co/j5e8N6Edd4

— zerohedge (@zerohedge) June 15, 2023

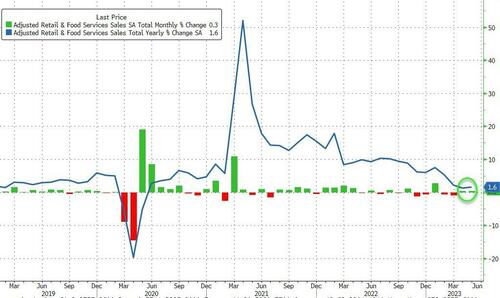

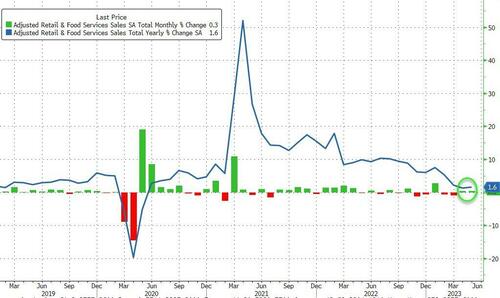

BofA was – once again – correct as Retail sales data smashed expectations across the board. Headline retail sales rose 0.3% MoM (-0.2% exp) while core (ex-Autos and Gas) rose 0.4% MoM (vs +0.2% MoM)…

Source: Bloomberg

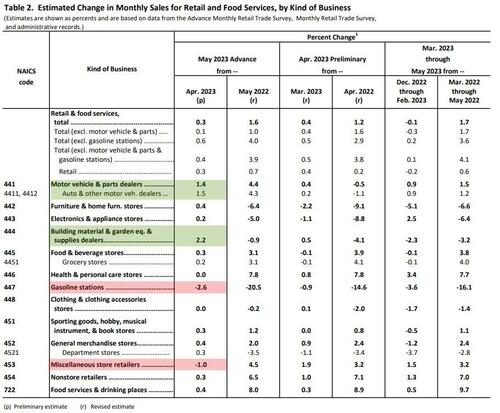

Under the hood, Gasoline stations and Miscellaneous Store Retailers saw sales slow as Building Materials and Motor Vehicle sales soared…

On YoY basis, both headline and core retail sales growth rose modestly from April…

Source: Bloomberg

The control group – which is used in the GDP calculation – rose 0.2% MoM as expected (a slowdown from April’s +0.6% MoM move, but still rising.

The death of the US consumer (or rather his credit card) remains greatly exaggerated.

Loading…

https://www.zerohedge.com/markets/retail-sales-unexpectedly-surge-may-led-autos-and-building-materials