Authored by Simon White, Bloomberg macro strategist,

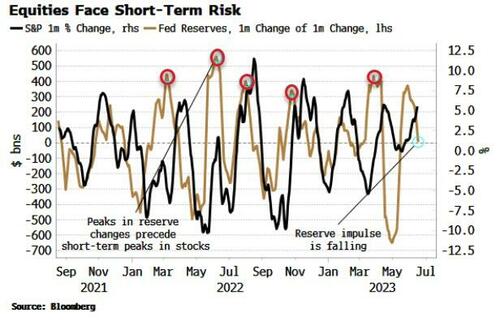

Equities face a short-term risk from overbought conditions, coinciding with the impulse from Fed reserves slowing.

Nothing moves in a straight line. Even though there are reasons to believe the medium-term positive trend in the S&P is intact, there are some short-term risks to be aware of.

So far, the liquidity drain from new sovereign issuance has not been as bad as feared as the Treasury has sugared the pill by tilting their issuance towards bills.

The Treasury also has not built back up its account at the Fed (the TGA) too aggressively.

Nonetheless, when it comes to reserves, it is not their change, but the change of their change (the impulse) that is more meaningful for equities. On that basis, equities are facing some short-term vulnerability.

There has been a deluge of Treasury issuance this month after an agreement on the debt ceiling was reached. Total issuance so far in June and slated for next week comes to over $800 billion. However, 85% of the ~$800 billion has been or will be in bills, with the remainder in notes and bonds.

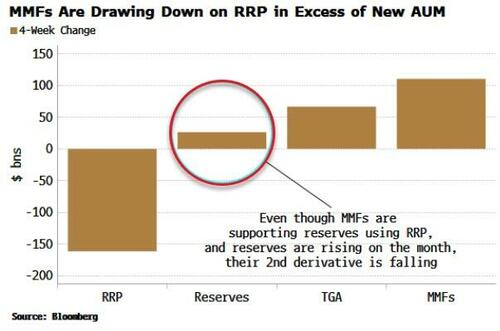

Bills should have less of a negative impact on liquidity as it is money market funds (MMFs) that typically buy them. MMFs seem to have been drawing down on the RRP facility to do so – taking advantage of more attractive bill yields – which overall has a neutral impact on liquidity. (As an aide, it was therefore good fortune for markets the Fed was so hawkish at this week’s FOMC meeting, even though they did not raise rates.)

In fact, over the last four weeks, MMFs look to have drawn down on the RRP more than enough to compensate for any loss of bank deposits to MMFs. The drop in the RRP has been sufficient to allow the Treasury to add to the TGA and still leave reserves higher over the last four weeks.

But as mentioned above, it is the change of the change in reserves that matters for stocks, and that is falling. Coming at a time when the S&P is looking overbought, this suggests that exercising some caution is warranted in the coming weeks.

Call skew has been rising relative to put skew as speculation heats up, leading to hedgers selling calls to buy downside protection via puts.

Loading…

https://www.zerohedge.com/markets/overbought-stocks-face-short-term-risk-reserves