Millions of Americans who took out loans to purchase overpriced used vehicles during the pandemic are at risk of going underwater. Financing costs are soaring, and used car values are sliding, culminating into a perfect storm as only the tip of the negative equity iceberg appears.

On Tuesday, credit reporting firm TransUnion and market researcher J.D. Power published a new report warning in recent quarters that used car loan-to-value ratios (LTVs) at origination have “trended in the wrong direction for consumers.”

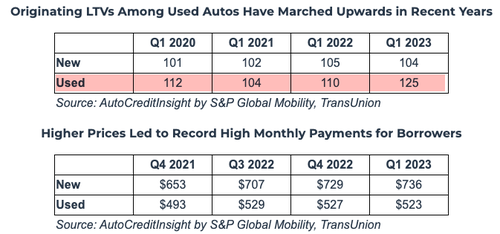

Originating LTVs in the first quarter averaged 125%, up from 110% for used cars in the same quarter a year ago—and up 21 percentage points versus the same period in 2021. A lower LTV indicates the borrower has more equity in their auto loan, and one above 100% means the loan exceeds the value.

“As vehicle prices have risen and overall inflation remains elevated, consumers are increasingly starting in higher than average LTV positions to afford used vehicles. It’s more important than ever for consumers to effectively manage their payments to fit within their budgets while also allowing for a cushion for other ongoing expenses like insurance and repairs,” said Satyan Merchant, senior vice president and auto business lead at TransUnion.

Merchant expects “accelerated depreciation” of used vehicles in the quarters ahead will result in a surge of borrowers with negative equity. He said, “This will be especially important for lenders to monitor.”

In a separate report, Ivan Drury, Edmunds’ director of insights, warned: “We are only seeing the tip of the negative-equity iceberg,” with vehicle prices, mostly used car prices, expected to keep sliding this year.

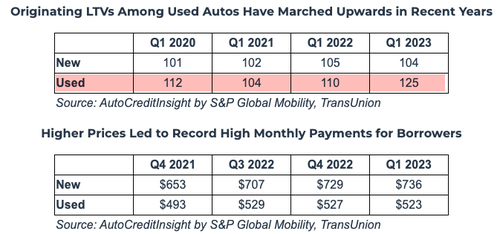

We penned a note in January detailing “More Americans Can’t Afford Their Car Payments Than During The Peak Of Financial Crisis.” The note explains that borrowers are overleveraged with +$1,000 monthly used car payments. And it’s only when the next recession strikes and unemployment rises that a surge in delinquencies will give rise to a flood of repossessed vehicles hitting the used car market, driving prices down even further.

Loading…

https://www.zerohedge.com/markets/negative-equity-surges-more-consumers-find-themselves-underwater-auto-loans