According to Morgan Stanley, Tesla’s monster run, which has taken shares from around $175 to as high as $275 over the course of the last month, is be running out of steam.

This morning, the bank’s auto analyst Adam Jonas downgraded the name to equal-weight…

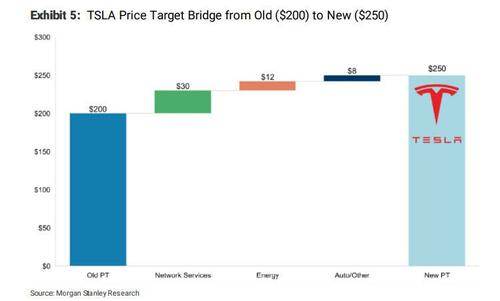

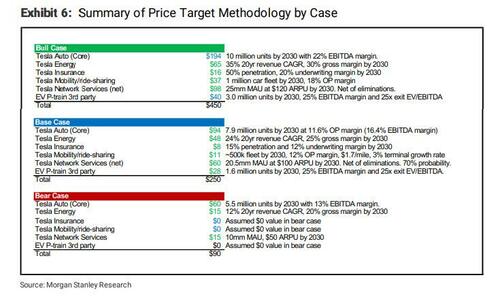

… even as he raised his price target from $200 to $250. Jonas’ bull case remains at $450 and his bear case remains at $90 for shares, to wit:

We raise our Tesla price target to $250 from $200, Bear Case valuation to $90 from $70,and Bull Case valuation to $450 from $390. Following these changes, we change our rating to Equal-weight from Overweight given a relatively full valuation and a more balanced risk reward and highlight key drivers and investor debates for the stock at this level.

To be sure, a range of $90 to $450 is… wide. This is how Jonas “explains” his various cases:

Despite his downbeat flip-flop, Jonas admits that Tesla “remains a ‘must own’ company in any EV portfolio” and that it “is emerging as an industrial ‘standard bearer’ for one of the greatest industrial changes we’ve witnessed in over a century – the electric transport and renewable energy economy.” We have been documenting how Tesla’s charging standard is now quickly becoming the EV industry’s charging standard.

In addition to charging, Jonas says to “look for other potential areas of collaboration (battery supply, operating system, FSD, etc.) to follow.

To Jonas the fly in the ointment is that the stock’s price has moved significantly higher, stating “Some investors may feel inclined to play the positive momentum from here, but we believe the current price, at over 100x our FY23 US GAAP EPS forecast, discounts significantly more than Tesla as just a dominant EV company.”

He continues: “We believe stock upside from here must come despite our view of continued downward skew to consensus estimates…”

Jonas also addressed the hype of Tesla as an AI company, ostensibly since the company’s rise higher was helped along by the broader market artificial intelligence rally that started with Nvidia:

Following Nvidia’s blowout quarter, AI exposed stocks have outperformed broadly and investors are constructing portfolios with exposure to the theme. While we understand why Tesla gets a serious mention in an AI conversation, we believe a re-rating on this theme is in the realm of the non-disprovable bull case. Autonomous driving and generative AI still remain, in our view, two very different technological disciplines. While the market may want to dream on the AI theme, we’d prepare to wake up to the sound of a blaring car horn (Nvidia is covered by semis analyst Joe Moore).

Jonas adds: “As Tesla approaches the $300 level, we think the stock begins to discount a business based on recurring software-derived/software-delivered revenue (i.e. SaaS) from its vehicle network and other services beyond just the 1-time sale of automobiles.”

“While we did not expect this recent rally in the company’s shares, we suspect many investors may be again looking at ways to justify the valuation beyond the confines of a unit x price automotive/hardware model. We’ve already begun to see this play out: Ford, GM, and most recently Rivian have joined Tesla’s increasingly ubiquitous supercharging network in the last month,” he adds.

Jonas concludes, talking about relative valuation as a result of this run higher:

“A recent run that has taken the stock as high as $274, before yesterday’s close of $259 has brought the stock to over 50xFY23e EBITDA vs the stock’s 3 year historical average of 39x and 5 year average of 27x (for ~EV/Forward Year consensus EBITDA). We think that Tesla might have been caught up in the AI multiple premium given the recent wave of interest surrounding the technology. While we do agree with the merits of classifying Tesla as an “AI company” (Is Tesla an AI Company? Yeah, Sure But…), we would urge caution against grouping all aspects of AI (for example, LLM with vision based neural network training) into one bucket. As a result, we believe that Tesla’s current valuation is relatively “full”.

Full note available to pro subscribers in the usual place.

Loading…

https://www.zerohedge.com/markets/morgan-stanley-downgrades-tesla-equal-weight-says-company-caught-ai-multiple-premium