By Stefan Koopman, Senior Macro Strategist at Rabobank

What’s The Way Forward?

It came as a revelation to no one that the ECB raised its deposit rate by 25bp to 3.50%. But as Bas and Elwin note in their post-meeting commentary, the surprise was in their forecasts. The increase in the staff projections for both headline and, in particular, underlying inflation added a hawkish slant to the policy decision. According to the ECB, this revision mainly reflects a continued strong outlook for the labor market. However, since the forecasts incorporate a forward curve to reflect the impact of future monetary policy, it is also a clear signal that the ECB thinks it needs to do more than the market has been pricing.

Even though the official statement once again reiterates that “the Governing Council will continue to follow a data-dependent approach,” President Lagarde commented that “barring a substantial change in the baseline, it is very likely the case that we will raise rates in July.” Completely abolishing forward guidance remains difficult, apparently, but it is of course true that a July rate hike to 3.75% had already been widely expected anyway. We continue to anticipate a long hold after that, but note that the risks of even further tightening have increased.

Indeed, as Ms. Lagarde repeated, “the ECB still has ground to cover.” Although the central bank’s own research (see here, slide 6) shows that unit profits have increased in every sector of the economy over the course of 2022, the ECB continues to blame workers for high inflation. According to Ms. Lagarde the revision in core inflation is to a large extent attributable to unit labour costs, yet she was also quick to note that the ECB is not yet seeing any spiralling of wages and prices that would cause a second-round effect. So even though most workers have yet to see any real wage gain, they are already being asked to resign themselves to this welfare loss and to take the distributional pain.

The Bank of Japan continues to see things differently. This morning it decided to maintain its current policy settings, which still include negative interest rates and yield curve control. This decision comes as policymakers anticipate a slowdown in inflation in the coming months. With new quarterly forecasts set to be released in July, it remains uncertain as to whether these will lead to any significant policy changes. In any case, today’s statement provided very few indications of a more aggressive stance – and thus saw dollar-yen reach its highest level since November last year. The Bank of Japan remains cautious about the potential negative impact of prematurely tightening policy, which could undermine Japan’s longstanding efforts to lift inflation to a structurally higher level.

It concluded a big week in central banking with the Fed delivering its hawkish skip and the ECB its hawkish hike, the Bank of Japan being as dovish as it can reasonably be, and the PBoC fueling optimism on China with some 10bp rate cuts. So with the Fed being outflanked by the ECB, and previously by the RBA and the BoC too, and with talks of China boosting growth with a USD 140bn stimulus package too, the US dollar was dealt some heavy blows. EUR/USD rose from 1.075 early this week to 1.095 at the time of writing, largely undoing the recovery that started mid-May.

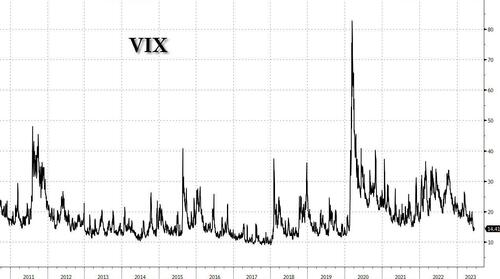

Equities rallied big time. Even with T-bills paying a nice 5% per year and the inverted yield curves screaming recession, investors want (read: have) to add more risk to their portfolio as the VIX falls to its lowest level in more than three years. Even though a “too low” VIX is always interpreted as a sign that things are “too quiet”, perhaps reminiscent of the years prior to the GFC, it does seem that the market has been injected a fresh dose of hopium.

The CPI data that was out on Tuesday was better than expected, with a further sharp deceleration next month being near certain. The way down in US inflation is actually going a bit faster than its way up, and occurs with employment continuing to grow at an above-average pace. We do note that US initial jobless claims continue to tick higher, although this is being partly attributed to seasonality issues and spikes in fraudulent claims.

Meanwhile, the Fed’s policy makers are no longer projecting a recession in their collective dot forecast. Despite signalling a willingness to go above and beyond in terms of rates, by adding two hikes to the infamous dot plot, the FOMC also raised its forecast for this year’s GDP growth from 0.4% to 1.0%, alongside a rise in core PCE inflation from 3.6% to 3.9%, and a decrease in unemployment from 4.5% to 4.1%.

The only way to square this week’s price action with policy action is that the market agrees, or at least *wants* to agree, with central bankers’ projections of soft landings. Labor market resilience is suddenly seen as helping to achieve this, instead of preventing one. And there is renewed belief that price and wage settlements can cool gradually, without requiring a sharp deterioration in order to force economic participants to accept that their prices can’t be raised over and over again.

So the key question to think about this weekend is: “what actually are the conditions for a soft landing?”

In our view, these four boxes need to be checked:

-

a steady deceleration in inflation, with all core metrics, not just the sliced-and-diced ones, seeing a clear path towards 2%;

-

a more balanced labor market, with a decline in the number of vacancies, fewer job-to-job moves, a full recovery in participation, and a period of below-trend employment growth;

-

a period of stable policy rates, preferably at a level that is broadly considered as not too loose and not to tight (okay, now we’re asking a lot);

-

stability in the profit/labour/tax share of income, in the vicinity of pre-shock levels to ensure that, for all the tit-for-tatting that is currently taking place, society agrees on a way forward.

That would truly be an accomplishment. Let’s set a reminder in one year

Loading…

https://www.zerohedge.com/markets/investors-want-read-have-add-more-risk-vix-falls-three-year-low