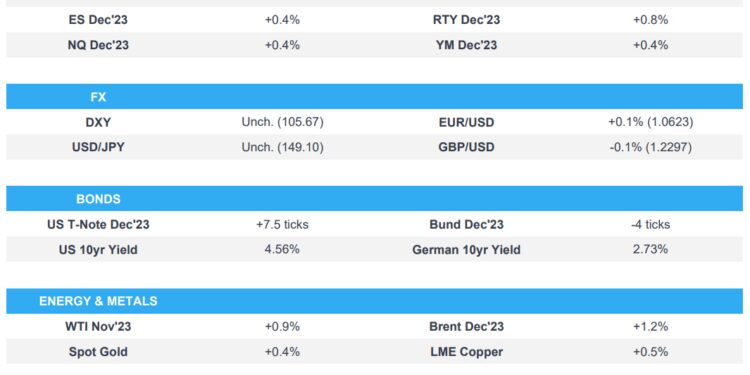

- European bourses are trading with modest gains in the wake of the late gains on Wall Street yesterday and the upbeat APAC session overnight.

- Dollar is depressed ahead of US CPI data after brief bounces post-PPI and FOMC minutes. Euro retains 1.0600+ status vs Buck. Yen is still drawn to 149.00 against Greenback.

- Debt futures fade after another strong rally to fresh cycle peaks for Bunds and Gilts.

- Chinese GDP growth might slow in Q3 to above 4.0% Y/Y from 6.3% growth in Q2 but is expected to improve after Q3, according to Securities Daily.

- Looking ahead, highlights include US Core CPI, Earnings, IJC & Cleveland Fed CPI, ECB & Banxico Minutes, Speeches from ECB’s Panetta, Fed’s Bostic, Logan & Collins, Supply from US, Earnings from Walgreens

12th October 2023

- Click here for the Newsquawk Week Ahead summary.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are trading with modest gains in the wake of the late gains on Wall Street yesterday and the upbeat APAC session overnight.

- Sectors in Europe are mostly firmer with Basic Resources and Energy top of the leaderboard, whilst Banks lag to the downside.

- US futures are trading on the front foot, continuing the strength seen in yesterday’s session, with the hotter-than-expected PPI print unable to cap sentiment in the run-up to today’s CPI.

- Click here for more details.

FX

- Dollar is depressed ahead of US CPI data after brief bounces post-PPI and FOMC minutes – DXY edges closer to chart prop within tight 105.530-730 confines.

- Franc remains firm on safe-haven grounds – USD/CHF probes 0.9000 and EUR/CHF nearer 0.9550 than 0.9600.

- Euro retains 1.0600+ status vs Buck and is surrounded by hefty option expiry interest.

- Yen is still drawn to 149.00 against Greenback as BoJ’s Noguchi sticks to dovish guidance.

- Cable unstable above 1.2300 amidst mixed UK macro releases and BoE members highlighting the extent of hikes in the pipeline.

- Click here for more details.

- Click here for the Option Expires for the NY Cut.

FIXED INCOME

- Debt futures fade after another strong rally to fresh cycle peaks for Bunds and Gilts.

- 10-year German and UK benchmarks towards a base of 129.59-130.20 and 94.83-95.66 respective ranges.

- T-note also consolidating pre-US CPI, IJC and latest Fed speak within narrow 108-09/00+ confines.

- Italy sells EUR 6.5bln vs exp. Italy to sell EUR 5.25-6.5bln 3.85% 2026, 4.00% 2030, 4.45% 2043 BTP & EUR 1.5bln vs. Exp. EUR 1-1.5bln 4.00% 2035 BTP Green.

- Click here for more details.

COMMODITIES

- Crude front-month futures have been grinding higher throughout the European morning despite any fresh macro catalysts and as investors look ahead to US CPI.

- Dutch TTF prices are once again on the grind higher after pulling back yesterday, with the complex still underpinned by Chevron’s Australian LNG situation alongside the suspected sabotage of the Baltic-connector gas pipeline in the run-up to winter heating season.

- Spot gold continues grinding higher despite the recovery of the Dollar as geopolitical premium continues to be baked into the yellow metal.

- US Private Inventory Report (bbls): Crude +12.9mln (exp. +0.5mln), Cushing -0.5mln, Gasoline +3.6mln (exp. -0.8mln), Distillates -3.5mln (exp. -0.8mln).

- IEA OMR: raises 2023 oil demand forecast to 2.3mln BPD (vs. prev. 2.2mln BPD), cuts 2024 to 880k BPD (vs. prev. 1mln BPD) amid weaker economic environment and efficiency improvements. The pullback in oil reflects demand destruction. Israel-Hamas conflict has not had a direct impact on oil flows; ready to act to keep the market well-supplied if needed. OPEC+ voluntary cuts will keep the market in deficit in Q4 but could shift to a surplus if extra cuts are unwound in January. Russian total oil exports rose 460k BPD in September.

- Saudi Energy Minister said the oil market should not be left alone; we should be proactive given numerous challenges.

- Russian Deputy PM Novak said the market is very sensitive but the balance; we quickly react to the situation in the oil market where there are many uncertainties; global economy is growing slower than expected. He added global oil demand will increase by 2.4mln BPD this year. He added that Russia lowered exports of oil and oil products, and Russian OPEC+ commitments include oil product exports.

- Iraq oil ministry spokesperson said OPEC+ priorities include achieving stability and balance in global markets. Severity of impact from security events on supply/demand flows depends on how long such events last. OPEC+ does not deal with fast reactions to challenges that face the market. Iraq is committed to voluntary cuts, according to Reuters.

- Grain storage facility and grain was damaged in Russian drone attack on Ukraine’s Odesa region, according to Reuters.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- BoE’s Dhingra said they think only about 20%-25% of the impact of interest rate hikes has been fed through to the economy and suggested that when growth is as slow as it is now, the chances of a recession or not recession are going to be pretty equally balanced so they should be prepared for that and it is not going to be great times ahead. Furthermore, she added that if growth falls by much more than the BoE expects from here, a cut may happen sooner, according to the BBC.

- BoE’s Pill said finely balanced issue if the BoE still has more to do. A lot of policy tightening is yet to come through. Inflation in the UK remains too high, according to Reuters. Pill said it is premature from policy perspective to be discussing unwinding policy; we may become overly sensitive to short-term fluctuations in data.

- ECB’s Stournaras sees no value in bringing forward the end of PEPP and sees no reason to raise banks’ requirements. He added that Italy’s government must reassure the European Commission and investors, according to Reuters.

- ECB’s Makhlouf said the ECB will have a better feel on rates after December. He added Italian bond spread will focus the ECB.

- ECB’s Wunsch said monetary policy is at the right level. Inflation shock from increasing oil prices could lead to an additional rate hike. When asked about whether October will see a PEPP announcement, said PEPP should be discussed, according to Reuters.

- ECB’s Villeroy said monetary patience is currently more important than activism; duration is more important than level, according to Reuters.

EUROPEAN DATA RECAP

- UK GDP Estimate MM (Aug) 0.2% vs. Exp. 0.2% (Prev. -0.5%)

- UK GDP Estimate YY (Aug) 0.5% vs. Exp. 0.5% (Prev. 0.0%)

- UK GDP Est 3M/3M (Aug) 0.3% vs. Exp. 0.3% (Prev. 0.2%)

- UK RICS Housing Survey (Sep) -69 vs. Exp. -63 (Prev. -68)

NOTABLE US HEADLINES

- Fed’s Collins (non-voter) said the Fed is at or near the peak of the rate cycle and a further hike could be warranted depending on incoming data, while she expects the Fed to keep policy restrictive for some time and said policy must stay restrictive until clear sign inflation moves to target of 2%.

- UAW said the 8,700 UAW members at Ford’s (F) Kentucky plant joined the strike after Ford refused to make further movement in bargaining, according to Reuters.

- BoJ Board Member Noguchi said there is no need to rush into responding to the rise in long-term rates; no need to immediately make YCC adjustments. BoJ Board Member Noguchi said they cannot be optimistic about an acceleration in wage growth; inflation is due to import price hikes including currency factors. There is still a distant to the achievement of the 2% inflation target, according to Reuters. He added it is wrong to think the rise in interest rates could bring forward the timing of policy change.

- Illumina (ILMN) must restore Grail’s (GRAL) independence to the same level as prior to the acquisition, according to EU regulators; has been asked to sell Grail after it completed the deal before securing approval.

- Click here for the US Early Morning Note.

GEOPOLITICS

- Russia and India are in talks about a summit this year between President Putin and PM Modi, according to Ria.

- Iran’s Foreign Minister is to travel to Lebanon amid the Israel-Palestine events, according to Tasnim citing the ambassador.

- US Secretary of State Blinken has landed in Israel, according to Reuters witness.

- US President Biden said the US is sending military assistance to Israel and they made it clear to the Iranians to “be careful”. Furthermore, President Biden held a call with UAE’s President and stressed his condemnation of Hamas, while the leaders discussed the importance of ensuring humanitarian assistance reaches those in need.

- US believes that Iran knew about the Hamas attack plan but not the timing and scale of the attack, according to WSJ.

- China Commerce Ministry on reports of the EU planning an anti-subsidy probe of Chinese steelmakers said EU’s action is against international trade offer, according to Reuters.

- A Committee of Russia’s Parliament lower house has drafted legislation to revoke the treaty on the nuclear test ban, according to Ria.

CRYPTO

- Bitcoin was lacklustre following a recent retreat to beneath the USD 27,000 level.

APAC TRADE

- APAC stocks were firmer after the region took impetus from the intraday rebound on Wall St where dovish Fed rhetoric offset the hot PPI data, while stale FOMC Minutes provided no major fireworks.

- ASX 200 was led higher by early outperformance in its top-weighted financial industry although the gains in the index were limited as energy and the defensive sectors lagged.

- Nikkei 225 was boosted on a break above the 32,000 level following softer-than-expected PPI data and comments from BoJ Board Member Noguchi who continued to toe the dovish line.

- Hang Seng and Shanghai Comp. were underpinned in which the Hong Kong benchmark gapped above the 18,000 level and spearheaded the advances in the region, while Chinese banks were buoyed after China’s sovereign wealth fund raised its stake in the largest banks for the first time since 2015.

NOTABLE ASIA-PAC HEADLINES

- Chinese securities regulator banned brokerages and their offshore units from taking on new mainland clients for offshore trading and it set an end-October deadline for the removal of apps and websites soliciting mainland clients, according to Reuters sources.

- China studies easing foreign stake limits in Chinese firms, via Bloomberg. In-fitting with reports seen in late September. Total overseas ownership in local firms is currently capped at 30%

- Chinese GDP growth might slow in Q3 to above 4.0% Y/Y from 6.3% growth in Q2 but is expected to improve after Q3, according to Securities Daily.

- BoJ Board Member Noguchi said the biggest focus is whether wage hike momentum will be maintained or not and the raising of the YCC band does not signify a tightening of monetary policy, while he added when inflation expectations are rising, some flexibility is needed to continue easy policy under YCC. Furthermore, Noguchi said there are signs upward price pressures are coming down and the BoJ’s near-term mission is to realise a situation where wage growth does not fall short of inflation as soon as possible through persistent monetary easing.

DATA RECAP

- Japanese Corp Goods Price MM (Sep) -0.3% vs. Exp. 0.1% (Prev. 0.3%)

- Japanese Corp Goods Price YY (Sep) 2.0% vs. Exp. 2.3% (Prev. 3.2%, Rev. 3.3%)

- Japanese Machinery Orders MM (Aug) -0.5% vs. Exp. 0.4% (Prev. -1.1%)

- Japanese Machinery Orders YY (Aug) -7.7% vs. Exp. -7.3% (Prev. -13.0%)

Loading…

https://www.zerohedge.com/markets/equities-firmer-dxy-lower-fixed-fades-gains-ahead-us-cpi-ijc-newsquawk-us-market-open