Authored by Simon White, Bloomberg macro strategist,

Federal Reserve rate hikes have had minimal disinflationary impact in this cycle, opening the door to a re-acceleration in inflation.

At first glance, Fed Chair Jerome Powell has little in common with the Wizard of Oz. But in one respect he may: pulling levers that do nothing.

It’s perhaps quite hard to believe, but there’s little evidence 525 bps of rate hikes have done anything to achieve the central goal of the Fed’s tightening campaign – a fall in inflation. At Wednesday’s FOMC, Powell expectedly left the door ajar for more rate hikes, but it is very clear the end of the cycle is near, or already here.

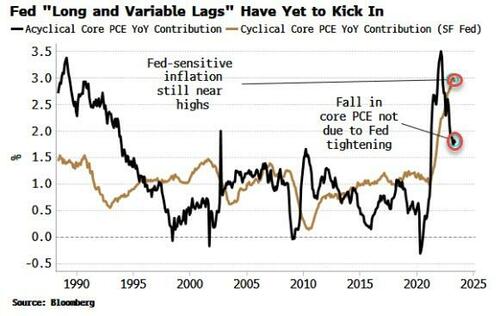

Of course, inflation has slowed. But the problem is that it has slowed despite the Fed’s hikes. The San Francisco Fed decomposes core PCE inflation into a cyclical and an acyclical component. The first is made up of the PCE sub-components most sensitive to Fed interest rates, and the latter is compiled from what’s left over, i.e. inflation that’s more influenced by non-Fed factors.

What’s surprising is that while acyclical inflation has fallen, cyclical inflation has barely budged and remains near its highs. Indeed, the decline in acyclical inflation has driven all of the fall in core inflation. In other words, the Fed has had little direct impact on the deceleration in core-price growth. Further, neither has the Fed had much influence on the decline in headline ex-core inflation as this been principally driven by the fall in energy prices.

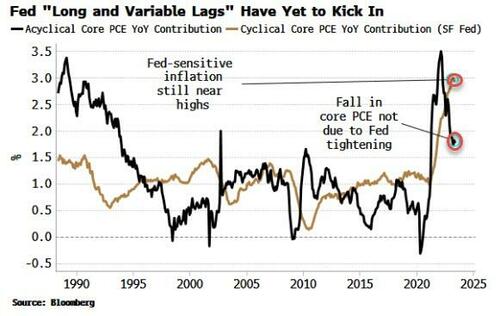

If the Fed was responsible for the fall in inflation we’d expect to see some increase in slack. Higher rates lead to lower demand, cost cutting, job losses and eventually, lower prices. But slack is still near its highs.

The chart below illustrates this very succinctly: the index of unused of labor capacity (unemployment + productivity) is stuck at its peak even while inflation has been falling.

This raises two key questions:

-

how has this “immaculate disinflation” trick been achieved, and

-

why has Fed policy so far not had a more negative impact on the real economy?

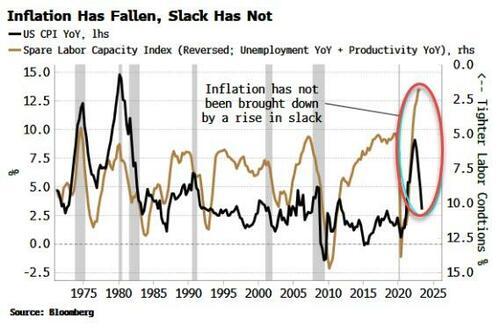

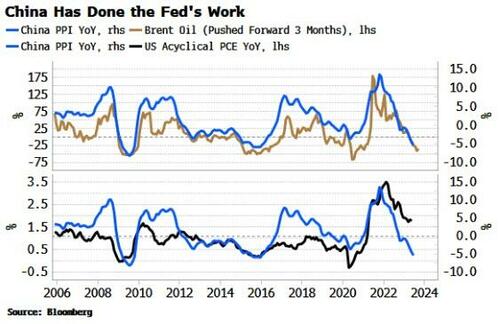

There are many idiosyncratic factors, but the answer to the first of these really comes down to China. The elephant in the room in this cycle has been its absence as a global growth engine and therefore a driver of inflation around the world. China is about the only country to have experienced net consumer deflation since 2020, while producer prices are currently contracting at more than 5% a year.

The chart below shows China’s PPI with Brent oil and with US acyclical PCE. PPI tracks the ups and downs of both very closely. The relationships are not mono-causal (very few are), but again the big picture is China’s significant negative influence on both US core inflation – via the acyclical PCE – and headline ex-core inflation, via the oil price, over the last year.

Which brings us to the question of why Fed rate hikes have not so far led to more economic weakness and higher unemployment? That comes down to two main factors: the Fed’s warehousing of interest-rate risk, and the Treasury put.

Even though the Fed has raised rates over five percentage points, its balance sheet has shielded the wider economy from the full brunt of the effect. Despite an ongoing QT program, the central bank’s balance sheet is only 8% off its highs, while the Fed still holds more than $7.5 trillion of interest-bearing securities that would otherwise have to be held by the public.

It’s the Treasury put, though – the US government’s willingness to run large and persistent fiscal deficits, with the current deficit at a historically elevated 8.5% of GDP – that’s the real insulator of tighter Fed policy.

The deficits have funded excess savings that have yet to be fully spent, supported demand that has kept corporate profits and margins elevated, and allowed firms to hoard labor, keeping the employment market tight.

This creates the perfect conditions for the Fed to make a policy mistake and pause prematurely, as not-too-weak growth and falling inflation give the impression its policy has been successful.

My view earlier in the year was the jobs market would weaken by more than it already has, potentially opening up a window where the Fed would cut rates before inflation rose again (even though in the long term this would likely have been a mistake). Now though, with inflation that’s showing signs it may come back sooner than originally thought, I see the converse risk – the Fed letting up in tightening too soon.

Stimulus in China continues to build, while buoyant excess liquidity is helping to push oil prices higher. These are sources of inflation the Fed has little control over, and they will begin to reinforce still-elevated domestic sources of price growth.

But by then, even if the Fed’s levers finally begin to gain some traction, it will likely be too late to prevent inflation’s second coming.

Loading…

https://www.zerohedge.com/markets/defective-fed-policy-ensures-inflations-revival