By Michael Msika, Bloomberg markets live reporter and strategist

Value stocks have lagged the market this year, but they’re starting to gain traction as the global economy seems more resilient than feared, while growth peers such as tech turn expensive after their strong rally.

The market leadership has been changing since the start of June, with year-to-date losers turning winners. The cheapest sectors — like miners, autos, banks and energy — are leading Stoxx 600 gains, while pricier peers such as food, tech and health-care shares lag. Meanwhile, the Federal Reserve delivered a hawkish message on Wednesday despite pausing its rate-hike campaign, which may help keep yields higher and help value stocks.

“The setup for value from where we are today is very very good,” says Mark Donovan, senior portfolio manager of the Boston Partners Large Cap Value fund. “The valuation gap between growth and value is quite significant. So I’m quite optimistic that the risk-reward opportunities and the prospective returns in a fundamental value strategy look quite good.”

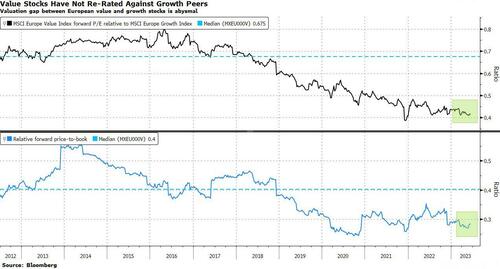

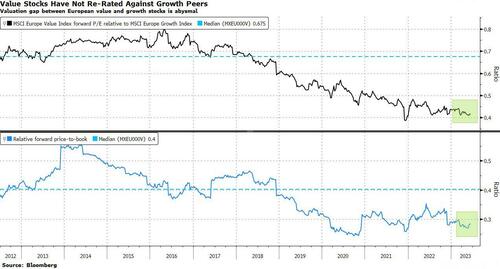

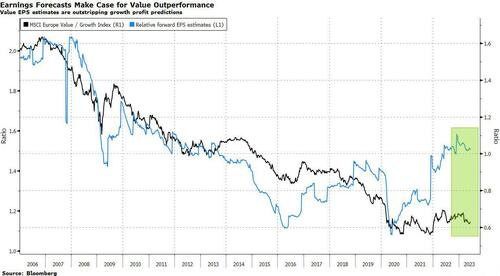

The valuation gap between the two groups has widened in the past few years, and more recently as the frenzy for artificial intelligence made tech stocks even more expensive than before. “European value stocks continue to look attractive,” say Societe Generale strategists including Andrew Lapthorne. They note that three-month earnings revisions in their value portfolio remain positive.

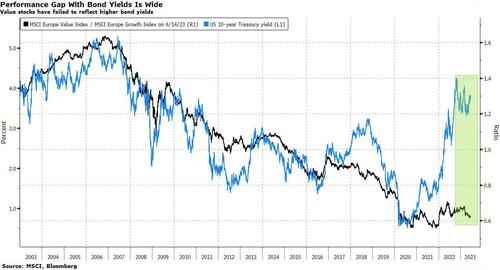

While a narrative of a peak in yields has driven the rally in growth at the expense of value this year, worries of a recession are fading, while rates are likely to stay at elevated levels in the near future, supporting the value trade. That may help the group catch up with the sharp move up in bond yields this year.

The European Central Bank, whose policy decision is due Thursday, has signaled more hikes on the way to tame inflation, while the Bank of England too may tighten more after buoyant UK jobs data this week. Meanwhile, any China stimulus is likely to boost value sectors such as autos and miners.

Investors are warming up to the trade. According to Bank of America, a net 19% of global fund managers in its June survey now expect value to outperform growth over the next 12 months, a 26 percentage-point reversal from a month earlier — the biggest monthly jump in favor of value since January 2022.

Some, such as Generali Asset Management strategist Michele Morganti, are wary of value and cyclical shares, citing tightening financial conditions and worsening economic surprises. “In line with a cautious stance on equity outlook, we maintain a defensive growth allocation,” he says, preferring sectors like software, food and health care equipment. He’s underweight banks, citing credit risks and lower economic growth.

“Our analysis indicates that the strength of re-rating will drive the relative performance of value vs. growth going forward,” say Liberum strategists Joachim Klement and Susana Cruz. “Starting in 2024, high EPS growth expectations for growth stocks could start to bite, leading to value outperformance.” Their screens based on earnings increases point to UK homebuilders such as Persimmon and Barratt, as well as retailers

Loading…

https://www.zerohedge.com/markets/central-banks-hold-key-revive-value-trade