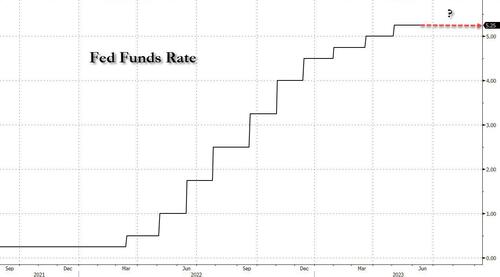

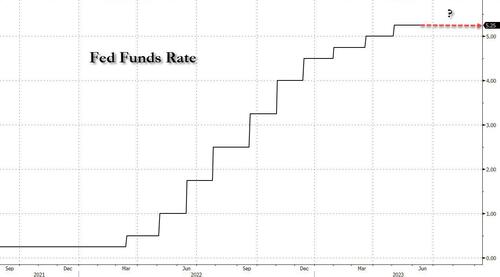

As we discussed in our lenghty FOMC preview, the broad consensus – among both economists and traders – is for the Fed to leave rates unchanged for the first time since March 2022 – market odds of a June hike are only 7%, vs 64% in July…

… while adding a tightening bias to today’s communications. Specifically, JPM expects for Powell to communicate that a pause does not prevent the Fed from hiking further (hence a “hawkish skip”), as the Fed wants to see the impact of its 500bps of rate hikes. The key will be to see a slowing in both growth and inflation or else the Fed may resume its hiking cycle.

Loading…

https://www.zerohedge.com/markets/your-last-minute-fomc-preview-lowest-expected-market-move-2021-and-trade-idea