Authored by Simon White, Bloomberg macro strategist,

Fitch’s downgrade of US sovereign debt tells us little we don’t already know about the US’s deteriorating fiscal outlook, explaining the muted reaction from Treasuries and the dollar.

Fitch cited the rising total debt load, ongoing issues with debt-ceiling standoffs, and the possibility of a recession as reasons behind its downgrade, none of which will be new to anyone in markets who’s sentient.

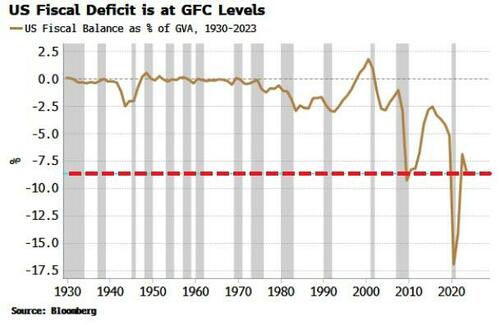

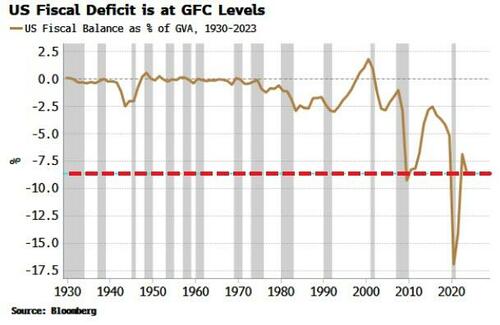

They also cited the fiscal deficit.

Most probably already know it’s large, but perhaps they don’t know it’s wider than it’s ever been outside of a recession, and it’s soon likely to be as swollen as it was in the depths of the Lehman recession.

Still, if any of this was a great surprise to market participants, then UST yields would not be essentially unchanged to within a couple of basis points since the announcement. Ditto the dollar after a brief mini-rally.

[ZH: Note that the rise in yields occurred exactly after ADP’s better-than-expected print and even more so after the Treasury Refunding announcement, NOT after the downgrade…]

It seems that credit-agency downgrades of DM countries matter less than they used to.

The reaction to Fitch’s announcement has been minor compared to S&P’s downgrade in 2011 that sparked a counter-intuitive rally in USTs (sometimes it must seem like you’re bulletproof when you have the world’s reserve currency).

Similarly, there was a bigger reaction to Moody’s UK downgrade in 2013 compared to its pandemic-related downgrade in 2020.

Downgrades still matter more for EM countries who typically rely on hard-currency borrowing from lenders.

DM countries have the option of printing their way out of trouble. That will work till one day it doesn’t, but in the meantime capital needs to find a home, and there are still limited, liquid options for pension funds, insurance companies, reserve managers, etc.

In general, credit-agency downgrades may matter less for markets since the reputational damage the agencies suffered in the GFC.

A 2018 BIS paper found that, after the GFC, sovereign CDS spreads responded less for countries shifted to negative watch from a stable outlook by one of the ratings agencies.

Loading…

https://www.zerohedge.com/markets/you-dont-need-ratings-agency-tell-you-when-its-raining