Authored by Simon White, Bloomberg macro strategist,

Bear steepenings of the yield curve, as we have had lately, are not uncommon, and cannot be taken alone as a sign of rising inflation expectations.

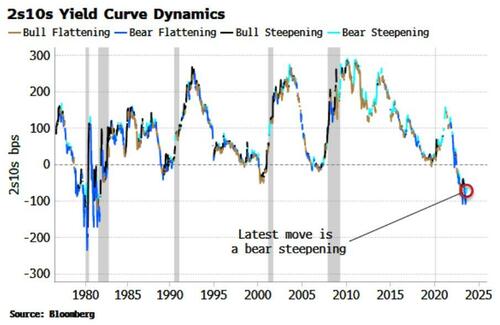

The yield curve has steepened over the last month, prompting some commentary that this is driven by inflation fears, and also that such moves are unusual. Yet in fact, bear steepenings occur fairly frequently.

We can see from the chart above that, especially since the GFC, bear steepenings in 2s10s have tended to be counter-trend rallies in the curve.

When the curve’s prevailing trend switched to steepenings, it is often driven by bull steepenings, i.e. the Fed is typically cutting rates aggressively in the run-up to a recession.

The chart also shows that bear steepenings have occurred at many different junctures over the last 50 years that have not been associated with escalating worries on inflation.

Therefore a bear steepening alone is not an indication of rising inflation premium.

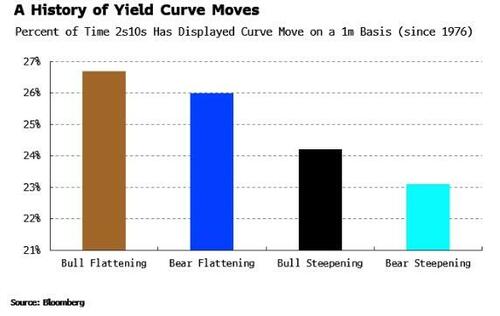

Bear steepenings are the least common of the regular curve moves. Still, excluding “twists” (i.e. when the 2y and the 10y move in opposite directions), they have occurred over 23% of the time since 1976 for the 2s10s yield curve.

There are reasons to believe that the market has been extracting some extra compensation for heightened inflation expectations, such as a rise in term premium and breakevens, but in truth neither perfectly captures the effect. The same also goes for bear steepenings.

Loading…

https://www.zerohedge.com/markets/yield-curve-bear-steepenings-arent-uncommon