Choice Hotels International publicly offered to buy competitor, Wyndham Hotels & Resorts, in a deal valued at nearly $8 billion. The decision to go hostile came after Wyndham rejected two offers from Choice.

Here’s a breakdown of Choice’s proposal:

- $90.00/share for Wyndham shareholders.

- Breakdown:

- $49.50 in cash.

- 0.324 shares of Choice common stock per Wyndham share.

- Premiums:

- 26% above Wyndham’s 30-day volume-weighted average closing price (ending Oct 16, 2023).

- 11% above Wyndham’s 52-week high.

- 30% above Wyndham’s latest closing price.

- Election Mechanism:

- Wyndham shareholders can choose:

- Cash.

- Stock.

- Mix of cash and stock (with standard proration).

- Valuations:

- Total equity value for Wyndham: ~$7.8 billion (fully diluted).

- Including Wyndham’s net debt: deal worth ~$9.8 billion.

“A few weeks ago, Choice and Wyndham were in a negotiable range on price and consideration, and both parties have a shared recognition of the value opportunity this potential transaction represents, said Choice CEO Patrick Pacious.

Pacious continued, “We were therefore surprised and disappointed that Wyndham decided to disengage. While we would have preferred to continue discussions with Wyndham in private, following their unwillingness to proceed, we feel there is too much value for both companies’ franchisees, shareholders, associates, and guests to not continue pursuing this transaction.”

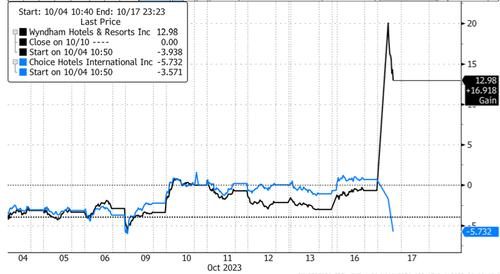

Choice Hotels shares dropped 6% in premarket trading in New York, while Wyndham shares Wyndham were up more than 12%.

This is the third offer from Choice in just half a year. In April, Choice offered Wyndham $80 per share, predominantly in stock. By September, they upped their bid to $85 per share and also increased the cash component of the proposal.

Loading…

https://www.zerohedge.com/markets/wyndham-hotels-soars-after-rival-choice-hotels-unveils-8-billion-buyout-bid