Authored by Simon White, Bloomberg macro strategist,

Poor liquidity in the Treasury market is contributing to a rise in implied and realized fixed-income volatility. A re-increase in inflation volatility means this dynamic is likely to persist.

Despite being one of the deepest markets in the world, the market for Treasuries has seen liquidity deteriorate in the years since the pandemic. On several measures – bid/offer spread, order-book depth, price impact of a trade – the Treasury market has shown marked signs of a decline in liquidity in recent years.

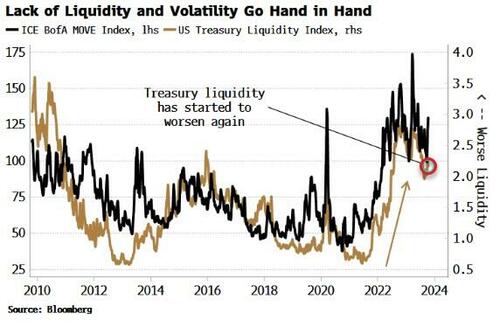

Bloomberg’s US Treasury Liquidity Index measures liquidity by comparing where yields are to where they “should” be based off a fitted curve. The greater the average of the yield errors across the curve, the worse liquidity is likely to be.

As the chart below shows, the Liquidity Index infers liquidity has markedly weakened over the last two years, and after showing an improvement over the last six months, it has started to worsen again.

Fixed-income volatility, using the MOVE index, intuitively rises and falls as liquidity worsens and improves respectively.

Bond volatility has been notably higher in this cycle than other assets’ volatility, such as equities and FX. Indeed, the recent rise in the MOVE index, i.e. implied volatility, has taken it to a level above realized volatility it has rarely exceeded in the last 30-plus years.

The immediate catalyst for the rise in bond volatility has been the Federal Reserve’s rate-hiking cycle. But this was itself triggered by the rise in inflation. It is the inherent increase in uncertainty that goes with elevated inflation that is the ultimate source of rising volatility.

Higher inflation volatility goes hand in hand with higher market volatility, especially in rates and fixed-income markets. Inflation is very likely to be persistent, and soon to begin re-accelerating. Inflation volatility has moderated somewhat from its recent highs, but is picking up again.

As long as inflation volatility remains elevated, bond vol will remain likewise. This is even more so the case as the yield curve continues to rise, with steeper curves an inherent source of yield volatility.

Loading…

https://www.zerohedge.com/markets/worsening-treasury-liquidity-keeping-fixed-income-vol-elevated