Over the years we have heard and read a lot of very, very stupid things when it comes to “global cooling” pardon “global warming”, climate change, ESG, and so on, but this may be the dumbest.

First the good news: Norway’s sovereign wealth fund – the world’s single largest stock market investor with $1.4 trillion in assets under management – made a mindblowing profit of $143 billion for the first half of the year, thanks to the growth of U.S tech companies (read the AI craze).

It helps that tech is the largest sector among the fund’s equity investments, representing 11.9% of the its total value at end-2022; it also helps that the fund’s holdings in tech companies jumped by nearly 39% in the period, with Apple, Microsoft and Nvidia as the stocks contributing the most, and helping to drive the fund’s 10% overall return.

Now the not so good news: even the Norwegians were shocked by this performance. CEO Nicolai Tangen told Reuters the strong return came as a surprise for such a large fund given “a pretty worrisome backdrop”, with high inflation and geopolitical tensions. It was partly due to AI becoming mainstream from previously being seen as “something with potential”, said deputy CEO Trond Grande. “Now we are seeing that potential being realized and that is being priced in the stock markets of these companies,” Grande told Reuters.

Asked whether he was concerned about a possible crash in tech stocks, Tangen said: “We are always conscious and worried about the biggest exposures of the fund. Now they are in the tech sector. Therefore we monitor that very thoroughly.”

And realizing that the gains won’t last indefinitely, CEO Tangen told a press conference on Wednesday that the world’s largest sovereign wealth has recently reduced its overweight investment position in the abovementioned major tech firm, something which the market has clearly not noticed yet judging by the continued meltup in the likes of Nvidia.

There is another reason why Norway is starting to offload tech exposure: looking ahead, the CEO said the fund expects it will be difficult to reduce inflation worldwide, not least due to a new phenomenon – inflation fueled by climate change.

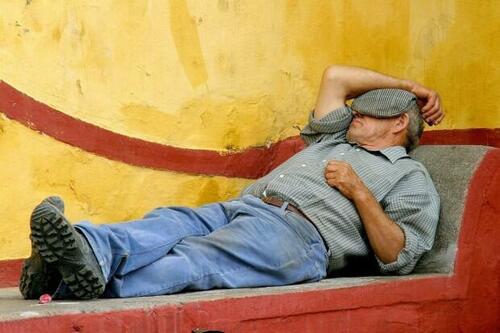

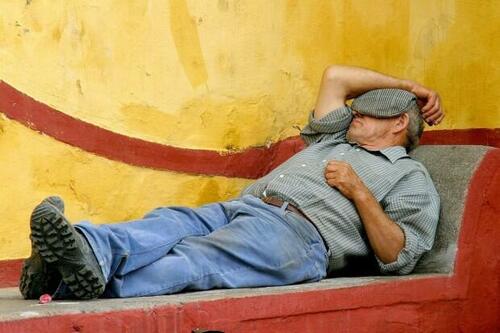

Which brings us to the really dumb news: the CEO said that global warming is lowering food harvests, and thus increasing food prices, and – wait for it – reducing productivity since some workers are unable to work in the middle of the day in some countries.

“The new thing here is the link between climate (change) and inflation and therefore between climate and financial markets,” Tangen said.

That’s right: the Nordic folks finally discovered… siesta.

But hey, if that’s the black swan that it will take to spook markets which will now rush to frontrun the fund which owns on average 1.5% of all listed stocks worldwide, so be it.

Loading…

https://www.zerohedge.com/markets/worlds-largest-investor-starts-cutting-tech-exposure-blames-global-warming-inflation-and