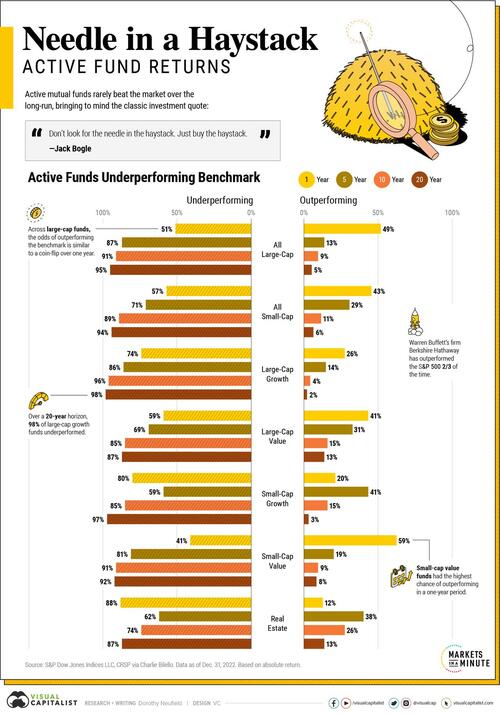

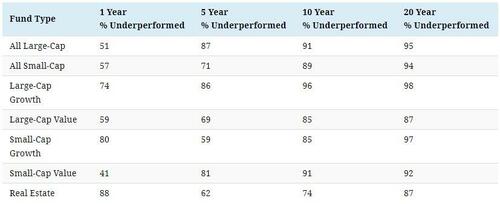

Over a 20-year period, 95% of large-cap actively managed funds have underperformed their benchmark.

As Visual Capitalist’s Dorothy Neufeld shows in the graphic below, the performance of actively managed funds varies widely across a range of fund types( using data from S&P Global via Charlie Bilello).

Missing the Mark: Actively Managed Funds

Several factors present headwinds to actively managed funds.

- Trading costs: First, fund managers will trade more often than passive funds. These in turn incur costs, impacting returns.

- Cash holdings: Additionally, many of these funds hold a cash allocation of about 5% or more to capture market opportunities. Unlike active funds, their passive counterparts are often fully invested. Cash holdings can have the opposite effect than intended—dragging on overall returns.

- Fees: Active funds can charge up to 1-2% in investment manager fees while funds that tracked an index passively charged just 0.12% on average in 2022. These additional costs add up over time.

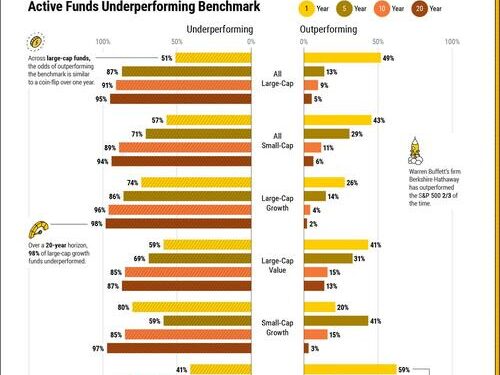

Below, we show how active funds increasingly underperform against their benchmark over each time period.

As we can see, 51% of all large-cap active mutual funds underperformed in a one-year period. That compares to 41% of small-cap value funds, which had the best chance of outperforming the benchmark annually. Also, an eye-opening 88% of real estate funds underperformed.

For context, Warren Buffett’s firm Berkshire Hathaway has beat the S&P 500 two-thirds of the time. Even the world’s top stock pickers have a hard time beating the market’s returns.

2020 Market Crash: A Case Study

How about active funds’ performance during a crisis?

While the case for actively managed funds is often stronger during a market downturn, a 2020 study shows how they continued to underperform the index.

Overall, 74% of over 3,600 active funds with $4.9 trillion in assets did worse than the S&P 500 during the 2020 market plunge.

Source: NBER

In better news, roughly half underperformed through the recovery, the best out of any market condition that was studied.

The Bigger Impact

Of course, some actively managed funds outperform.

Still, choosing the top funds year after year can be challenging. Also note that active fund managers typically only run a portfolio for four and a half years on average before someone new takes over, making it difficult to stick with a star manager for very long.

As lower returns accumulate over time, the impact of investing in active mutual funds can be striking. If an investor had a $100,000 portfolio and paid 2% in costs every year for 25 years, they would lose about $170,000 to fees if it earned 6% annually.

Loading…

https://www.zerohedge.com/markets/what-success-rate-actively-managed-funds