One look at the market’s reaction today tells you all you need to know: with virtually all major banks expecting a 5-handle on headline CPI…

- 5.1% – Goldman Sachs

- 5.1% – Citigroup

- 5.1% – JP Morgan Chase

- 5.1% – Morgan Stanley

- 5.0% – Barclays

- 5.0% – Bank of America

- 5.0% – Credit Suisse

- 5.0% – Bloomberg Economics

- 5.0% – HSBC

- 5.0% – UBS

- 5.0% – Wells Fargo

… the fact that we got the first sub-5% headline Y/Y print, the lowest in two years…

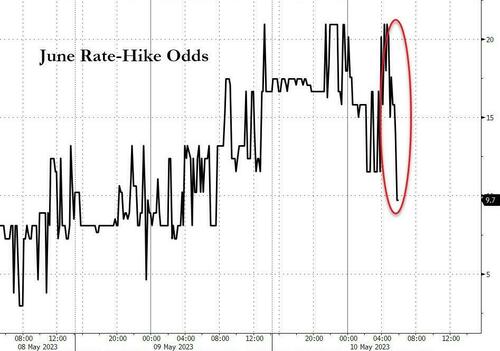

… was enough to crush changes for a June rate hike, which were cut more than in half, from over 20% before the CPI report to a single digit after.

The big picture shouldn’t be lost. Overall CPI peaked at 9.1% in the first half of last year and has been steadily declining, now under 5%. It has been bumpy — as Powell says — but there is definitely a lot of progress.

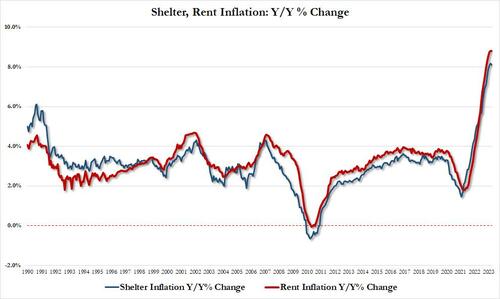

To be sure there is one more CPI report before the June FOMC decision, but unless gasoline prices somehow double from here, we are unlikely to see a major jump in YoY inflation, especially now that shelter and rent inflation has peaked.

So with that in mind, here is a snapshot of some early and quick Street hot takes from various economists, traders and strategists, courtesy of Bloomberg:

Vincent Reinhart, chief economist at Dreyfus and Mellon

The question to ask is: “Was today’s print disqualifying for Fed action in June?” “I think the answer is ‘no.”

Ira Jersey, Bloomberg Intelligence chief US interest rate strategist

The as-expected CPI report, with some of the details promising for future inflation prints, leads us to think the knee-jerk rally and bull steepening is warranted. Though only one data point, the trend of inflation didn’t reaccelerate as some feared; we continue to think Treasury yields will remain range-bound for now, but the curve may continue to bull steepen over time…. Dropping TIPS inflation breakevens point toward a market still not concerned about price gains continuing far into the future. That risk still remains, yet the Fed will breathe a sigh of relief and feel comfortable pausing its rate hikes at the June meeting.

Ben Jeffery, rate strategist at BMO Capital

Overall, it was a slightly weaker look at consumer prices in April especially when considering the ‘super core’ figures. The bull steepening reaction resonates both with the details of the print, and also a market that was prepared for a stronger read than what was ultimately delivered. We’re on board with the steepening move, and from here we will be looking to this afternoon’s 10-year refunding as a test of duration appetite. With the inflation data now in hand, we expect a decent result for the new notes.

Giuseppe Sette, president at Toggle

This inflation report seems to suggest that for the time being, the Fed will not have a problem with inflationary pressures, which are trending as expected. With core CPI firm at 5.5%, traders would do well to remember that rates historically are always higher than inflation except during a recession. In other words, rates don’t need to rise for monetary policy to be restrictive.

Derek Tang, economist at LH Meyer/Monetary Policy Analytics

The Fed will view falling inflation with suspicion at first because they don’t want to be burned again. Overall it was good news. They will take it as a sign of encouragement but services inflation is still too strong despite visible progress. It doesn’t rule out a June hike but doesn’t make us put it back in.”

Quincy Krosby, chief global strategist for LPL Financial

Rent-related inflation will indicate definitive signs of easing, helping to push overall headline inflation lower. Today’s report suggests that the Fed’s campaign to quell inflation is working, albeit more slowly than they would like.

Peter Boockvar, CIO of Bleakley Financial Group

While inflation could see a 2 or 3 handle by year-end, it is where it settles out at on a sustainable basis in 2024 that should be most relevant. We know, though, that we have a slowdown in rents to come that will show up in the calculations and core inflation will continue to fall.

Anna Wong, Bloomberg chief economist

The bad news in the report is in core goods – which rose 0.3%, the fastest monthly gain since last August. Driving the increase are used-car prices, which rose 4.4% — higher than we estimated. We expect used-car prices to continue rising amid higher demand and low inventory levels.

Ellen Zentner, Morgan Stanley chief US economist

We continue to see the data and financial conditions firmly supporting a pause in June,” though overall the CPI figures “should encourage the Fed to keep the door open for a June hike.

Andrew Hollenhorst, chief US economist at Citigroup,

It’s just hard to look at this number and think that the Fed is going to see anything here that tells them that they’re on that path toward 2%.

Diane Swonk, chief economist at KPMG

The CPI is still simmering but not accelerating. Important to remember that airfares and medical costs are measured differently in the Fed’s more favored index. This still allows for a pause in June to better assess additional tightening in the pipeline.

David Bahnsen, CIO at The Bahnsen Group,

The actual inflation rate is very likely at the Fed’s 2% target due to the way shelter and housing components are calculated. The housing component of CPI is largely representative of rental prices, which has a lag effect as renters typically lock-in their lease for long periods of time. Real estate prices across the board have declined considerably in recent months, and it’s going to take a few more months for the CPI to reflect this decline.

Source: Bloomberg, original research

Loading…

https://www.zerohedge.com/markets/wall-street-reacts-todays-cooler-expected-cpi-report-supports-june-pause