Authored by Mark Cudmore, Bloomberg macro strategist,

The US stock market capitalization accounts for 44.1% of the global equities market.

That’s near the seeming limit of the past 20 years (Bloomberg data on this only goes back to September 2003) and there are structural reasons why the US share should decline over the coming years.

It’s not just that US stocks are extremely expensive when compared to most other global share markets or even their own internal history. It’s that the US slice of global market cap is very stretched relative to the US share of global GDP.

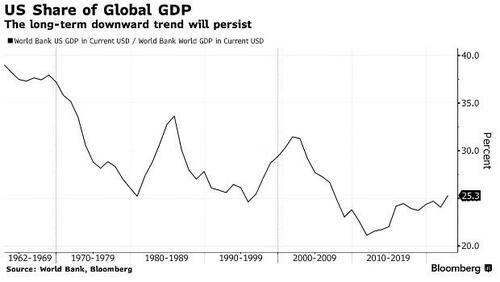

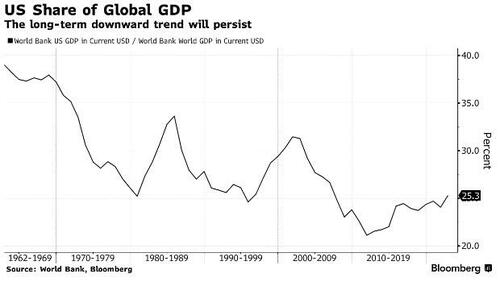

The share of global GDP stood at 25.3% as of end-2022, according to World Bank data.

That’s been on a declining trend over the past 60 years, with volatility provided by significant currency effects. It’s intuitive and unsurprising that the decline will continue.

The US has a falling share of the world population and is growing more slowly than most of the world. Consensus forecasts on Bloomberg put 2023 US growth at 1.6% versus world (including US) growth at 2.6%. Those are the most important long-term drivers, but over the shorter-term cycle of a few years, the much larger impact is due to currency changes. The dollar rose to a 20-year high in 2022.

US stock market cap shouldn’t have anything close to a direct 1:1 correlation with the nation’s GDP — they are mostly multinational companies, after all — but there’s some connection.

Over the past decade, US stocks have significantly outperformed the nation’s growth to give them their expensive valuations. Now, all the dynamics are turning negative, on a relative basis, at the same time: GDP growth, share-price valuations and currency impacts.

How quickly can that ratio of global market cap shrink? In November 2010, it fell to 28.6% from a high of 46% in September 2003:

One final point is that this long-term argument makes no assumption on whether stocks are in a bull or bear market. It’s a relative valuation framework.

Loading…

https://www.zerohedge.com/markets/us-stocks-will-underperform-global-equities-over-next-decade