Authored by Simon White, Bloomberg macro strategist,

US cyclical stocks continue to hint at recession risk, yet there are signs the downturn will not be too severe.

Despite the rally appearing bloated, a potential decrease in the market’s perception of recession risks could still propel it further.

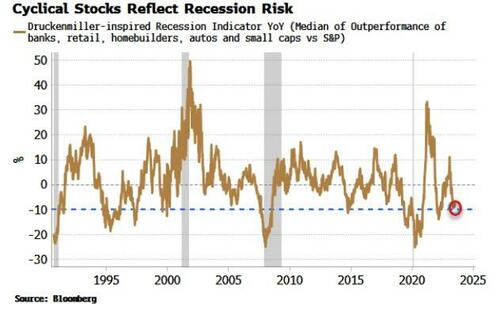

Renowned investor Stanley Druckenmiller has often called the inside of the stock market the best economic predictor he’s ever met. An indicator based on his supposition that the most cyclical equity sectors lead the cycle has recently turned down again.

As the chart below shows, it is close to levels that have previously preceded recessions.

Concurring with Mark Cudmore in his recent post, a recession is still highly likely (although I think we could see one sooner). It is signaled by a pervasive slowdown – both sectorally and geographically – in economic activity and monetary tightness.

My recession gauge is composed of 14 different sub-indicators that a cover a wide range of inputs, from credit spreads to Fed regional indexes. Recessions are typically preceded by most of these indicators activating together, capturing the regime-shift nature of economic slumps. The gauge continues to anticipate a downturn imminently.

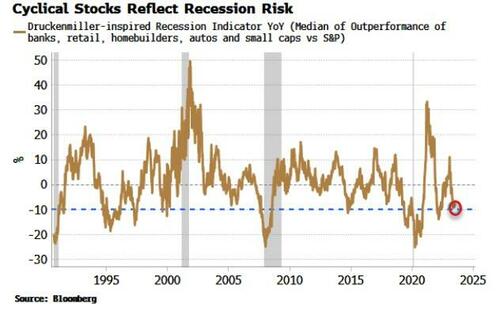

Nonetheless, it gives no information on the severity of the recession. On that, though, there are increasing signs it will not be too deep (the main wildcard is the credit market, which should be watched carefully). The different cycles that operate in the economy, e.g. the housing cycle, the inventory cycle, the business cycle, etc, do not look like they will reinforce each other, tempering the downturn.

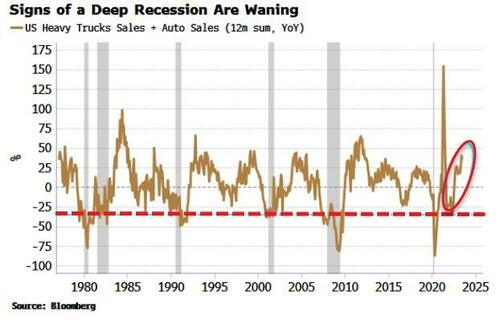

Truck sales hint at this outcome. They are an excellent leading indicator of economic activity. Yet they are rising. Combine them with auto sales and we can see that while they were very close to a recessionary level last year, they now look healthy.

So a recession is still the base case, but it may not be as severe as expected.

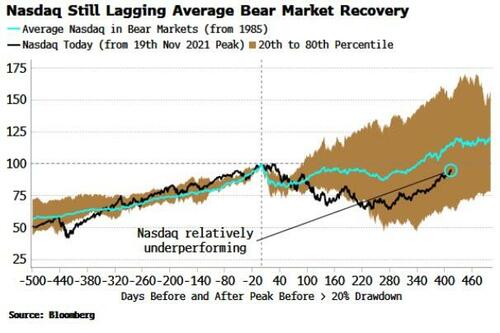

Despite all the fanfare of the AI-led rally, tech stocks in aggregate still look like they behaving circumspectly – the Nasdaq 100 is, believe it or not, underperforming relative to the average performance in a bear market…

Loading…

https://www.zerohedge.com/markets/us-stocks-still-flirt-pricing-recession-risk