Expectations for this morning’s headline CPI print were for a plunge from 4.0% YoY to 3.1% YoY (due to shelter, used-cars, and seasonals); however, what The Fed will be watching for is Core Services CPI Ex-Shelter, which fell to +3.93% YoY – the lowest since Jan 2022…

Source: Bloomberg

Notably the MoM increase in Core Services CPI Ex-Shelter was just 0.09% – the smallest MoM rise since Sept 2021.

The headline CPI rose just 0.2% MoM (below the 0.3% MoM expected) which dragged the headline down to +3.0% YoY (cooler than expected) – the lowest since March 2021..

Source: Bloomberg

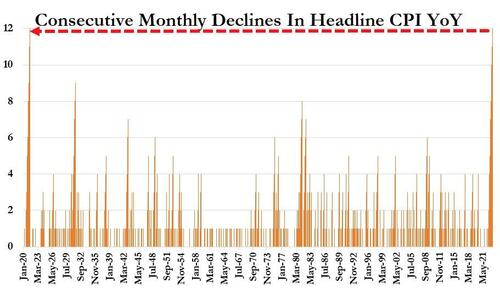

This is the 12th straight month of YoY declines in headline CPI – equaling the longest streak of declines in history (since 1921)…

Core CPI fell to 4.8% YoY – the lowest since Oct 2021…

Source: Bloomberg

The monthly core increase — 0.2% in June — was the smallest 1-month increase in that index since August 2021.

The index for all items less food and energy rose 0.2 percent in June. Here are the components:

-

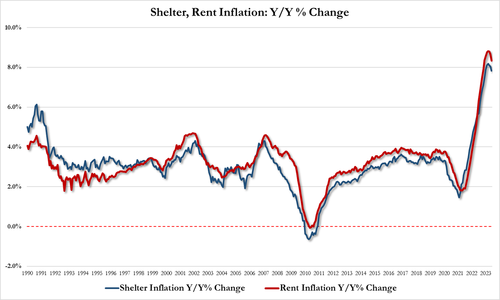

The shelter index increased 0.4 percent over the month after rising 0.6 percent in May.

-

The index for rent rose 0.5 percent in June, and the index for owners’ equivalent rent increased 0.4 percent over the month.

-

The index for lodging away from home decreased 2.0 percent in June after increasing 1.8 percent in May.

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy.

-

June Rent inflation 7.83% YoY, down from 8.04% and lowest since Dec ’22

-

June Shelter inflation 8.33% YoY, down from 8.66% and lowest since Nov ’22

While Shelter accounted for over 70% of the increase in the monthly CPI, this is still a badly lagging indicator and has yet to catch down to the real time.

The problem is that real-time indexes have again inflected higher.

Among the other indexes that rose in June was the index for motor vehicle insurance, which increased 1.7 percent, and the index for apparel which increased 0.3 percent.

Several indexes declined in June, led by the airline fares index, which fell 8.1 percent over the month following declines in April and May.

-

The index for communication fell 0.5 percent over the month.

-

The household furnishings and operations index fell 0.1 percent over the month, after declining 0.6 percent in May.

-

The index for new vehicles was unchanged in June.

-

The medical care index was unchanged in June, after increasing 0.1 percent the previous month. The index for physicians’ services rose 0.7 percent over the month, while the index for hospital services increased 0.4 percent.

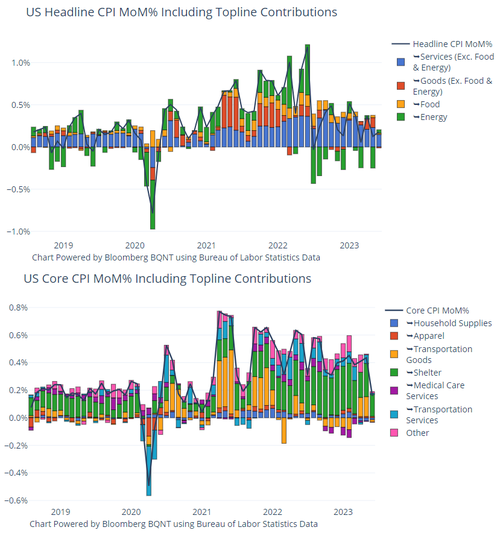

Services inflation remains very sticky, even as Goods inflation fades…

Source: Bloomberg

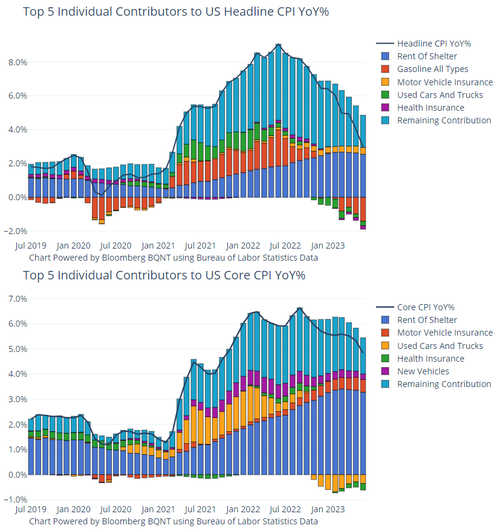

Under the hood, these are the biggest drivers of the YoY drop in headline and core CPI…

And the biggest drivers of the MoM change…

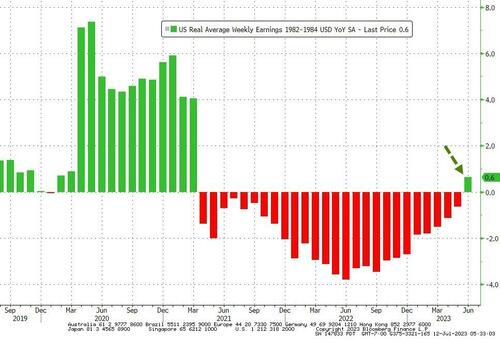

For the first time in 27 months, ‘Real’ wage growth rose YoY in June (+0.6%)…

Source: Bloomberg

It appears M2 signaled that the ‘stickiness’ is over and a tsunami of deflation is about to hit…

Source: Bloomberg

Here’s what to expect from markets (via Goldman):

-

>0.5% S&P sells off at least 200bps (5% probability)

-

.4 – .5% S&P sells off 100 – 200bps (10% probability)

-

.3 – .39% S&P sells off 0 – 100bps (30% probability)

-

.2% – .29% S&P rallies 0 – 100bps (35% probability)

-

.1% – .19% S&P rallies at least 100bps (15% probability)

-

< .1% S&P rallies at least 175bps (5% probability)

So expect stocks to rise from here, since, regardless of where you sit in the Fed debate, inflation decelerated in June to the slowest pace in more than two years. That’s the headline takeaway from today.

However, as Bloomberg notes – The questions now are: Is this a genuine turning point?

Does it reflect a material slowdown in the economy and how will the Fed respond?

Remember, policy makers in the 1970s were blamed for cutting rates at the first sight of inflation easing — only to be later blamed for policy error.

Loading…

https://www.zerohedge.com/markets/us-consumer-price-inflation-drops-27-month-lows-longest-streak-declines-ever