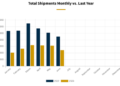

UnitedHealth Group Inc. shares plunged the most in three years after CFO John Rex told an audience at the Goldman Sachs Global Healthcare Conference that a recent surge in surgeries and other medical care might push expenses higher than previously forecasted. The exec’s comments rippled through the S&P 500 Managed Care Index, sending Humana Inc. and Elevance Health Inc lower.

Rex’s comments came late Tuesday at the Goldman healthcare event. He said the premium revenue spent on care for the second quarter might be “moderately above” the high end of expectations. This was enough to send UnitedHealth shares down as much as 9.3%.

The largest daily decline in three years.

“The surge in elective procedures like joint replacements comes after many of these surgeries were postponed by hospitals during the Covid pandemic,” Bloomberg noted.

UnitedHealth is the largest US health insurer. And concerns about higher costs unleashed a wave of selling across the S&P500 Managed Care Index, tumbling 7.5% in the early cash session. Some of the worst performers were Humana, plunging 13%, Centene Corp. -7%, and Elevance Health -6.5%.

UnitedHealth has forecasted a medical loss ratio — a measure of medical expenses — to be between 82.1% and 83.1% for 2023. The ratio premium revenue is spent on medical care. Rex said the ratio will be in the upper half of the range for the full year. Analysts surveyed by Bloomberg have an estimate of around 82.53%.

RBC Capital Markets analyst Ben Hendrix told clients the comments are great news for hospitals and surgery-center operators like Tenet and Surgery Partners Inc.

Here’s what other analysts are saying about Rex’s comments (list courtesy of Bloomberg):

Truist (buy, cuts PT to $580 from $610)

- Analysts expect the commentary around expenses to “create some pressure/chop”

- Still, remains bullish on the company on its significant scale and diversification, the ongoing move toward value-based care and sizable balance sheet/significant free cash flow

- Maintains buy rating

Oppenheimer (outperform, PT $610)

- “We believe the comments are likely to weigh on the entire group,” analyst Michael Wiederhorn writes in a note

- “The limited recent commentary from peers has not drawn any attention to changes in utilization”

JPMorgan (overweight)

- Analysts believe the diversity of the business could provide “potential offsets” to the downside

- “We think UNH’s comments will increase the perceived risk for the group going into 2Q earnings even though the impact could vary significantly depending on each company’s pricing/utilization assumptions”

- Says comments “meaningfully increase” the perceived risk for Managed Care peers even though they haven’t called out similar pressure

RBC (outperform, PT $592)

- “We view the stronger than expected elective volume as a solid read-through for our ASC favorites SGRY and THC, as well as for sustained outpatient momentum among the other acute care hospitals”

SVB Securities (outperform, cuts PT to $560 from $625)

- Updated estimates to reflect new expectation of higher trend

- “We selectively favor providers over payers given historically high sector controversies”

- Maintains outperform rating

Sector-wide selling of the managed care index indicates that traders finally realize all those deferred procedures during the pandemic are coming due and will pile up costs for health insurers.

Loading…

https://www.zerohedge.com/markets/unitedhealth-cfo-triggers-health-insurer-meltdown-rising-cost-fears