Authored by Matthew Piepenburg via GoldSwitzerland.com,

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In many recent articles and interviews, I’ve warned that Powell’s “higher for longer” war against inflation will actually (and ironically) lead to, well… greater inflation.

That is, the rising interest expense (nod to Powell) on Uncle Sam’s fatally rising 33T bar tab will inevitably need to be paid with an inflationary mouse-clicker at the Eccles Building.

I’ve also consistently maintained that Powell’s war on inflation is mostly just optics, as he secretly seeks inflation to help pay down that bar tab with an increasingly inflated/debased USD.

Powell achieves this open lie by publicly declaring a steady decline in inflation by simply misreporting the true CPI number.

As John Williams recently argued, true inflation using an honest (rather than the openly bogus BLS) measure is now closer to 11.5% rather than the officially reported headline rate of 3.7%.

This should come as very little surprise to those whose eyes are open to the Modis Operandi of debt-soaked/failed regimes. As former European Commission President, Jean-Claude Juncker confessed: “When the data is too bad, we just lie.”

But even for those who still believe the current Truman Show inflation (and “soft landing”) narrative out of DC, the Bezos Post or legacy media A, B, or C, there’s more fire adding to the inflationary flames than just bogus narratives and calming platitudes.

In particular, I’m talking about oil-driven inflation, and nothing burns faster.

Scary Flames in the Oil Supply

Left or right, the dumb out of DC just keeps getting dumber.

Between rising rates (nod to Powell), which make capex investing untenable for US oil producers, and a Weekend at Bernie’s White House, which has spent years effectively legislating US oil into oblivion, US energy supply is falling, and we all know that weakening supply leads to higher prices—and inflation.

Meanwhile, Saudi Arabia, whom that same White House called a “pariah state,” has not been warming to Biden’s awkward fist-pumps and increased production pleas, but rather joining other OPEC leaders in cutting, rather than expanding, oil production.

Gee, what a geopolitical shocker…

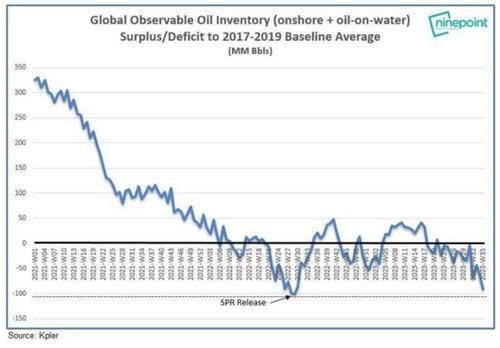

Net result, both national and global oil inventories are falling, and falling hard.

The Awkward Oil Two-Step

The once “go green” White House realized that the world, and inflation scales, still revolves around oil, especially after sanctioning Western Europe’s former energy supplier in one of the most short-sighted (i.e., stupid) policy decisions since the Iraq war.

This may explain why Biden changed his stripes and why there was a sudden pivot toward allowing greater US shale output in 2023 by pumping more cash into those shale fields at a pace not seen in 3 years.

Unfortunately, however, this may be too little too late (like Powell’s QT) to prevent oil price shocks and higher inflation into year end, thus adding insult to an already injured (and rising) US CPI measure of inflation.

As oil supply tightens, oil prices, and hence inflation rates, rise together with bond yields and interest rates—a perfect storm for over-inflated bond, stock, and real estate markets.

Those prices and inflation rates would be even worse if Chinese oil demand rises—which is why current Western headlines are literally praying for China to implode first. This might explain why The Economist has had two consecutive cover stories about an imploding China.

See how big media and big government sleep together?

Tying it Together

Regardless, we need to tie all this together.

If, as I see it, inflation (however misreported) becomes obviously more real and felt, the consequent rising bond yields will make the USD stronger and Uncle Sam’s bar tab more expensive, which hardy bodes well for America’s twin deficit black-hole of unpayable debt unless…

…Unless the Fed starts printing more fake and inflationary money to buy its own IOUs and weaken its export-killing, and BRICS-ignoring, USD.

Again, no matter how I turn the macros, the Fed will eventually have no choice but to pivot toward more instant liquidity and hence more inflationary policies to save/monetize its broke(n) bond markets.

Once this inevitability becomes a headline, the temporarily rising USD will be seen for what most of the informed world already recognizes—just another fiat monster backing a world reserve currency in the hands of a nation whose debt to GDP and deficit to GDP ratios mirror that of any other banana republic.

Reality is Hard to Look at Directly, But not for the BRICS

Many in the US or EU may not wish to see this. Bad news, like death and the sun, is hard to stare into.

But the BRICS nations, no strangers themselves to embarrassing balance sheets, are seeing this clearly.

Although I never bought into the gold-backed BRICS currency hype, I have zero doubt that this amalgam of commodity-heavy nations has a common enemy in the current US-dominated (and USD-driven) international trade system, whose hegemonic days are now numbered and whose alliances, as we warned from day-1 of the Putin sanctions (economic suicide), are forever de-dollarizing away from DC.

Moreover, the BRICS don’t need an “official” gold backed currency to trade their real assets in gold rather than Dollars. All they have to do, as Marcus Krall and I recently discussed, is request payment for their exports in gold.

The BRICS+ nations are hardly the perfect marriage of unlimited trust and efficient coordination. Nevertheless, they share an existential threat from an over-priced USD and negative-returning UST.

Furthermore, and as I recently noted at the Rule Symposium, they may not trust each other completely, but they do trust gold completely.

System Change is Now a Matter of Survival

Never has the phrase the “enemy of my enemy is my friend” found a better home than among the rising list of BRICS+ actors who recognize that their very survival hinges upon escaping the suffocating death of paying > $14T of USD-dominated debts whose rising costs (rates) they can no longer afford lest they become vassals of DC.

As Luke Gromen recently observed, from the perspective of the BRICS nations, it’s “either hang together or hang separately.”

A Changing Petrodollar?

China, for example, can not abide forever by a petrodollar system of oil purchases. As the world’s largest oil importer, it mathematically recognizes that it will eventually run out of dollars to buy that oil.

In short, China needs to come up with a better plan—outside the Greenback.

And they will.

By the way, have you noticed the next BRIC in the wall? It’s Saudi Arabia.

See a trend? See a looming change in oil currencies?

Just saying…

As I warned months ago, this Saudi trend away from DC and closer to Shanghai could eventually be a key driver in slowly unwinding the current petrodollar system between a once “friendly” US-Saudi relationship toward a now weakening relationship which hitherto ensured the global demand (and hence the survival) of an otherwise debased paper Dollar.

If the petrodollar system radically or even slowly unwinds, this will do far more to destroy demand and the inherent purchasing power of the USD (and send gold skyrocketing) than any gold-backed BRICS trade currency.

And yet with all the recent sensationalism preceding the BRICS summit in South Africa, almost no one saw this—at least not in the legacy media.

Imagine that…

Other Tricks Up the BRICS Sleeve: More USD Assets than Liabilities

Aside from knee-capping the USD via a shift (gradual or sudden) in the petrodollar trade, it’s worth noting that but for South Africa, the remaining BRICS nations have more USD assets than liabilities, which means they can start dumping USTs to the detriment of Uncle Sam in order to raise USDs.

Many idealogues and US-thinktankers still think the US has all the power over these silly little BRICS nations who allegedly suffer from a dollar shortage.

The chest-puffers still see the USD as all-powerful and all-controlling, after all, just ask Iraq or Libya…

But the dollar-forever crowd is missing the forest for the trees or the basic math of fantasy debt.

If you haven’t noticed, the US just added an extra $1.9 trillion of insane borrowing to the back end of 2023.

And they did this as rates are rising and with the Fed still in full QT/suicide mode.

This mathematically places downward price pressure on bonds and hence upward cost pressure on yields, a scenario America simply can’t play out for much longer at $95T+ in combined public, household and corporate debt.

If the BRICS nations chose to add a layer of US asset dumping to this toxic mix, the ramifications for Uncle Sam would be even more staggering/painful for a debt-based system already on the cliff’s edge.

This is Bad, Really Bad

To repeat: The macros, no matter how I turn them, have never been this bad, this vulnerable and this foreseeable.

The US is now trapped in a vicious circle of debt for which there is no way out other than a currency-destroying return to more artificial, QE “stimulus” and the mother of all inflationary waves.

The horizon is now clear: Yields are up, twin deficits are up, inflation, even the mis-reported kind, is up, and yes, GDP is up too, but as I recently wrote, debt-driven GDP growth is not growth, but just debt.

Unless DC cuts spending at record levels (which kills election results for political opportunists and thus won’t happen), the only tool Washington DC has is more fake money and more real inflation, which means the Dollar in your wallet, checking account or portfolio is about to insult you.

Loading…

https://www.zerohedge.com/geopolitical/bad-really-bad