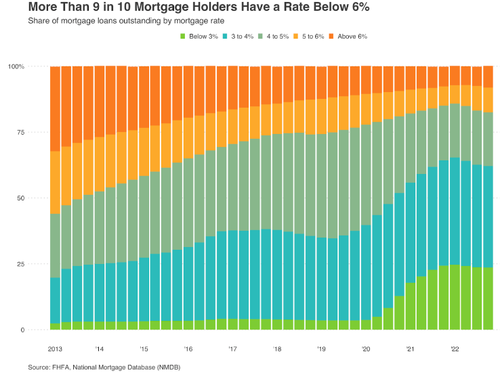

A recent Redfin analysis revealed that 92% of homeowners with mortgages have rates significantly lower than the current weekly 30-year fixed mortgage rate of 7.16%. Specifically, 92% have rates under 6%, 82% are beneath 5%, 62% are under 4%, and 24% are below 3%. This has led to many homeowners feeling trapped by their mortgage rates nationwide.

The reluctance of many homeowners to sell their homes has exacerbated the inventory shortage, which has only propped up home prices. No homeowner in their right mind would give up a sub 3% 30-year fixed mortgage rate for the current market rate. People just don’t want to pay more interest after an inflation storm wrecked household finances for the last two years under ‘Bidenomics.’

Millions of Americans are sitting on very cheap mortgages, trapped in their homes in this high-rate environment. For them, moving is no longer an option.

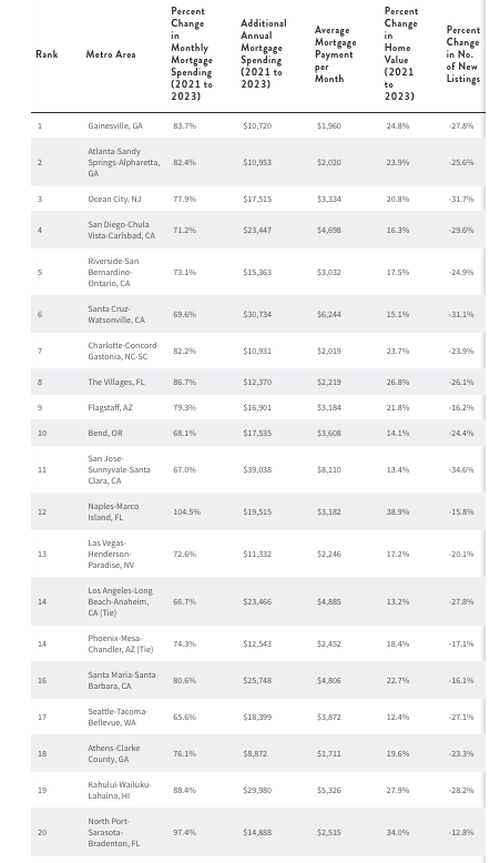

A new study from MoneyGeek found homeowners in the southern part of the US feel the most trapped. In four cities, Gainesville, Georgia; Atlanta-Sandy Springs-Alpharetta, Georgia; Ocean City, New Jersey; and San Diego-Chula Vista-Carlsbad, California, homeowners were the most trapped.

MoneyGeek researchers analyzed data for 312 metro areas across home values, historic mortgage rates, and housing supply and demand trends. To determine cities with the most trapped homeowners, average mortgage spending had to increase while the housing supply deceased.

Most trapped homeowners were in the southern part of the country:

- Gainesville and Atlanta, Georgia, rank as the No. 1 and No. 2 metro areas where homeowners are most trapped in their mortgages. Homeowners looking to buy would face increases of more than 82% in annual mortgage spending. Further south, in the Naples-Marco Island area of Florida, mortgage costs have more than doubled since 2021.

In the Northeast, the report found Ocean City, New Jersey, had the most:

- National housing trends reveal a tightening grip on supply and demand. In the Northeast, Ocean City, New Jersey, is seeing a 31.7% plunge in housing supply, while Austin, Texas, grapples with a 56.5% surge in listing-to-close time, signaling a dip in demand.

Southern California also made the top of the list:

- San Jose, California, has the highest average mortgage payment, which surged by 67% to $8,110 per month between 2021 and 2023, posing a challenge for budget-conscious homeowners. To manage this cost without exceeding 28% of income, prospective homebuyers would need an annual income exceeding $420,000.

Best and Worst Areas for Homeowners Trapped in Mortgages

Here are the top 20 cities where homeowners feel the most trapped:

In April, we outlined this powerful dynamic in a note titled “Owners Trapped By Low-Rate Mortgages, Buyers Thwarted By High-Rate Mortgages.”

Dampened affordability means homebuyers and homeowners are paralyzed. Jacob Channel, senior economist at LendingTree, recently called this environment: “In many ways, we’re in uncharted territory right now.”

Loading…

https://www.zerohedge.com/markets/these-cities-have-most-trapped-homeowners-their-low-rate-mortgages