U.S. corporate profits hit record levels in 2022, even as stocks fell into a bear market and inflation reached 40-year highs.

Given these headwinds, investors are watching corporate fundamentals very closely. Corporate profit margins provide a buffer against higher borrowing costs and price pressures and for many reasons, they are a key measure of financial health.

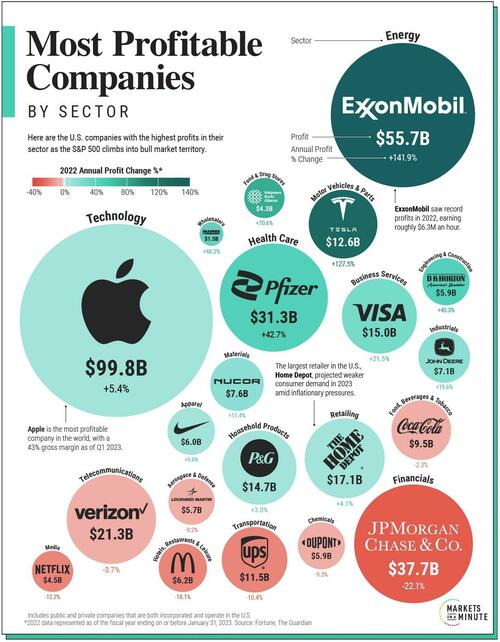

In the following infographic, Visual Capitalist’s Dorothy Neufeld shows America’s most profitable companies by sector, using data from Fortune.

America’s Most Profitable Companies

Here are the U.S. firms with the highest annual profits in their sector. Data is based on the fiscal year ending on or before January 31, 2023 across companies in the Fortune 500.

Both public and private companies that are incorporated and operate in the U.S. are included.

| Company | Sector | 2022 Annual Profit | Annual % Change |

|---|---|---|---|

| Apple | Technology | $99.8B | 5.4% |

| Exxon Mobil | Energy | $55.7B | 141.9% |

| JPMorgan Chase | Financials | $37.7B | -22.1% |

| Pfizer | Health Care | $31.3B | 42.7% |

| Verizon Communications | Telecommunications | $21.3B | -3.7% |

| Home Depot | Retailing | $17.1B | 4.1% |

| Visa | Business Services | $15.0B | 21.5% |

| Procter & Gamble | Household Products | $14.7B | 3.0% |

| Tesla | Motor Vehicles & Parts | $12.6B | 127.5% |

| UPS | Transportation | $11.5B | -10.4% |

| Coca-Cola | Food, Beverages & Tobacco | $9.5B | -2.3% |

| Nucor | Materials | $7.6B | 11.4% |

| Deere | Industrials | $7.1B | 19.6% |

| McDonald’s | Hotels, Restaurants & Leisure | $6.2B | -18.1% |

| Nike | Apparel | $6.0B | 5.6% |

| DuPont | Chemicals | $5.9B | -9.3% |

| D.R. Horton | Engineering & Construction | $5.9B | 40.3% |

| Lockheed Martin | Aerospace & Defense | $5.7B | -9.2% |

| Netflix | Media | $4.5B | -12.2% |

| Walgreens Boots Alliance | Food & Drug Stores | $4.3B | 70.6% |

| W.W. Grainger | Wholesalers | $1.5B | 48.3% |

Apple is the most profitable company in America. Reaching almost $100 billion in profits in 2022, it outpaces the profit leaders in both the energy and financials sectors combined. Furthermore, at the end of 2022, its net profit margin stood at nearly 25%.

Amid a maturing smartphone market, the company is focusing more on service-based revenue. iPhones make up roughly half of its total net sales, yet growth is plateauing. Last year, iPhone sales growth was 7%, compared to 39% the year before. Meanwhile, services sales—including cloud, AppleCare, and advertising—increased 14% annually.

Within the energy sector, Exxon Mobil took the top spot with record profits of over $55 billion. Profits jumped almost 142% last year as oil prices spiked with Russia’s invasion of Ukraine. Steep cuts in costs through the pandemic also helped to bolster the company’s returns.

JPMorgan Chase saw the highest profits in the financial sector. As the nation’s largest bank by assets, it saw a sharp decline in its investment banking division as higher interest rates made financing mergers and acquisitions less lucrative. Overall, profits sank more than 22% annually.

Corporate Profits in Perspective

Low taxes and interest rates contributed to about one-third of profit growth across nonfinancial companies in the S&P 500 over the last 20 years, a paper from the Federal Reserve shows.

Now, as interest rates climb higher, steeper costs could cut into bottom lines. The good news is so far, corporations have shown resilience to a shifting interest rate regime.

In the first quarter of 2023, U.S. corporate profits fell moderately by just over 5%.

Profitability and Competitive Advantage

What does this mean for investors?

For investors looking for companies that can weather higher rates, profitability is one factor to consider. Companies with strong profitability can reinvest in their business, pay dividends, and better withstand road bumps from rising costs.

Going further, companies with high profitability often have a strong market share thanks to economies of scale lowering costs, brand loyalty driving demand, and economic moats. We can see this with Apple and Visa, for example.

Over time, this builds a sustainable competitive advantage. As companies preserve profitability, it adds value to shareholders, often supporting share prices over the longer-term.

Loading…

https://www.zerohedge.com/markets/these-are-most-profitable-us-companies-sector