By Alex Kimani of Oilprice.com

The last two energy crises that threatened hundreds of energy companies with bankruptcy have rewritten the O&G playbook. At the height of the shale boom, the U.S. Shale Patch expanded production aggressively and also made numerous aggressive tactical or cyclical acquisitions. However, the 2020 oil price crash that sent oil prices into negative territory has seen energy companies adopt a more restrained, strategic, and environment-focused approach in their spending.

U.S. shale drillers have abandoned their trigger-happy drilling days and are mostly sticking to their pledge to cut costs, return money to shareholders in dividends and share buybacks, and also pay down debt. This has pretty much become the trend even on a global scale.

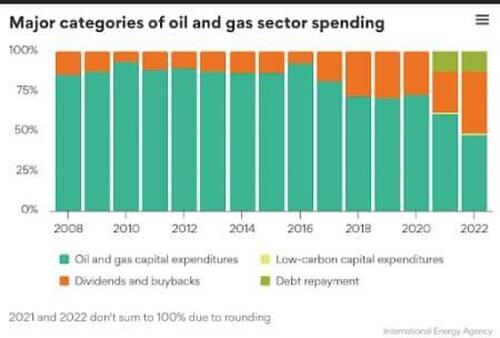

Many investors may already be aware of the new modus operandi by oil and gas companies. However, what is not readily apparent is the full extent of the change in ethos. Well, the change has been pretty dramatic: the International Energy Agency (IEA) has revealed that energy companies spent a mere 48% of their operating cash flow on capital spending in 2022, down sharply from 93% in 2016 but hiked dividends and share repurchases to 39% of cash flows up from 7% in 2016.

In effect, energy companies have cut capex by nearly half but increased cash returns to shareholders by nearly five-fold.

In a clear sign of the times, the amount of capital investment flowing into the solar sector is poised to overtake the amount of investment going into oil production for the first time ever in 2023, the International Energy Association has reported.

According to Fatih Birol, the IEA’s executive director, for every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Solar investments are expected to attract over $1 billion a day in 2023 with over $1.7 trillion slated to flow clean energy technologies such as EVs, renewables and storage. Overall, global investment in energy is projected to hit ~$2.8 trillion in the current year.

The oil and gas sector spent 1% of cash flows on low-carbon and clean energy projects in 2022, up from zero in 2016. These companies have also been taking advantage of high commodity prices to pay down debt, with 13% of cash flow going into debt repayments in 2021 and 2022 up from nearly zero.

M&A Declines

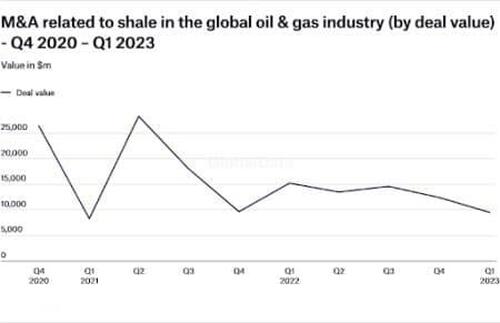

Yet another market segment has witnessed major change in the energy transition: Mergers and Acquisitions. Oil and gas executives have become increasingly hesitant to pull the trigger on new deals, with mergers in the U.S. energy sector decreasing both in volume and deal value.

While there have been some headline-grabbing big deals recently, on a quarterly basis the stats tell a different story.

According to GlobalData’s United States of America (USA) Lower 48 Unconventional Oil and Gas (Major Shale Plays) Market Analysis and Forecast, 2021-2026 report, shale-related deal volume fell a whopping 60% Y/Y with only 21 deals consummated during the quarter while total deal value fell 38%Y/Y to $9.5B.

Most of those deals were struck in the Eagle Ford shale of South Texas, where assets can be purchased for the value of existing production alone. That’s quite unnerving considering that energy experts generally expected a deluge of M&A action with the sector enjoying some of its highest profits in years. The biggest deals during the quarter was the acquisition of Eagle Ford operator Ranger Oil by Canada’s Baytex Energy (NYSE:BTE) for $2.5 billion as well as Chesapeake Energy’s (NASDAQ:CHK) asset sale to WildFire Energy for $1.42 billion as well as a separate $1.4 billion sales agreement with Britain’s INEOS.

“The collapse in deal counts is really remarkable, with the low count likely the new normal in shale M&A. We are seeing far fewer opportunities for deals in the current market that is much more consolidated and has much less undeveloped resources,” said Dittmar.

“While opportunities still exist, shale M&A may be in its latter stages,”Andrew Dittmar, a director at Enverus, has said, blaming low commodity prices for the sharp slowdown.

Nevertheless, Enervus says that total value of future deals is likely to rise again in the Permian, noting that top-tier locations there have sold for $2 million and up to $3 million meaning only companies with deep pockets will be able to buy into the basin.

Source: GlobalData Oil & Gas Intelligence Center

Loading…

https://www.zerohedge.com/markets/new-playbook-us-shale-more-shareholders-less-output-growth