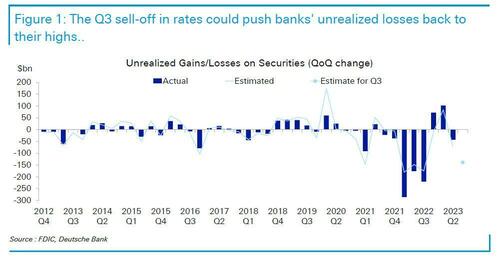

Earlier this week we discussed why the 74 bps spike in 10Y yields would lead to an approximately $140 billion surge in unrealized debt losses on US bank books, which at the end of Q2 amounted to $5.4 trillion in total duration exposure, As a result, total cumulative unrealized bank losses would soar to a new record high of $700 billion, potentially triggering an expansion in the Fed’s BTFP “temporary” bank bailout facility.

But until we get a detailed account of the latest bank balance sheet carnage, a question has emerged: what about the total cumulative losses across all investors on the fixed income asset class? After all, it’s not just banks that are suffering losses as a result of soaring yields, losses on an asset class which is traditionally used as “ultra safe” collateral across the global repo market, and therefore any impairment could lead to massive margin calls both in and out of the banking sector?

Loading…

https://www.zerohedge.com/markets/margin-call-moment-70-trillion-global-losses