And the hits just keep on coming for China.

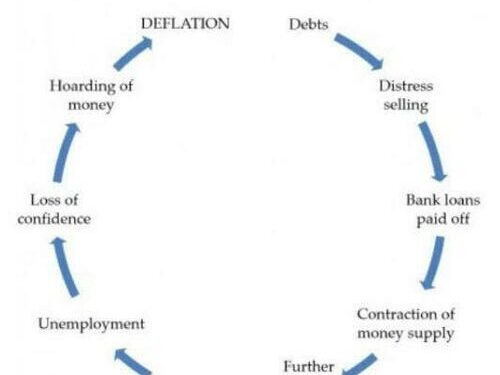

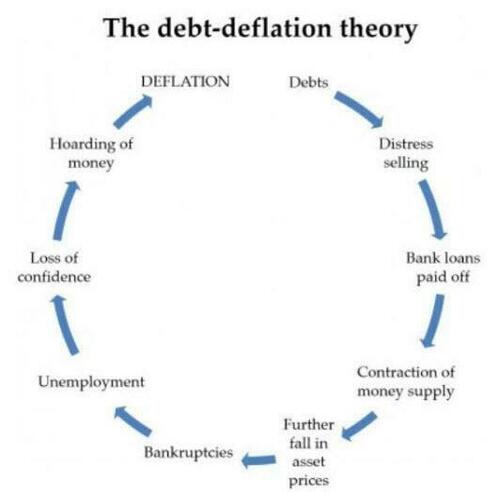

With its economy on the verge of a Japanification vicious loop, where record debts, lead to distressed selling, repayment of debt, contraction in the money supply, falling asset prices, a wave of bankruptcies, surging unemployment, a slowing economy and a crisis of confidence, which then leads to money hoarding and deflation…

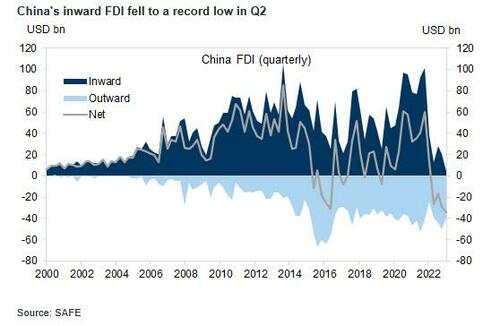

… not to mention a growing property crisis, shadow banking crisis, a youth unemployment crisis, a record collapse in foreign direct investment…

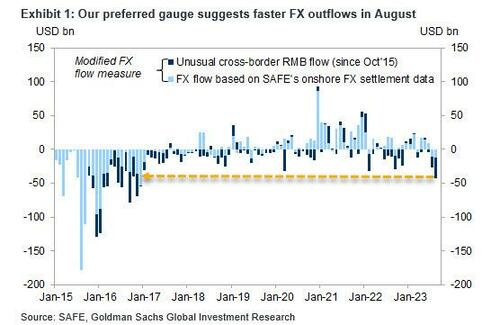

… China is now also facing a sudden surge in FX outflows: according to Goldman’s preferred gauge of FX flows, China’s net outflows were $42bn in August, the fastest pace of outflows since December 2016 when China was reeling from the 2015 shock yuan devaluation, vs the already concerning $26bn outflows in July (which we discussed last month). Foreign investors’ net selling of equities through the stock connect channel rose materially in August, contributing to the acceleration of outflows. Goods trade related inflows remained robust on the other hand.

Here are the key points from the latest data:

1. In August, China experienced $24bn in net outflows via onshore outright spot transactions, and $12bn inflows via freshly entered and canceled forward transactions. Another SAFE dataset on “cross-border RMB flows” showed outflows of $31bn in the month, suggesting net payment of RMB from onshore to offshore. Goldman’s preferred FX flow measure therefore suggests a total US$42bn outflows in August, in comparison with US$26bn outflows in July, an outflow which was the highest since July 2022.

2. The current account continued to show inflows. There was a net inflow of $26bn related to goods trade in August, higher than the $18bn in July. Goods trade surplus conversion ratio rose to 38% in August vs 22% in July, in contrast to the continued depreciation of the currency. On the other hand, the services trade deficit was $14bn, more negative than $11bn in July as outbound tourism continued to recover. The income and transfers account showed outflows of $5bn in August, smaller than $6bn in July.

3. Portfolio investment channel saw faster outflows in August. Stock Connect flows showed strong net selling of equities through northbound and net buying through southbound, which implies US$22bn outflows through the Stock Connect channel, vs US$5bn inflows in July. This was the fastest pace of outflows through the Stock Connect channel since January 2021. Foreigners’ holding of RMB bonds data are not released yet.

4. Official FX reserves (released earlier in the month) declined to US$3,160bn in August from US$3,204bn in July. By Goldman’s estimate, FX valuation effects would have cut FX reserves by $19bn in August, so after adjusting for FX valuation effects, FX reserves still decreased by $25bn in July. While the unfavorable asset price effect likely contributed to this decline, the decline might not be fully explained by asset price declines, suggesting potential usage of FX reserves to manage the currency amid outflow pressures.

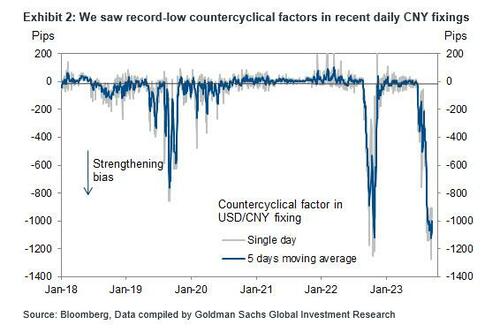

5. Goldman forecasts continued monetary policy easing in Q4, including a 25bp RRR cut and a 10bp policy interest rate cut. CNY exchange rate will likely continue to face depreciation pressures in the near term while policymakers maintain tight capital controls and guide market expectations to slow the depreciation trend of the currency.

And so, with China’s currency the weakest it has ever been, and with FX outflows accelerating sharply, one can’t help but remember the panic observed after the August 2015 devaluation, which not only shocked global markets but woke bitcoin from its long slumber as billions in Chinese savings scrambled to the safety of offshore bank accounts via one of the few still open cracks in China’s great monetary firewall. How long until we get a rerun?

More in the full Goldman note available to pro subs.

https://www.zerohedge.com/markets/hits-just-keep-coming-china-suffers-biggest-fx-outflow-2016-amid-sudden-surge-capital