Authored by Lance Roberts via RealInvestmentAdvice.com,

Lately, we discussed macro-related market issues such as the” A.I., chase,” but a technical review can help manage shorter-term risks. Currently, the debate is about the market rally from the October lows. Is it a resumption of the 2009 bull market trend or an extended bear market rally?

Unfortunately, I don’t have the answer.

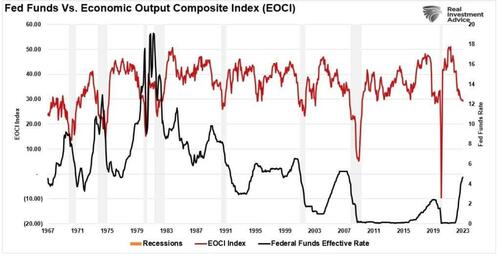

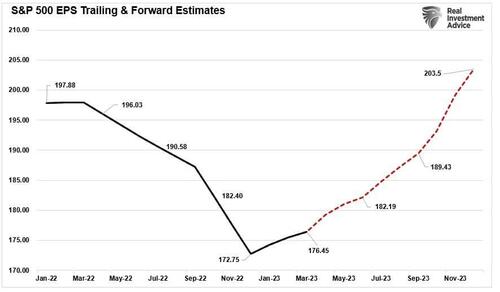

The bearish case is compelling, given higher interest rates, increased debt levels, and slowing economic activity. Our Economic Composite Index (which comprises more than 100 data points) suggests the economy will enter a recession over the next 6-months.

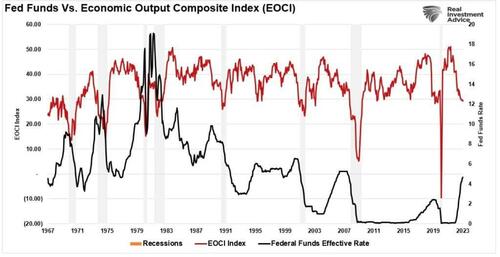

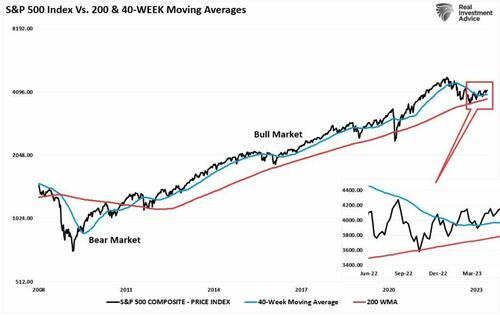

However, the bulls can also make a compelling case. The technical dynamics and improving earnings are certainly supportive of the rally. Technically, the correction from January 2022 to the long-term bullish trend line of the 200-week moving average is complete. With the market holding that support and moving above the 50-week moving average provides further validation.

Fundamentally, earnings are expected to grow rapidly through the end of 2023 and break above the 2022 peak.

Of course, such a strong technical and fundamental recovery in earnings must result from an economic expansion. The problem is that view contradicts the current economic data.

So which view is correct?

Again, I have no idea which view is correct. As such, we must focus on the shorter-term technical market view to manage investment-related risks.

Bulls In Control, But Resistance Ahead

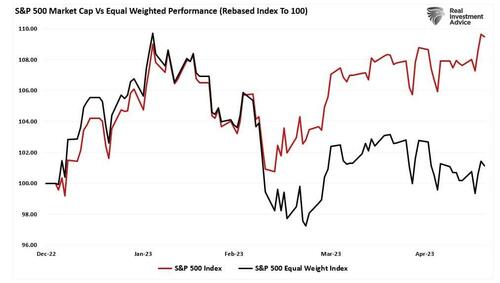

As noted, the bulls are clearly in control of the market currently. However, as we discussed last week, the market is being driven by a narrow advance in the mega-capitalization stocks. Visualizing the disparity in participation is clear between the market capitalization performance and equal-weighted indices.

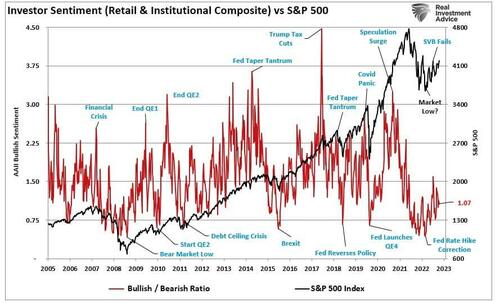

The narrowness of the market advance is potentially an issue if it doesn’t broaden out. However, the rally can last longer than many expect as the Fear Of Missing Out (F.F.O.M.O weighs on bearish sentiment. The more the market rallies, the more it weighs on bearish investors until they eventually capitulate. The conversion of bearish sentiment fuels a rally in the short term. Despite the rally from the October lows, there remains a significant level of negative investor sentiment in the market.

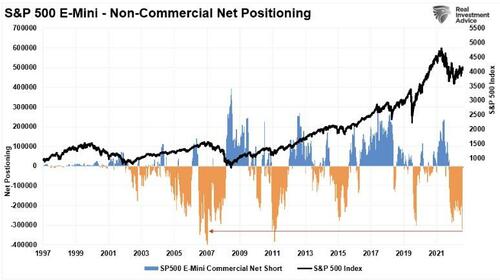

Adding to that pessimism, as noted in “C.O.T. Extremes,” the massive level of short positions by Non-Commercial speculators against the S&P 500. Such is another source of potential buying to support a further rise.

“Since 2009, large net short positioning has denoted market bottoms. Each of the periods where the COT net short positioning became more extreme, such provided the “fuel” for the ongoing advance as traders were forced to cover their short-positioning as markets rose.”

While the still pessimistic view, and massive short position, will provide the “fuel” needed to propel the markets higher near term, multiple levels of resistance are ahead. From a technical perspective, the first significant resistance level will be the 61.8% retracement from the October lows at 4332. Following is the 78.96% retracement level, then two minor resistance levels at 4637 and 4703 before attaining the 2022 peak.

If or when each of these technical levels gets taken out, such will force more buyers into the market, driving higher prices. That cycle will repeat until something eventually breaks. Until then, the bulls are clearly in control on a technical basis.

It’s A One-Sided Argument

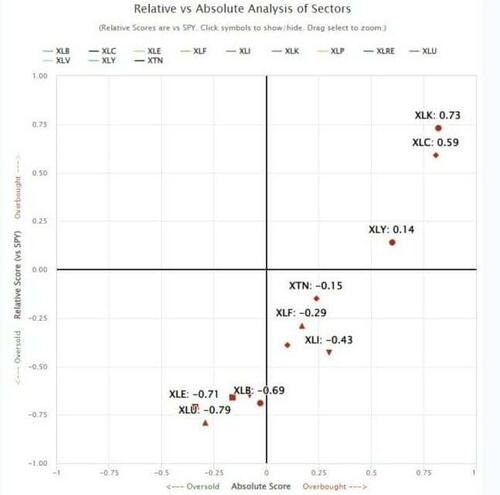

As noted, the risk of “something going wrong” has not been eliminated. As discussed last week, the technology trade is absorbing the bulk of inflows as every other market sector remains under pressure. Such is due to the continued economic and fundamental outlooks of weaker growth, bank stress, and higher rates.

Historically, such a wide divergence between short-term technical trends and fundamental realities doesn’t last indefinitely. Eventually, a market rotation occurs as those realities set in. Another issue for the technology-centric trade is that it is a bet on disinflation, given that technology stocks are long-duration assets. However, inflation remains “stickier” than expected, and the divergence between technology stocks and bond prices is quite extreme. Along with the bearish breadth divergence, it does give a reason for skepticism on the sustainability of the tech rally

While there are certainly reasons for concern, the bullish technicals remain supportive of the rally for now. Whether this is a “new bull market” or another “bear market rally,” we will not know until much later. However, as Callum Thomas of @TopDownCharts recently posted, bear market rallies can last much longer than many think.

While there are many reasons to be bearish on the markets, it is essential to remember that “stocks climb a wall of worry.”

The current market advance looks and feels like the Dot.com advance in 1999. How long it can last is anyone’s guess. However, importantly, it should be remembered that all good things come to an end. Sometimes, those endings can be very disastrous to long-term investing objectives. This is why long-term returns tend to take care of themselves by focusing on “risk controls” in the short term and avoiding subsequent major draw-downs.

Loading…

https://www.zerohedge.com/markets/bearish-case-compelling-ai-chasing-bulls-are-control