Authored by Simon White, Bloomberg macro strategist,

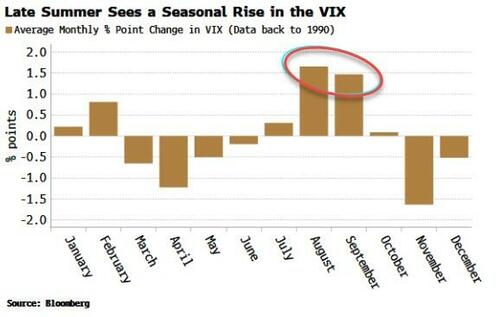

Speculation is driving the VIX lower but mid-summer seasonals are very positive for equity volatility, coinciding with an upcoming week of central-bank meetings and earnings announcements as potential vol catalysts.

We’re in the dog days of summer, but it’s never quite felt like you can let your guard down completely market-wise. Still, if your only gauge was the so-called “fear” index, aka the VIX, then you might have concluded we’ve already been in the doldrums for several months – last week, the index closed only smidge above where it was early 2020.

But that might be about to change. August and September are typically the months that see the most upside for the VIX. Seasonals should never be looked at in isolation. But nor should they be ignored when they show such a strong skew.

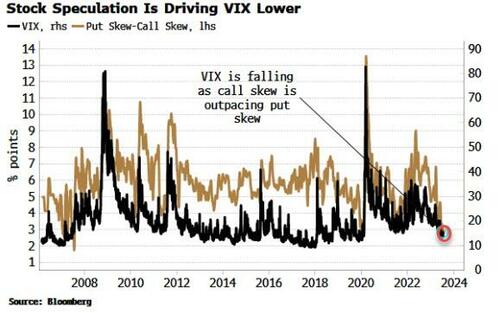

The VIX’s drive lower since last year matches almost perfectly the relative rise in call skew compared to put skew. Put skew has been rising as tail-risk insurance has risen. But call skew (and call volume) has been rising even more as speculation drives demand for calls (typically calls are sold to harvest extra premium from the underlying stocks – the JP Morgan Hedged Equity Fund is a huge player in this area).

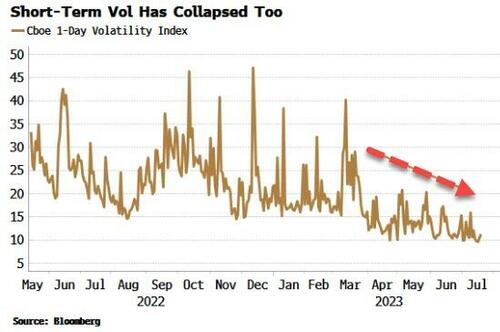

The net effect is to drive realized and implied vol, i.e. the VIX, lower. And this is not just a phenomenon in longer-dated vol (the VIX is composed of options whose remaining expiry is ~30days). Short-dated vol is collapsing too. The chart below shows the CBOE’s 1-Day VIX, which is composed of options very close to their expiry.

This was not the case earlier in the year, when the VIX was subdued even as vol at the front-end of the curve was elevated. Now, though, vol across the curve is dropping.

Summer or not, risk hasn’t gone away. The ECB and the Fed are later this week, about 170 S&P 500 companies will announce their earnings, and there are ongoing endogenous risks from a short-term overbought market replete with speculation that can border on feverish. It might soon get hot again for the VIX.

Loading…

https://www.zerohedge.com/markets/summer-might-be-about-heat-vix