Authored by Simon White, Bloomberg macro strategist,

Existing US home sales for July numbers are due out later today. Signs of weakening in the midst of a rising rate environment will leave homebuilder stocks prone to underperformance.

Existing and pending sales have remained weak since last year, while new home-sales growth has surged.

This has been due to a low inventory in the stock of existing homes.

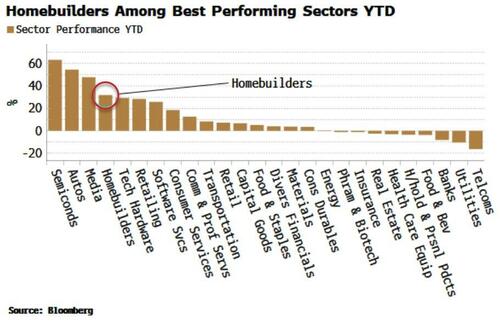

No doubt this has helped fuel homebuilders to being one of the best performing sectors year-to-date. Firms such as M/I Homes (+104% YTD), Green Brick Partners (+102%) and Topbuild Corp (+80%) have delivered returns commensurate with AI companies.

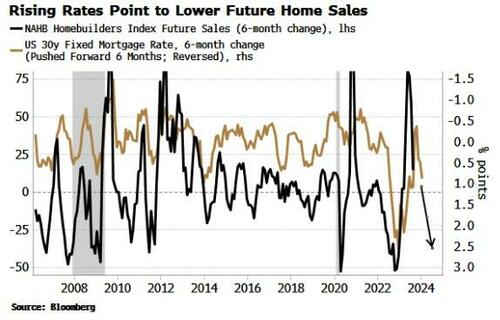

But the recent rise in yields does not yet look fully reflected in the price. The chart below shows that the 6-month change in the 30-year fixed mortgage rate leads the NAHB’s gauge of future home sales by about six months. The rise in mortgage rates thus points to weaker sales soon coming through.

The rise in rates also points to weaker growth in building permits, which is a reliable leading indicator for the housing market itself.

Moreover, homebuilders as a sector have relatively high duration. This year the market has been trading as if high inflation is a thing of the past. Instead, there is a good chance it could soon begin rising again. Higher-duration sectors such as tech, media, autos – and homebuilders – are exposed in such a situation.

Bond yields are continuing to rise. If the market believes the neutral rate is higher – and Governor Powell may give some color on this at this week’s Jackson Hole symposium – then it will underscore the risks from elevated inflation and thus the likelihood that yields are finding a new, higher equilibrium level.

Loading…

https://www.zerohedge.com/markets/stretched-homebuilders-are-vulnerable-rising-rates