Strong housing data today is bad news for The Fed – and the market’s ‘pause-hopers’ – as it threatens to re-ignite the Owners Equivalent Rent segment of CPI (which has rolled over and is helping with the recent trend of disinflation).

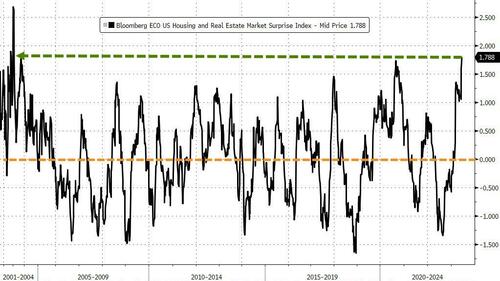

For context, the housing macro data is seeing the biggest serial upside surprises since 2003…

Source: Bloomberg

Consumer confidence also spiked, according to The Conference Board, and Durable Goods orders also surged in May. All-in-all, hot, damned hot, as overall macro surprise data is soaring…

Source: Bloomberg

And that all sent hawkish shivers through the STIRs market – with a 25bp hike in July now trading at 75% odds (and that terminal rate – around 5.35% – holding through year-end)…

Source: Bloomberg

But long-duration stocks didn’t care. In fact from the moment the cash market opened, we were off to the races as the algos lifted everything (with Small Caps and Nasdaq leading the charge). The Dow lagged, weighed down by WBA’s weakness. Some late-day selling, profit-taking wiped a little lipstick off the pig…

Options-traders (all expiration and 0-DTE) panic-bought calls all day…

Source: SpotGamma

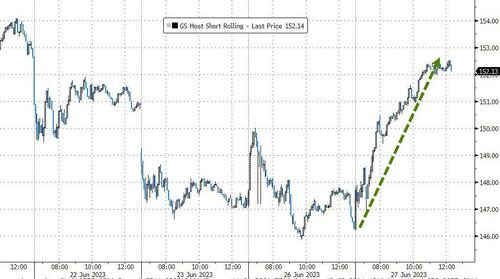

Which ignited a huge short-squeeze. ‘Most shorted’ stocks surged over 4% from their lows…

Source: Bloomberg

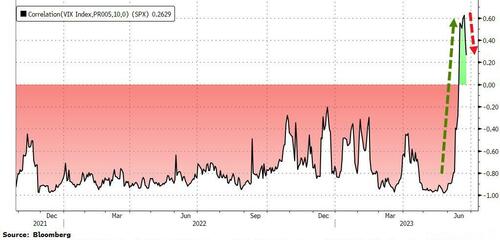

VIX was lower again on the day and with stocks higher, the outlier correlation of VIX and S&P has begun to fade from 30 year highs…

Source: Bloomberg

From around 1130ET, the market barely saw any negative TICKs…

Source: Bloomberg

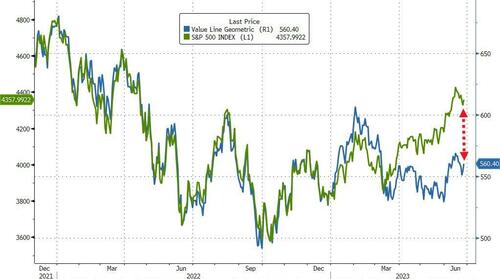

Before we leave equity-land, we note that while many have noted the concentration of equity market performance, we point out that the ‘median’ stock’s performance is dramatically decoupled from the S&P 500 cap-weighted indices. We note that the last time these two indices decoupled to this scale was Q4 2021 (marking the peak in the S&P 500)…

Source: Bloomberg

Treasury yields were all higher on the day with the belly underperforming (3Y +8bps, 30Y +2bps). Yields are all higher on the week now…

Source: Bloomberg

The yield curve (3s30s) flattened (inverted deeper) almost back to pre-SVB lows…

Source: Bloomberg

Bonds (even Bills) continue to offer an alternative (6mo bill yields at their widest vs the S&P’s earnings yield since Jan 2001)…

Source: Bloomberg

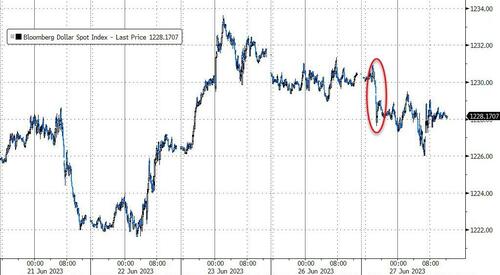

The dollar was lower on the day – despite the hawkish shift in rates – dumped during the early Asian market (Yuan strength) and then going nowhere…

Source: Bloomberg

Bitcoin surged overnight up to $31,000 but fell back – still closing higher though…

Source: Bloomberg

Oil prices tumbled ahead of tonight’s API data, with WTI unable to hold $70, falling back to the recent range lows…

Gold continues to make lower highs and lower lows, back to 3-month lows…

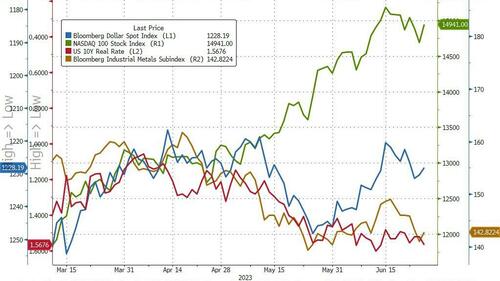

Finally, to sum everything up…strong data (hawkish ‘good is bad’ signal), rate-hike odds up (hawkish response), stocks up (implied dovish signal, easing financial conditions), bond yields up (hawkish response to less recession risk, Fed reaction function), dollar down (implied dovish response to a hawkish shift?), commodities down (implied demand fears from hawkish response).

Longer-term things have ‘decoupled;…

Source: Bloomberg

Confused yet? Are macro data surprises at “as good as it gets” levels?

Loading…

https://www.zerohedge.com/markets/stocks-soar-strong-data-batters-bonds-bullion-sparks-hawkish-shift-rate-hike-odds