- US stocks mostly tumbled with the declines led by the Nasdaq 100 which posted its second worst day of the year.

- APAC stocks were mixed as further support efforts from China partially offset the headwinds from Wall St.

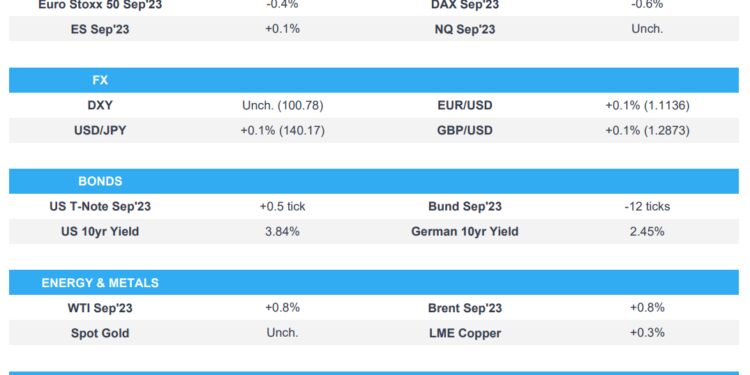

- European equity futures are indicative of a softer open with the Euro Stoxx 50 -0.3% after the cash market closed up by 0.3% yesterday.

- DXY held onto yesterday’s gains, EUR/USD and Cable sit on 1.11 and 1.28 handles respectively, USD/JPY choppy post-Japanese CPI.

- Looking ahead, highlights include UK Retail Sales, Earnings from Danske Bank, Evolution AB, American Express & Schlumberger.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks mostly tumbled with the declines led by the Nasdaq 100 which posted its second worst day of the year as poor earnings receptions for NFLX and TSLA catalysed a sharp pullback, while a higher yield environment also provided headwinds for equities ahead of Friday’s monthly stock options expiry and Nasdaq 100 rebalances.

- SPX -0.68% at 4,534, NDX -2.28% at 15,466, DJIA +0.47% at 35,225, RUT -0.89% at 1,967.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden launched a working group aimed at ending debt-limit standoffs and the White House will explore all legal and policy options to prevent a future debt-ceiling standoff, while it will examine potential actions Congress could take to make default risk a thing of the past, according to a White House official.

- USTR’s Tai had a direct and candid exchange with EU’s Dombrovskis regarding the October 31st deadline for a steel and aluminium trade agreement.

APAC TRADE

EQUITIES

- APAC stocks were mixed as further support efforts from China partially offset the headwinds from Wall St where the Nasdaq 100 suffered its second-worst day of the year on tech disappointment and amid a rising yield environment.

- ASX 200 was subdued amid losses in tech, financials and the mining-related sectors, albeit with downside limited amid the lack of catalysts from Australia.

- Nikkei 225 slumped at the open but was well off its lows amid currency swings and somewhat ambiguous CPI data which printed mostly in line with expectations but showed a slight acceleration for the headline and core inflation.

- Hang Seng and Shanghai Comp were underpinned by further supportive efforts from China in which the NDRC released policies to boost electronics products consumption and measures to promote automobile consumption.

- US equity futures traded sideways heading into the monthly stock options expiry and Nasdaq 100 rebalances.

- European equity futures are indicative of a softer open with the Euro Stoxx 50 -0.3% after the cash market closed up by 0.3% yesterday.

FX

- DXY traded rangebound overnight and held onto yesterday’s gains after briefly climbing to just shy of the 101.00 level on the back of the recent upside in yields owing to the multi-month low initial jobless claims data.

- EUR/USD struggled to recover from this week’s declines and remained firmly beneath the 1.1200 handle.

- GBP/USD attempted to nurse some of the prior day’s losses, while attention turns to UK Retail Sales.

- USD/JPY was choppy and traded on both sides of the 140.00 level after the mostly in-line inflation data although the pair is ultimately propped up by the wider yield differentials.

- Antipodeans were indecisive after recent selling pressure and lack of pertinent data releases.

- PBoC set USD/CNY mid-point at 7.1456 vs exp. 7.1965 (prev. 7.1466)

- China’s FX regulator said yuan flexibility is increasing and market understanding of two-way fluctuation and risk-neutral also increased. China will prevent sharp volatility in the exchange rate and will keep the yuan basically stable at balanced levels in a forceful manner, as well as comprehensively use policy measures to stabilise expectations.

- Turkey introduced a 15% reserve requirement for FX-protected Lira deposits and is to withdraw TRY 450bln-500bln liquidity from the market through the change in reserves, according to Reuters.

FIXED INCOME

- 10yr UST futures lacked direction after yesterday’s heavy selling pressure ahead of supply and after the initial jobless claims data although prices are off their worse levels after support held at 112.00.

- Bund futures languished below 133.00 and near the prior day’s trough after its recent one-way slide.

- 10yr JGB futures were choppy as participants digested the latest inflation data and with prices largely ignoring the improved demand at the enhanced liquidity auction from Japan.

COMMODITIES

- Crude futures were supported as sentiment somewhat improved and Chinese participants entered the fray.

- OPEC+ moved the online panel a day later to August 3rd (prev. August 2nd), according to Reuters sources.

- US Senate voted to block sales of US strategic oil reserves to China, according to Bloomberg.

- Spot Gold was uneventful with prices contained as the greenback held on to recent spoils.

- Copper futures gradually edged higher with a mild tailwind amid China’s support measures.

CRYPTO

- Bitcoin eked mild gains in otherwise rangebound trade beneath the psychological USD 30,000 level.

- US House Republicans introduced a new digital assets oversight bill that aims to establish a regulatory framework to protect crypto investors, according to CoinDesk.

- FTX sues Sam Bankman-Fried and other former executives to recoup hundreds of millions of dollars of alleged fraudulent transfers, according to Reuters.

NOTABLE ASIA-PAC HEADLINES

- China’s NDRC released policies to boost electronic product consumption and encourages scientific research institutes and market entities to apply domestic AI technology to improve the intelligence level of electronic products.

- NDRC also issued measures to promote automobile consumption and are to encourage regions with purchase restrictions to issue annual purchase targets as soon as possible, according to Reuters.

- China is to explain anti-espionage law and mineral export restrictions to Japanese, US, South Korean and EU company executives on Friday, according to Jiji.

- US ambassador to China was hacked in the China-linked spying operation, according to WSJ sources.

DATA RECAP

- Japanese National CPI YY (Jun) 3.3% vs. Exp. 3.5% (Prev. 3.2%)

- Japanese National CPI Ex. Fresh Food YY (Jun) 3.3% vs. Exp. 3.3% (Prev. 3.2%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jun) 4.2% vs. Exp. 4.2% (Prev. 4.3%)

GEOPOLITICS

- White House’s Kirby said cluster munitions are now in Ukrainian hands and are being deployed in the field, while he expects to see another round of Ukraine support in the coming days.

- Russia is not preparing to attack civilian ships in the Black Sea despite US claims, according to RIA quoting the Russian ambassador to the US.

- US Central Command said the US is to deploy a marine unit following Iran’s recent attempts to seize ships.

UK/EU

NOTABLE HEADLINES

- UK PM Sunak reportedly eyes holding the UK general election in November 2024 to allow the economy as much time as possible to recover before going to the polls, according to Bloomberg citing sources.

- UK PM Sunak’s ruling Conservative party won Boris Johnson’s former parliamentary seat of Uxbridge and South Ruislip but lost the seat of Somerton and Frome, as well as the Selby and Ainsty seat in the by-elections, while the Selby loss broke the record for the largest Tory majority overturned at a byelection by Labour since 1945, according to The Guardian’s Pippa Crerar.

DATA RECAP

- UK GfK Consumer Confidence (Jul) -30.0 vs. Exp. -26.0 (Prev. -24.0)

Loading…

https://www.zerohedge.com/markets/stocks-slump-after-nq-pullback-though-china-support-offset-apac-impact-newsquawk-europe