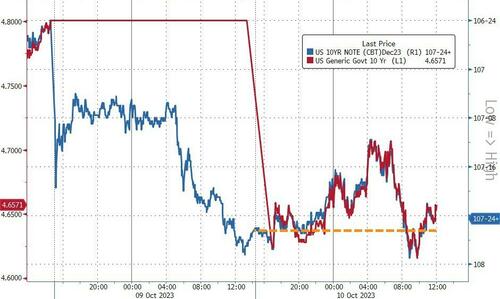

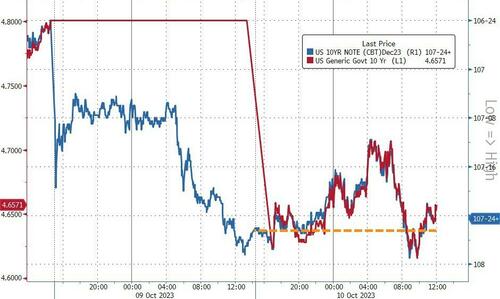

With bond traders coming back to work after yesterday’s Columbus Day market closure, yields actually ended practically unchanged on the day (from where futures-implied levels closed yesterday)…

Source: Bloomberg

But since Friday’s cash close, yields are significantly lower (10-14bps lower)…

Source: Bloomberg

With 2Y Yields back below 5.00% for the first time in almost a month…

Source: Bloomberg

And rate-change expectations have pushed lower after yesterday’s dovish FedSpeak from Jefferson and Daly…

Source: Bloomberg

Equity markets trod water overnight and then took off again at the cash open with Small Caps leading the charge. Around 1300ET the market took a dive as headlines hit of a second carrier group being sent to Israel and also a very ugly 3Y auction which ratcheted equities lower. Things stabilized a bit but then selling pressure hit in the last few minutes…

Mostly thanks to another big short squeeze…

Source: Bloomberg

0-DTE traders aggressively faded today’s rally…

Source: SpotGamma

For context, the Nasdaq and Small Caps are up over 4% from Friday’s post-payrolls lows..

Energy stocks are the best since Friday’s close and Banks the worst, but all sectors are green…

Source: Bloomberg

Nasdaq Composite topped its 50- and 100-DMA but was unable to hold them today…

VIX was squeezed back to a 16 handle

The dollar continued its recent leak lower – back at one week lows…

Source: Bloomberg

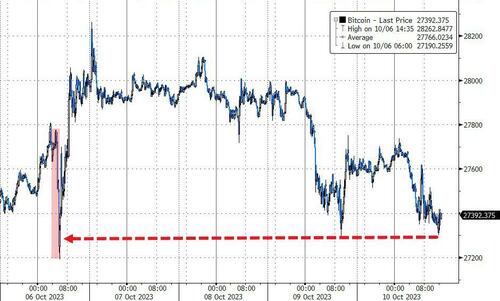

Bitcoin pushed back lower today after an overnight bounce, back to payrolls lows…

Source: Bloomberg

Oil prices were modestly lower from yesterday’s surge higher after Israeli attack with WTI holding above $85…

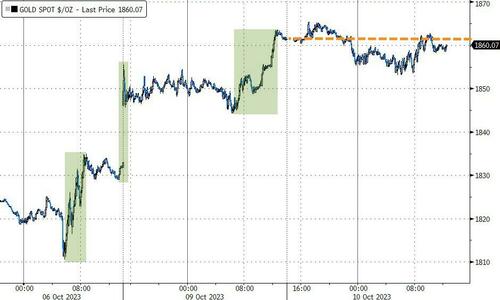

Gold was basically flat on the day holding post-payrolls gains…

Source: Bloomberg

Finally, two interesting regime shifts.

Tighter financial conditions suggest stocks should be considerably lower…

Source: Bloomberg

…and the decline in reverse repo utilization (and reserves at The Fed) suggest the S&P should be notably higher…

Source: Bloomberg

…perhaps the former tightening is ruining the flow from the latter’s shrinkage and pushing them into Bills not Big Tech.

Loading…

https://www.zerohedge.com/markets/stocks-extend-post-terror-attack-gains-oil-bonds-gold-flat