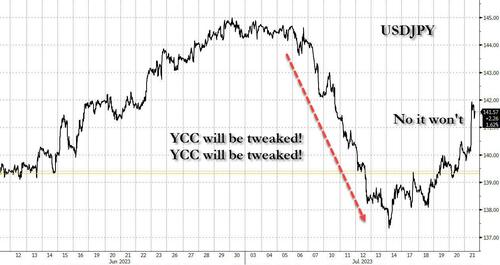

As we observed earlier this week, the yen has seen a surge in volatility and been on a rollercoaster ride in recent weeks following a rise in speculation that – as a result of spiking transitory inflation – the BOJ may tweak its Yield Curve Control beyond the current +/- 0.50bps band on the 10Y (everyone still remembers the catastrophic consequences of the last such “tweak” when the BOJ had to spend hundreds of billions in US dollars to avoid a collapse in the JGB market).

So despite very clear messaging from both Reuters…

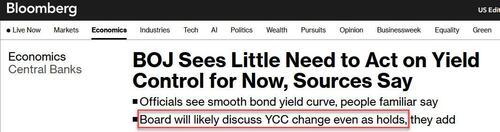

… and Bloomberg…

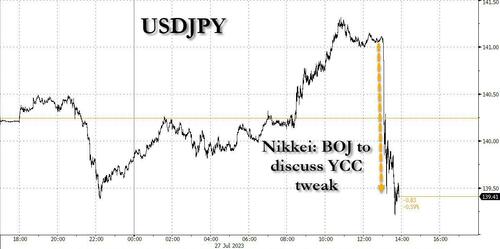

… that despite the heightened drama (thank you momentum chasing Mrs Watanabe) potential leaks and heightened speculation, the BOJ would do absolutely nothing, moments ago – at 2am local time because that’s how BOJ “sources” roll – Japan’s Nikkei reported that the Bank of Japan “will discuss tweaking its yield curve control policy at a policy board meeting Friday to let long-term interest rates rise beyond its cap of 0.5% by a certain degree” in “what would be a shift toward a more flexible policy approach.”

The more flexible approach is, of course, necessary assuming Japan’s inflation – which is now above that of the US – remains sticky.

The only issue is that it won‘t: Japan has seen inflation spikes on many previous occasions only to fizzle quickly thereafter courtesy of the country’s demographic doom loop.

To that point, just before the BOJ decision tonight we will get the latest Tokyo inflation data (Friday morning Japan time), and is forecast to have risen at a slower rate than in June. The headline and core rate, which excludes fresh food, are both predicted to decline to 2.9% from 3.2% prior. If reality meets expectations it would be the first time since September both have fallen below 3%. That would bolster Governor Ueda’s case that the central bank should stick with its stimulus settings until it sees signs of more sustainable inflation.

It’s not just Ueda though: earlier this morning, Japan’s top government spokesman also said he hopes the central bank continues to conduct appropriate monetary policy in order to achieve its 2% inflation target in a sustainable and stable manner (that said, Chief Cabinet Secretary Hirokazu Matsuno declines to comment on what will be discussed at the Bank of Japan’s 2-day policy meeting from Thurs).

So in what appears to be a bizarre attempt to stop out yen bears before the Yen resumes its plunge again after the BOJ announcement, the Nikkei decided to telegraph what (according to its anonymous, FX trading sources) will be discussed today… even though we already knew that.

Recall, last week Bloomberg reported that since a portion of the BOJ board is in favor of acting early on YCC, “a discussion of the matter is likely” even if it won’t lead to anything. Furthermore, it won’t be the first time: “the BOJ also discussed the need for any change to YCC at the previous meeting, they said.“

And then there are the practical considerations: the BOJ in early July surveyed major banks about how much they would expect long-term rates to increase if yield curve control were adjusted or scrapped, according to sources familiar with the discussions. The banks see 10-year yields as likely to top 0.5% if the policy were dropped, pointing to the risk of a surge in market rates if the central bank abandoned its controls entirely. Translation: the BOJ has learned its bond market lesson from the January YCC disaster and will only act when it absolutely has to, not when inflation has peaked and is already declining.

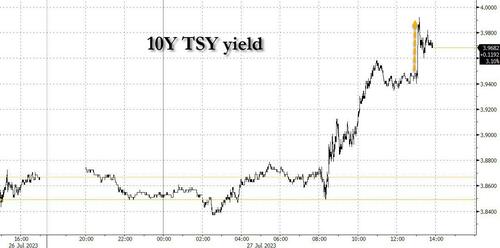

But leaking the BOJ was hardly the intention of the Nikkei article: rather, it was to stop out traders who were getting a little too complacent (don’t be surprised if we learn in a few months that Powell had called Ueda this week) and the moment the 2am local time Nikkei report hit, 10Y TSY yields (which will be dragged sharply higher should JGBs implode which they will if YCC is tweaked again) spiked and were this close to breaching the key 4% psychological level…

… while the USDJPY tumbled anew as the yen surged on what is another clear attempt at stopping out yen bears.

And then there were stocks which promptly reversed much of the day’s gains…

… while sending the Dow deep in the red for the day and in danger of ending what would otherwise be a record streak of 14 uninterrupted green closes, the longest in DJIA history. In any case, even if we do have a red close today, after the BOJ does nothing tonight, the stupid meltup will resume on schedule.

Loading…

https://www.zerohedge.com/markets/stocks-dump-yields-yen-spike-after-regurgitated-trial-balloon-boj-will-discuss-tweaking