Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below, we look at gold in a broke(n) world of hubris, debt, Realpolitik and a rising east.

For well over a year, we’ve openly declared that the Fed is cornered.

That is, Powell knows he needs higher rates to allegedly “fight” inflation but also knows that raising rates into an historical debt bubble means one “credit event” (or “crunch”) after the next, from tanking USTs in 2020 to tanking banks in 2023.

It seems only now that the WSJ (Mr. Timiraos), along with a former Indian central banker (Mr. Rajan) is confessing the same.

Human, All Too Human

But Powell is more than just a cornered banker, he’s an insecure and “human, all too human” political man with admittedly more concerns about his legacy than a tanking market or painful recession.

As he himself declared: “I will not become ‘just another Arthur Burns,’” which translates to: “I’m not going to be a dove as the economy and markets race toward a financial horror-film that the Fed itself directed since Greenspan killed capitalism.”

Thus, and with almost zero regard for common sense, basic math and history, this cornered banker is trying instead to be Paul Volcker, but has forgotten that Volcker raised rates to fight inflation when public debt was at $800B not $32T.

Not Volcker, All Too Volcker

Furthermore, Volcker led the Fed at a time when USTs were loved rather than unloved.

Since 2014 in general, and 2022 in particular, the level of foreigners dumping Uncle Sam’s IOUs is breath-taking and makes it all too clear to any holding even a rudimentary understanding of the bond market that the US will be financing its own deficits at levels (and trillions) which end empires.

For years, the US has pretended to be what it once was: Respected and credible. But its balance sheet, as argued elsewhere, is no different than just any other banana republic.

Like the very nations Uncle Sam once mocked (think Argentina), the US has been issuing more IOUs despite a world that is buying less of the same.

Thus, and like Argentina circa 2000, the US has already begun regulating (forcing?) US banks and money market funds to buy its over-issued debt, with the end result of simply crushing some of those banks and money markets in a toxic wave of QT.

With friends like the Fed, who needs enemies?

And like the banana republics, the US is now in a corner wherein inflation is too sticky to cut rates yet bank (and other credit participant) pains are too high to raise rates.

Clear, All Too Clear Bar Tab

Since 2014, it has become harder to export Uncle Sam’s inflation (or launder its debt burdens) by expecting other nations to simply absorb his increasingly unwanted USTs and openly embarrassing bar tab.

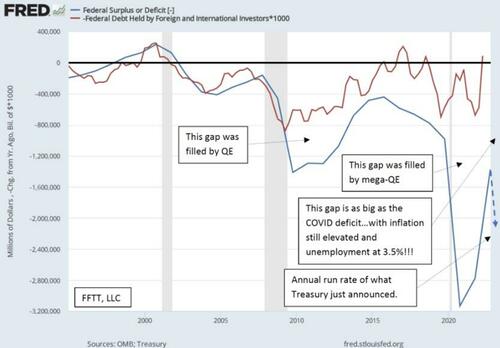

As the following graph provided by Luke Gromen makes “clear, all too clear,” the gap between Uncle Sam’s embarrassing deficit (blue line) and the meek level of foreign buyers of his debt (red line) reveals two historical points:

- US deficits are appalling; and

- Who or what is going to fill that “gap”?

Kill the Currency or Save the (Broken) “System”?

If the history of broke empires, nations and regimes is any guide, and if the psychology of short-sighted politicians seeking re-election (i.e., bribing the electorate with mouse-clicked dollars) over sound-money is equally so, then we can be almost certain that the Fed and Uncle Sam’s end-game boils down to choosing between saving the system or killing the currency.

For us, the choice ahead is fairly obvious, which also means that gold, which hovers like a vulture over debased currencies, will be licking its chops in the years ahead.

China Licking Its Chops and Expanding Its Swaps

But gold is not the only vulture about to get fatter in an increasingly de-dollarized backdrop.

China, love it or hate it, has been sharpening its knives and forks for years in a patient and long-sited play to win an economic and currency war with Uncle Sam.

After all, emperors for life, like Xi, can afford to be more far-sighted than US politicians who prostitute sound money responsibilities for easy money re-election.

This may be why tiny-thinkers like Trudeau, or folks who probably never had a girlfriend in college, like Klaus Schwab, have such a crush on Xi and the kind of power he can wield without having to worry about silly little things like democratic elections…

It’s Good to be King (But not a USD)

Getting back to those emerging market “banana republics” which the US so often mocked, it’s worth noting that Argentina has just doubled its currency swap access to $10B, but here’s the kicker: The swap is in CNY not USD…

Meanwhile, Pakistan just signed a deal with Russia to buy crude oil, but guess what, Pakistan is paying that bill in CNY and not USDs…

See a trend?

It’s the very trend we warned of the moment Uncle Sam weaponized the world reserve currency in those insanely myopic (i.e., stupid) sanctions against Russia in early 2022.

Settlement deals like these (FX and energy) almost certainly involve swap lines with Chinese fingerprints and with countries (like Argentina and Pakistan) who hold less and less US FX reserves, which is no surprise given that few countries wish to hold “reserve assets” that can be turned off at a political whim.

In short, if the world is slowly but steadily looking outside the USD, it’s because the US has slowly but steadily shot itself (and its Dollar) in the foot since March of 2022.

In fact, throughout Q1, global central banks have been engaging in record-breaking levels of CNY currency stacking (109B yuan by end of March) via FX swap lines.

To date, the Chinese central bank (PBOC) hasn’t listed the names of these nations and banks, but the SLOW trend away from an increasingly distrusted USD and rising China is pretty hard to ignore as more nations are using the yuan for energy and real asset deals while holding the USD/UST merely to pay down old debts.

Why?

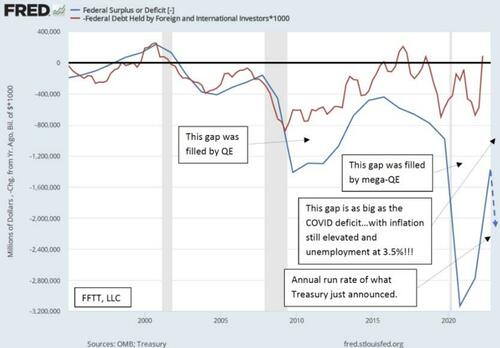

Because the rest of the world is seeing what American media outlets and store-bought DC politicos are refusing to confess, namely: China was winning the global trade war even before DC weaponized the USD:

See the trend?

Playing the Long Game in the World of the Short-Sighted

But as indicated in many recent articles and interviews, the CNY is not about to become the world reserve currency.

It’s bond market and rule of law are decades beyond such credibility or use.

But this doesn’t mean that China or its CNY has to worry, for the yuan’s increasing role as trade a settlement currency rather than reserve currency suits China just fine for now.

In Gold They Trust

Furthermore, China, like Russia, is fully aware of the Realpolitik (i.e., distrust) of their laws and bond markets.

They know, as George Washington knew, that “nations have neither permanent friends nor enemies, just permanent interests.”

In other words, for China and Russia to win the long game (rather than putting green), they need to win the trust of other nations by appealing to their interests rather than platitudes.

And nothing holds the interests of skeptical yet USD-tired nations like gold, as gold, love it or hate it, is far more trustworthy than men, be they from DC, Buenos Aires, Moscow, Beijing or Paris.

How the USD Lost Trust

For a brief window after 1944, when the USD was backed by gold, other nations could trust the USD as a life raft in times of crisis.

Nixon, of course, sank that raft in 1971 and took away the gold standard to ensure his re-election at the long-term expense of his country.

How’s that for a “profile in courage”?

Now, some 50+ years later, the slow end of the USD as a life-raft, trusted asset or even trade currency is reaping the costs of its political, human and monetary sins.

Weaponizing that dollar only added to this gradual yet eventual fall.

China is now creating more liquidity with each passing day, as it has swap lines with just about everyone.

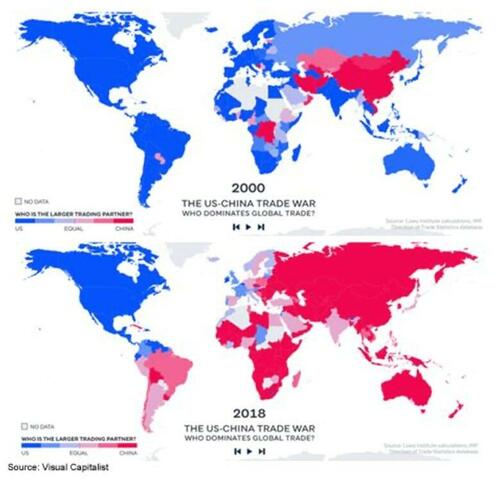

Xi, like Putin, are also stacking gold at un-disclosed levels, but even the official numbers are telling.

And what are they telling us? Or what, for example, is Sergei Glasyex concocting behind the scenes?

Well, I’m guessing it has a lot to do with building trust the old-fashioned way—namely: With gold in the mix of its trade settlement platforms and swaps.

In the coming years, this “guess” is going to emerge as a reality, and like a chess-player or polo player, I, like many other investors, nations and central banks, am playing gold three moves ahead as gold becomes a net settlement asset.

Peak Cheap Gold

Notwithstanding the otherwise undeniable and changing patterns in the aforementioned global FX and geopolitical stage, one merely has to consider the seemingly unlimited supply of otherwise unwanted USTs with their intrinsically limited duration and then compare such toxicity with a simple bar of gold, which, unlike Uncle Sam’s IOUs, has an infinite duration and limited supply.

In short: Supply and demand still matter.

Toward this end, it’s worth noting that gold discoveries are shrinking in supply as demand for the same is, and will continue, to rise.

In the 1990’s, for example, there were over 180 major gold discoveries (i.e., 1m oz. and higher); in the 2000’s there were 120 such discoveries, 40 in the 2010’s and NONE since 2019.

Think about that for a second or two.

Also, think about the simple fact that Uncle Sam, the holder of the world reserve currency, has been hiking rates into the greatest debt bubble in once proud national history, thereby increasing US solvency risk (and thus pointing toward dollar debasement down the road) with neon-flashing clarity.

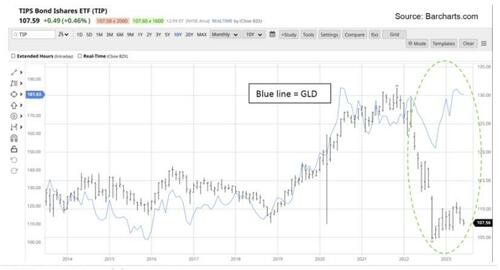

Gold, quite simply, is separating from real rates and acting more and more on its own, as the fear trade gets easier and easier to see, and gold gets easier and easier to, well…TRUST.

Stated even more simply, demand for this “pet rock” is increasing as its supply is falling.

If you took high school econ, then you know what that does to the price of gold and the fall of the USD’s purchasing power.

Again: See the trend?

Loading…

https://www.zerohedge.com/markets/solid-gold-broken-world