By Sagarika Jaisinghani and Farah Elbahrawy, Bloomberg markets live reporters and strategists

Shaky Earnings Outlook Can’t Stop Rally For Now

Europe’s earnings outlook seems increasingly shaky. So, it’s a good thing that it might all be priced in already.

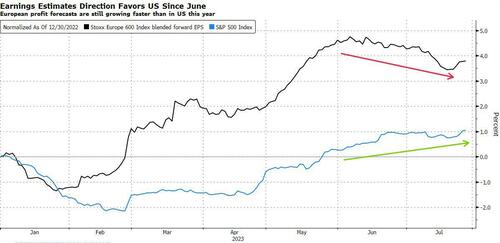

While prospects for Corporate America appear brighter as recession worries ease, a host of challenges are spoiling things across the Atlantic, including a wobbling economy and unhelpful gains in the euro. Still, that hasn’t stopped the Stoxx 600 from grinding about 3% higher since the start of the season.

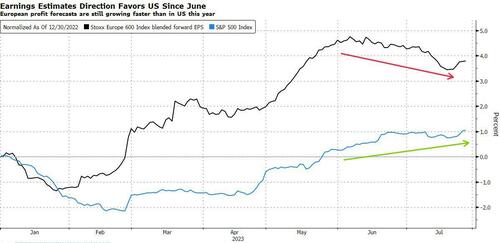

About halfway through this term’s report card, earnings for the MSCI Europe are down by almost 12% on a year earlier, according to data compiled by Bloomberg Intelligence. That’s the first drop since 2020. Over in the US, companies are presenting the most earnings beats in two years.

European investors spoiled by this year’s stock rally have been quick to show their disapproval of underwhelming numbers, as the post-earnings slumps in luxury-goods giant LVMH, software company SAP and UK lender Barclays illustrate. On average, companies that missed profit estimates so far have underperformed the index by 2 percentage points on the day — the harshest punishment in almost six years, data from Bank of America shows.

That said, there are some hints that investors have started to price in the bad season. For example, while many firms in the chemicals sector issued profit warnings in June, share-price reaction has moderated with each new announcement. Croda International fell sharply on the day of its warning, but Clariant, BASF and Wacker Chemie all rose after theirs.

Worryingly, Europe’s fortunes are only set to diverge further from the US in the second half, as business activity weakens and sticky price pressures test the resilience of the region’s consumers, market participants say.

European conditions continue to look challenging,” says Stephanie Niven, a London-based portfolio manager at investment firm Ninety One. “There’s still a lot of inflationary pressures and we need to see the impact of the ECB’s monetary policy begin to feed through. Europe could feel more pain in the coming nine months.”

Star billing in next week’s earnings line-up goes to Anheuser-Busch InBev, BP and BMW, who will face investor scrutiny of how they are navigating stubbornly high costs at a time of slowing spending power in households across the region. Meanwhile, a weakening dollar threatens to be a headache for exporters such as distiller Diageo and health-care group Fresenius. Beverages group Davide Campari has already lamented the negative currency effects it fears it will have to manage.

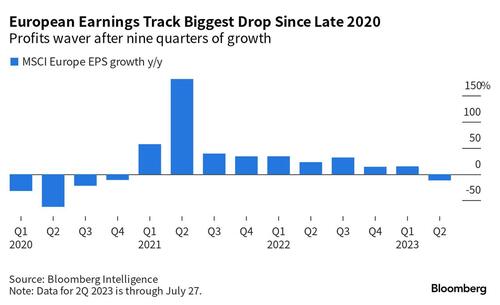

There are early indicators of bad news ahead for European earnings in the rest of the year. Analysis by BofA shows that Europe’s earnings revision ratio — the measure of profit upgrades against downgrades — is at its lowest since January for the past four weeks. UBS strategists say the region’s CEOs are sounding the most gloomy on earnings calls since the Covid pandemic.

The team at Sanford C. Bernstein is more optimistic. While strategists Sarah McCarthy and Mark Diver acknowledge the darker economic outlook, they argue regional equities are already priced for a slowdown. Cheaper valuations compared with the US also make Europe more attractive in the event of a slowdown, they said.

Grace Peters, EMEA head of investment strategy at JPMorgan Private Bank, also sees scope for European equities to rally after underperforming the US since April. “We believe that there is a catch-up trade here, particularly if European earnings hold up versus consensus expectations this earnings season, as they have so far,” Peters says.

Loading…

https://www.zerohedge.com/markets/shaky-earnings-outlook-cant-stop-rally-now