By Jan-Patrick Barnert, Bloomberg markets live reporter and strategist

August has played out largely as expected, with equities recording a familiar seasonal slump. But don’t get too excited about September, either: historical charts suggest it’s a time of frailty for stocks. Add to that underwhelming trading volumes and a reluctance right now among dip buyers to stick their necks out.

The Stoxx Europe 600 Index did stray from the script a little this month, trimming its losses half way through with some help from supportive economic data. Fans of statistical and seasonal patterns might want to stay on the side of caution, however, given that September shows a weak average performance over almost every historical time frame ranging from five to 30 years.

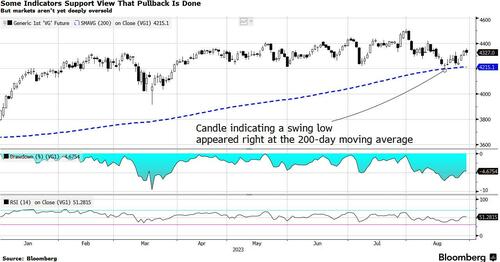

While the bounce from this month’s drop of as much as 5.5% in the index looks solid for the moment, it’s not yet clear that investors are convinced by the recent bottom. And if they aren’t, the latest move higher might be met with fresh selling given that the benchmark has struggled to break out of its sideways range since May.

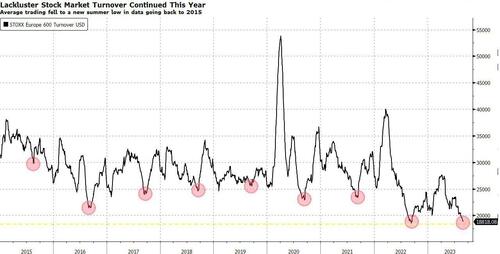

This summer’s trading volumes are among the lowest in recent years and some of the support the market received this year from systematical buyers and short covering looks to have faded. “The August pullback was more due to buyers’ strike than a broad de-risking,” notes Barclays strategist Emmanuel Cau. “Positioning hasn’t reduced much.” Still, the rotation to cash, bonds and defensives indicates caution and the tailwind from investors being underweight is “largely gone,” he says.

Are buyside and fundamental investors ready to act on an improving interest-rates and economic outlook and spend some more of the money they’ve kept sidelined on riskier assets? “The honest answer is no, not yet,” says Axa Chief Investment Officer Chris Iggo. “There is not much that is clearly good value,” he says, adding that “cash continues to be attractive” with investors preoccupied by the complexity of US growth, inflation and the impact of policy.

With no shortage of data points to study in the quest to decipher what lies ahead for stocks, the focus is clearly on inflation and economic growth. However, UBS Global Wealth reminds us that the consumer is also a factor not to forget. “Our take is that the US consumer, and therefore the economy, should remain fairly resilient well into 2024,” says Mark Haefele, its chief investment officer. “But monetary policy is restrictive, and this will weigh on consumer spending and growth in the coming quarters.”

With the buzz of excitement around AI quietening and this year’s broad re-risking rally seeming to have run its course against a backdrop of data uncertainty, picking quality stocks has emerged as the best option for many in the market. August, indeed, has served up a clear defensive footprint with miners, autos and industrial goods all falling 5% and more during the wider market’s second-biggest pullback of 2023.

There’s a similar picture when slicing equities by factors, with styles like quality, size and dividends outperforming growth, volatility and leverage.

“Easy gains from normalization in positioning are behind us,” is how Cau at Barclays sums it up.

Loading…

https://www.zerohedge.com/markets/september-needs-new-buyers-keep-rebound-going