Authored by Simon White, Bloomberg macro strategist,

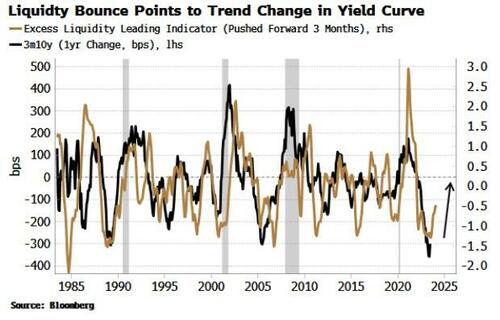

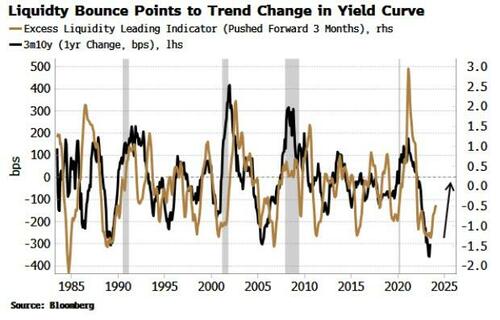

Increasing excess liquidity indicates that the nascent steepening in the 3-month vs 10-year yield curve will continue.

The yield curve in this cycle has wrong-footed many in the depth and persistence of its inversion.

We have to go back to the early 1980s to see a curve this inverted.

The 3m-10y yield curve has shown tentative signs of bottoming in the last two months – with today’s ADP jobs data adding to steepening pressure – and the rise in excess liquidity posits it should keep steepening.

There have been a few false starts, where it looked like the curve was durably steepening, only for the Fed to renew its hawkish credentials. However, this time we have seen a pronounced upturn in excess liquidity which has often preceded yield-curve steepenings.

How might the curve steepen? Rate cuts (or their expectation) are usually the way, but they are becoming less likely.

The jobs market so far (at least based on the surface data, subject to revision) has held up well enough to keep the Fed in play. Not enough economic weakness could be seen before inflation re-accelerates again which I think it will do, as soon as in six months.

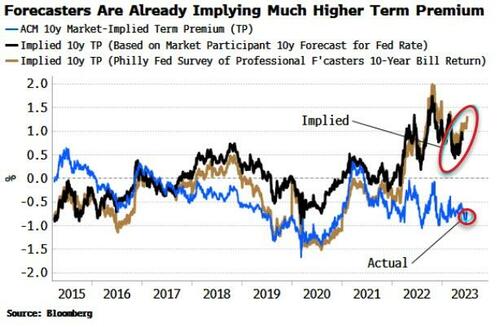

If that is the case, and price growth starts rising again once the current disinflation impulse peters out, term premium looks exposed to re-pricing higher, as bond holders demand extra compensation for inflation that – contrary to expectations – is not over.

Term premium has been surprisingly subdued despite the highest inflation in decades, as the market believes (for now) the Fed will ultimately rein it in.

Yet implied term premium from forecasters is already considerably higher than term premium itself.

If it were to match implied values, the 3m-10y yield curve would be at least 100 bps steeper, all other things equal, corroborating the message from excess liquidity that the curve’s trend has changed.

Loading…

https://www.zerohedge.com/markets/rising-liquidity-points-yield-curve-trend-change