Authored by Simon White, Bloomberg macro strategist,

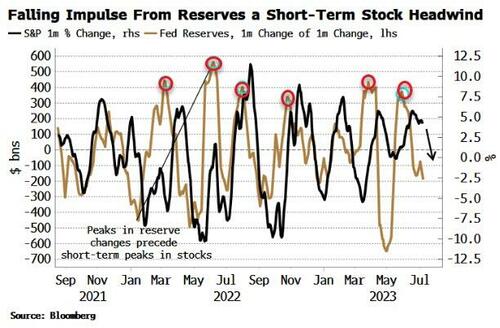

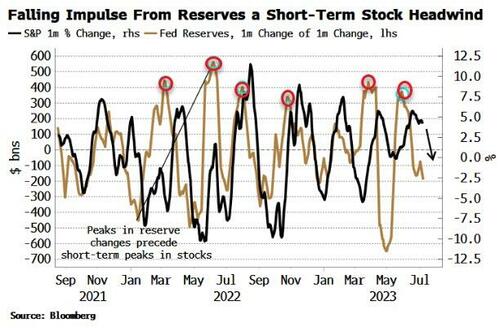

Falling reserve growth continues to be a near-term risk factor for equity markets.

The Federal Reserve’s QT program is now back on track, with the size of the Fed’s balance sheet now lower than it was prior to its emergency expansion in the wake of March’s banking fracas.

But the impact has been blunted as reserves – which back risk assets and USTs – are still higher than they were in March by about $180 billion. The Fed’s recent hawkishness has taken out some of the “pivot” from the rates curve and kept bill yields at a more attractive level than the RRP facility.

Money market funds have drawn down the RRP by ~$300 billion since March, and this source of reserves has allowed them to on net rise even though the total size of the balance sheet is lower by ~$50 billion.

But it is the change of the change (the “impulse”) of reserves that is key for risk assets, and on this basis, reserves are currently a headwind for stocks.

The falling impulse in reserves explains the resistance equities ran into to towards the end of June.

Thursday’s rise in yields shows stocks remain vulnerable.

On the plus side, long positioning has come off (according to CoT data for speculators), while the S&P’s beta to CTA funds has been falling, suggesting they are less long, and therefore less likely to exacerbate any sell-off.

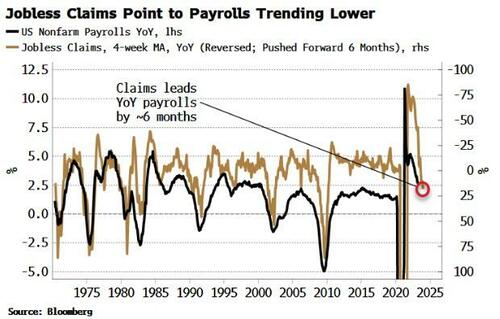

Payrolls is a noisy data series month to month, but the trend is down, and leading indicators project that will continue. For instance, the deterioration in jobless claims is consistent with payrolls continuing to trend lower.

Stocks may therefore escape the worst today, but it’s unlikely to be plain sailing for them until the impulse from reserves starts to rise again.

Loading…

https://www.zerohedge.com/markets/reserves-continue-pose-short-term-risk-stocks