Authored by Simon White, Bloomberg macro strategist,

There is no big hedge fund short in US equities to boost equity prices. But investors’ large underweight could have the same effect as they chase the market higher.

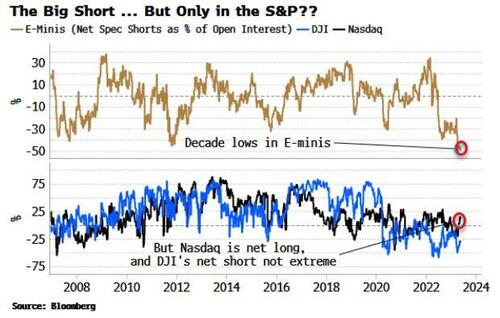

It would be easy to fixate on data showing the largest net-short in S&P E-mini futures in over 10 years. But as is so often the case in finance, things are not always as they first seem. This supposed big short does not match positioning in the Nasdaq and the Dow Jones. It would be odd if speculators, i.e. hedge funds, were only short the S&P.

Instead, it is likely the data is being affected by the index-arbitrage behavior of hedge funds. Index arbitrage was once the preserve of banks, but fell victim to the Volcker Rule. This was introduced in the wake of the GFC, and limited banks’ proprietary trading activities, including specifically the realization of short-term arbitrage profits. Index arbitrage involves selling index futures to clients and buying baskets of stocks against it.

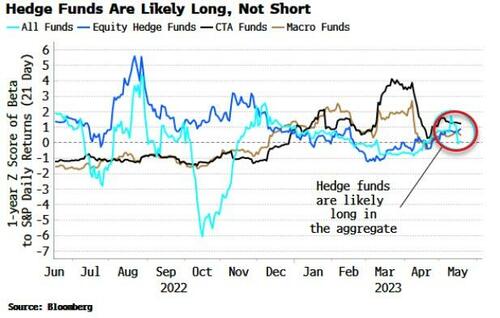

So hedge funds, classed as speculators in the CFTC positioning data and not commercials as banks are, moved in on this business, which means the data cannot be taken at face value. One way to see this is by looking at the beta of HFRX hedge fund returns and equity-market returns. Hedge funds in the aggregate – as well as macro funds, equity long-short and CTAs – are likely neutral to net long equities, not short.

But this does not mean FOMO can’t power the market higher. AI is helping to fuel sentiment. We will see whether the current burst of innovation with Large Language Models suffers from the “Amara effect,” where the short-term impact of a new technology is overestimated, but underestimated in the longer term. Either way the equity rally is being driven by AI-related stocks, with the top three year-to-date performers in the S&P being Nvidia, Meta and Advanced Micro Devices.

Throw in a large investor underweight, with BoA’s Fund Manager’s Survey showing the most negative net percent of managers who are overweight US equities than any other major asset class, then even without the mythical “hedge-fund short,” markets have the propensity to keep heading higher for the time being.

Loading…

https://www.zerohedge.com/markets/price-chasing-not-short-covering-will-drive-market-higher