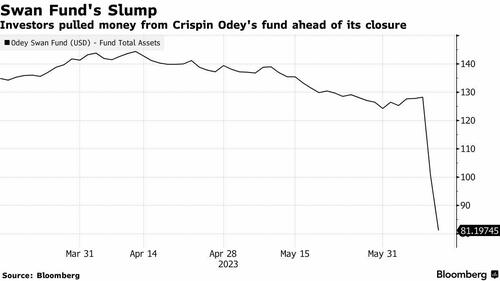

Odey Asset Management (OAM) appears to be swiftly winding down operations after the Financial Times, one week ago, published a #MeToo style hit-piece against its founder Crispin Odey. The allegations led several major banks to cut prime brokerage services. And it even led to the ousting of the billionaire fund manager from his own fund.

On Thursday, multiple media outlets obtained a letter from OAM partners to clients, informing them OAM is in “advanced discussions” to transfer funds and employees to other asset managers. The partners said the move was subjected to regulator approvals and due diligence.

“Acting in the best interest of our investors and our staff has continued to be our primary concern over the past few days. We will continue to update you,” the letter, which was obtained by Reuters.

The letter continued: “We have been, and remain in constructive dialogue with our service providers and key counterparties … It has however become clear that some investment management activities of the partnership are affected by recent events.”

The London-based investment firm, which up until this month managed $4.3 billion, had its banking relationships with Morgan Stanley, Goldman Sachs Group Inc., and JPMorgan Chase & Co. severed days after the FT piece. Then OAM gated the Brook Developed Markets Fund after it faced “redemption requests in excess of ten percent of the net asset value” on Monday.

By Wednesday, UK lawmakers requested answers from Financial Conduct Authority into the fund.

OAM, like many hedge funds, relies on leverage from prime brokerage service providers to make risky bets. Cutting access to those services and soaring redemptions likely led to its quick demise.

Even though OAM booted Odey on Saturday, explaining “he will no longer have any economic or personal involvement in the partnership” that appears not to be enough as the letter to clients likely signals the firm’s end.

Last week, Odey told Reuters the FT report was a “rehash of an old article and none of the allegations have been stood up in a courtroom or an investigation.”

Loading…

https://www.zerohedge.com/markets/odey-asset-management-advanced-discussions-rehouse-funds-after-founder-sexual-assault