It was inevitable that in a week when the world’s most important transnational emerging market organization, the BRICS, added 6 new members to its ranks, that BofA’s chief investment strategist would have something to say about it, and sure enough, it is the main highlight of his latest Flow Show note (available to pro subs here).

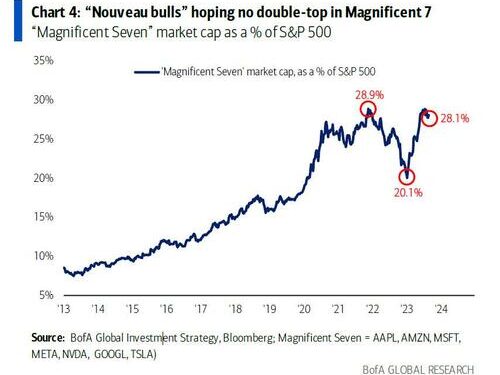

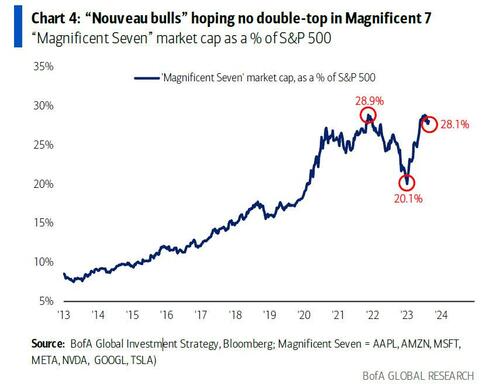

But before we get into the emerging weeds, so to speak, a quick detour into what until now had been the driving force of market upside in 2023, and what according to Hartnett no longer will be: we are talking of course, about the “Magnificent 7” stocks, which as the BofA strategist notes are up 93% YTD (largely on the back of the AI bubble which however, may have just popped judging by the “sell the news” slump in NVDA in the two days since reporting record blowout earnings). As Hartnett notes, with regional banks still down 37% YTD, and China real estate bonds crashing 55% in 2023, losers are still losing, while the “nouveau bulls” are hoping there is no magnificent double top in the magnificent 7.

Loading…

https://www.zerohedge.com/markets/nyet-zero-hartnett-warns-nasdaq-just-peaked-while-brics-11-end-globalization