By Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley

10-year US Treasury yields eclipsed 4% this past week for the second time this year and the third time since 2008. The most recent move began in mid-May from a level 70bp lower than current market yields. The yield on 2-year US Treasury notes rose more than 100bp during the same period – sending the 2s10s yield curve back to its most inverted levels of the hiking cycle.

Despite these large moves, US Treasury yields rose less since mid-May than the yields on UK, Canadian, and Australian government bonds. UK gilt yields were up the most since mid-May, with 10-year yields higher by almost 100bp and 2-year yields by 175bp. What common denominator could explain these moves? The repricing of market-implied central bank policy paths.

Market-implied policy paths repriced higher for all G10 central banks except the Bank of Japan. Since mid-May, markets have added 175bp of further rate hikes from the Bank of England, between 75-100bp from the Reserve Bank of Australia, and between 50-75bp from the Bank of Canada. In contrast, markets only repriced the Fed and European Central Bank rates higher by 30-40bp.

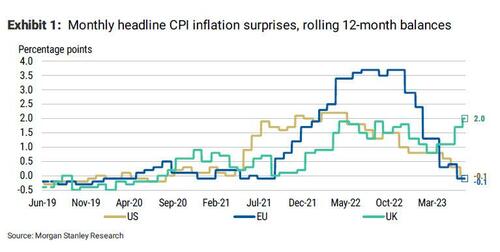

A common foe – inflation – helps to explain these differences in repricing. Where inflation data surprised the most to the upside – the UK, followed by Australia, then Canada – we see the largest repricing of market-implied central bank policy rates. Where inflation surprises were smallest (the US and euro area), inflation stickiness and hawkish central bank rhetoric helped to reprice policy.

Despite the challenging environment through 1H23, global government bonds performed reasonably well, returning just over 1% year to date. While investors would have been better off in cash, the performance of bonds stands in sharp contrast to the -12% total return in 2022. In addition, the year-to-date performance of global government bonds sits just below its average going back nearly 30 years to 1994.

We expect government bonds to perform much better in the second half of the year, with returns depending critically on the outlook for inflation, central bank policy rates, and associated guidance. On those scores, our economists forecast a supportive environment. Indeed, most bond markets are already pricing the peak central bank policy rates that our economists expect. In some cases, markets price even higher rates.

In addition, our economists foresee a moderation in economic activity and inflation beyond what many central bankers would consider their modal expectations. Such a deceleration – even if associated with a soft landing – could see central banks adjust their hawkish stances, according to the impression our Chief Global Economists, Seth Carpenter, got at the ECB’s annual conference.

Of course, in the best environments for government bonds, central banks actively ease monetary policy, an environment our economists see taking shape a year from now. As such, expected returns for global government bonds this year, while admirable, may be closer to the average calendar year return since 1994 of 4.25% than the 8-12% returns typically delivered during recessions.

At the same time, we think that government bonds could perform even better than average, considering the risks that markets are not pricing in. Recent moves in bond markets suggest that investors have warmed to the idea that monetary policy lags are shorter than in years past, despite policymakers’ uncertainty about their timing and effect. The risk to this increasingly popular view, naturally, is that lags have not shortened and this time is not different after all.

The possibility that central bank hikes to date may weigh on economic activity into year-end, and that any remaining hikes may not come until mid-2024, increases the attractiveness of government bonds, in our view. Hence, while they’ve been battered and bruised, government bonds look primed for a comeback in 2023.

Loading…

https://www.zerohedge.com/markets/morgan-stanley-why-bruised-and-battered-government-bonds-are-primed-comeback