Morgan Stanley US equity strategist Michelle Weaver joins a growing number of Wall Street analysts warning about deteriorating conditions for consumers. Weaver wrote in a recent note to clients that travel companies exposed to “lower-income consumers” are beginning to experience “demand weakness.”

Weaver’s note, published on Sept. 21, follows JPMorgan consumer trader Brian Heavey’s truth bomb on Sept. 20 when he turned extraordinarily negative on the US consumer. Since then, Mike Wilson, Morgan Stanley’s chief investment officer, penned a note about the ‘consumer falling off a cliff.’

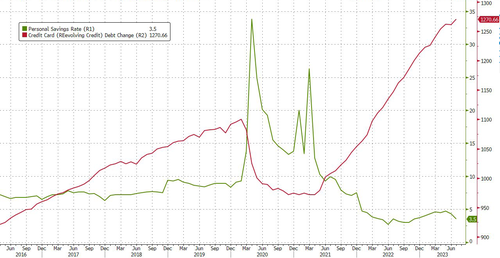

“A significant proportion of US Consumers have drawn down their Covid era excess savings and our US Economics team estimates that lower-income households have fully exhausted their excess savings, while middle- and higher-income households are less willing to spend their excess savings on consumption,” Weaver told clients.

Her note was published after the Fed’s latest beige book that warned: “Some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending.” And a period when credit card growth wanes, and the consumer has never been in worse shape.

Also, the three-year pause in student loan payments has expired, as some 28 million borrowers are imminently facing a restart in payments. This will add a $15.8 billion monthly headwind – or $190 billion per year – to US consumer spending.

Understanding all of this, Weaver’s view is that some of the first impacts of a slowdown will be “travel companies exposed to the lower-income consumer showing indications of demand weakness.”

Here’s more from the note:

-

Low-Cost Airlines Slowing. A number of major airlines attended Morgan Stanley’s Industrials Conference last week and there was a marked difference in tone between the Ultra Low Cost Carriers (ULCCs) and Legacy Airlines. Two high-utilization ULCCs noted that demand has taken a significant, sharp turn down and these companies now expect pre-tax margins to be significantly lower. These companies may have higher exposure to low-income consumers (though we note that some other ULCC carriers with potential exposure to low-income consumers said that demand was trending in line with expectations). Meanwhile, the legacy carriers were much more positive on the demand environment and their primary concern remains higher fuel costs.

-

Hotels Are Showing Signs of Demand Weakening.TheGaming&Lodging industry has also been cooling especially in the economy segment of the market. Overall revenue per available room (RevPAR) for US hotels has been tracking at a lower trajectory for 3Q vs 2Q and hotel occupancy is down vs 2019. Economy RevPAR has been consistently down 3-4% yoy since April. While on the high-end, luxury RevPAR was down 4% in April, then flat to -2% through summer and down -3% MTD for September. Economy and luxury hotel demand is driven by leisure, consumer travel rather than business travel. There has also been weakness in the regional casino space over the past 6 months, which is primarily exposed to lower- and middle- income consumers.

-

Consumers Intend to Shift to Cheaper Modes of Travel. Our most recent AlphaWise Consumer Survey shows that consumers want to keep traveling and 58% of respondents are planning to travel over the next 6 months. Net spending plans for international travel declined from 0% last month to -8% this month, while domestic travel plans without a flight moved higher. This indicates that consumers want to keep traveling but are increasingly looking at taking cheaper trips and are choosing destinations they can drive or take a train to vs having to fly.

She added:

Travel has shown signs of cooling, led by areas exposed to low-income consumers. This problem could broaden out crimping company margins and earnings. We believe there could be more downside ahead and are underweight the Consumer Discretionary sector.

None of this is a surprise, as we’ve already reported in July, “Airline Stocks Hit Turbulence After Alaska Air Signals Slowing Demand,” and last month, “American Airlines Cuts Earnings Forecast As Headwinds Hit Airline Industry.” In mid-July, we said, “Cash-Strapped Consumers Travel By Bus To Destination Hotspots.”

Still no recovery in airline stocks.

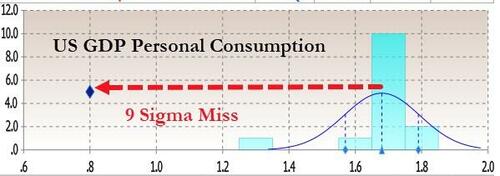

Meanwhile, last week, Personal Consumption data in the latest GDP revision collapsed in a stunning 9-sigma miss to expectations.

… and there goes the “strong” Bidenomics economy as “strong” data points only last about a month and then are downgraded.

Beware of a faltering consumer.

Loading…

https://www.zerohedge.com/markets/morgan-stanley-chilly-season-travel-middle-class-consumers-falter