Just a few weeks after Morgan Stanely declared that the Fed’s hiking cycle was over, this morning the bank’s chief economist Ellen Zentener pulled a sudden U-turn, and conceded that “the bar for a July hike is significantly lower than we had initially expected and have added a 25bp hike to our policy path. The revision is a level shift upward to 5.375% fed funds end-23, and 4.375% end-24.”

And in a conclusion that will infuriate her chief equity strategist Mike Wilson, who as noted yesterday, expects stocks to tumble in the second half to fresh cycle lows (i.e., around 3,600) as a hard landing recession slams stock earnings, Zentner said that she continues to see “a soft landing staving off rate cuts to next year.”

Yet in a typical sellside plot twist, Zentner’s assessment is hardly the bullish take a superficial read of her notes suggest: after all, by now it is common knowledge that the Fed’s aggressive rate hikes have just one purpose – to accelerate the recession and contain the inflation the Fed’s policies triggered in 2020/21. In this context, Morgan Stanley adding another rate hike to its forecast after previously calling it a day on the Fed’s hiking calendar, means that the bank now expects the economy to enter stall speed that much faster.

Zentner confirmed as much, writing over the weekend that a question that has come up in all of the bank’s client meetings last week was “when do they expect to see the first negative payroll print”?

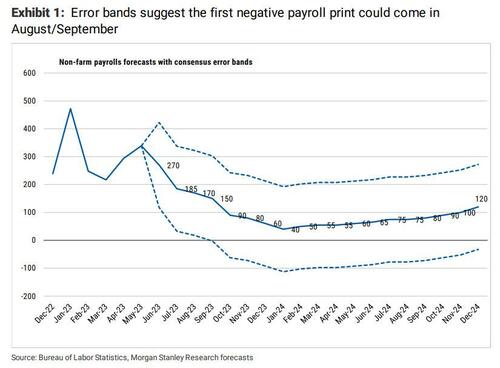

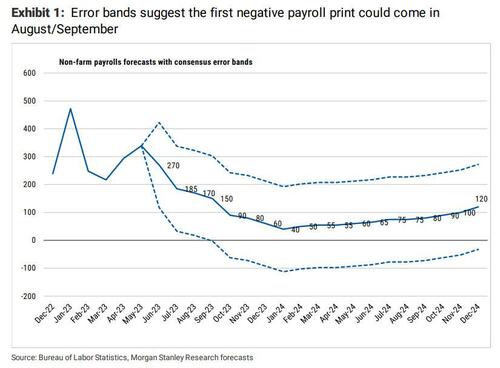

In response, she says that she now forecasts a significant slowdown in monthly nonfarm payroll (NFP) growth this year that falls below the 90k replacement rate in 4Q23,and bottoms in January 2024 at 40k before gradually improving to 72k/month in 2024. With job growth that slow, Zentner warns that “is highly likely that at least one of those prints will be negative, especially since prior to Covid just one standard deviation on total nonfarm payroll growth was ~200k.”

This means that either August or September could mark the first negative payroll print, according to MS. The chart below shows the bank’s NFP forecasts with confidence intervals that are constructed using historical consensus forecast errors. In particular, the error bands are two standard deviation bands using consensus forecast error volatility from 2010 to 2019 (one standard deviation band of the consensus forecast error is 75k). Using this method, August is on the line and September is the first time the band moves into negative territory.

This matters because according to Zentner, “on a negative payroll print this year, risk-off sentiment in financial markets may soar, especially as investors remain on recession watch despite the strengthening soft-landing story.” Worse, in typical fashion, the Fed is unlikely to be quick to react: “this can make the FOMC at times seem tone deaf to the incoming data, though it is more likely a reflection of a Committee that makes low-frequency decisions in a high-frequency world. A negative payroll print could be a one-off, more supporting evidence could be needed,and that takes time.”

More in the full note available to pro subs.

Loading…

https://www.zerohedge.com/markets/morgan-stanley-sees-first-negative-payroll-print-august-or-september