By Jane Foley, Senior FX Strategist at Rabobank

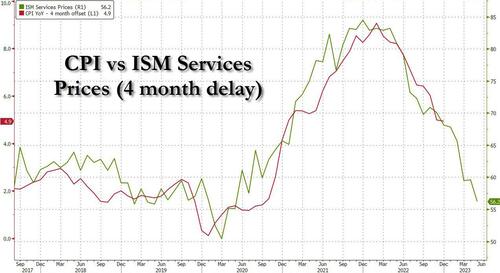

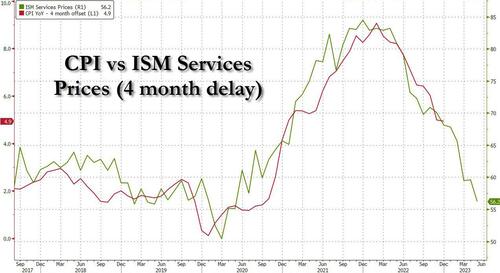

A string of US economic data releases yesterday emboldened the view that the US economy is perhaps a little less resilient than previously thought. The final composite PMI number for May was revised lower as activity in the services sector showed less expansion than in the preliminary figure. The ISM services index barely displayed any growth at all as new orders slowed and employment dropped below the critical 50 level. Although ISM data indicated that prices paid remained robust, it dropped to a three year low. This will likely come as a relief to the Fed and is certainly supportive of the view that the Fed can afford to pause its tightening cycle this month. In the same vein, US factory orders for April registered softer than expected numbers. The tone of the data brought to a halt the better tone of equity markets, took the steam out of yesterday morning’s oil price rally and initiated some downside pressure on treasury yields which weighed on the USD.

Ahead of the June 13-14 FOMC meeting, most of the month’s key US data releases are now out of the way. The obvious exception is the US CPI inflation report which is due on June 13. Since Fed officials will be adhering to the pre-FOMC meeting blackout period, there is a strong possibility that trading in US assets could be subdued for a few days. That said, T-bill issuance may draw more market attention that is often the case in the coming weeks as the Treasury plays catch up after restricting the issuance of paper in the run up to the debt ceiling deal. Yesterday’s 3- and 6-month t-bill auctions were both well received.

The AUD lurched into life last night on the back of a second consecutive surprise tightening from the RBA overnight. That said, the 25-bps rate hike was hardly a bolt out of the blue. The RBA has maintained a tightening bias and last week the risks of a move today had increased. The April CPI print registered a quicker than expected 6.8% y/y, up from a previous reading of 6.3% y/y. On Friday, Australia’s Fair Work Commission announced a 5.75% minimal wage increase and made a technical change to the classification for the national minimum wage which the union says will result in a hike of 8.6% for the lowest paid workers. This sparked market concerns that aggregate wage growth could top the 4% level, from 3.7% in the last quarter and supported the concerns of RBA Governor Lowe that a combination of weak productivity growth and higher wages deals in Australia could make it more difficult to push CPI inflation back to the Bank’s 2% to 3% target range.

The RBA has been accused of being one of the most dovish G10 central banks. Following this morning’s rate hike its policy rate stands at 4.1%, which is below the levels of many of its peers. Even so, the move has triggered the debate about whether the market could be underestimated the hawkishness of other central banks. Market forecasts of peak ECB interest rates have edged up since the start of the week, mostly on the back of yesterday’s hawkish commentary from ECB President Lagarde. She underscored her full commitment to fighting inflation, describing price pressures as ‘strong’ and reiterating that there is no clear evidence that underlying inflation has peaked. Her comments are despite the recent round of softer CPI inflation readings in parts of the Eurozone. The headline rate for the region eased to 6.1% y/y in May from 7.0% in April, while the core measures edged down to 5.3% from 5.6%. This had resulted in some softening in market pricing for future ECB rate hikes and had strengthened the view that policy-makers were honing in on peak rates.

Loading…

https://www.zerohedge.com/markets/mixed-reality