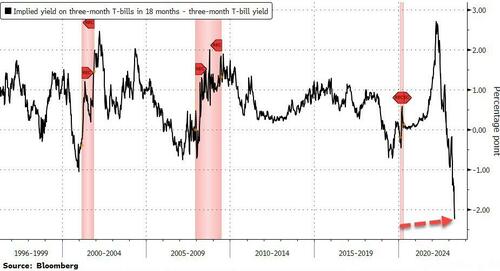

Soaring job cuts (Challenger Gray), increasing jobless claims, rising unit labor costs, paint a very stagflationary picture (and an ECB rate-hike didn’t help) with Jay Powell’s favorite yield-curve-based recession indicator has collapsed to a fresh low (its most inverted ever)…

Source: Bloomberg

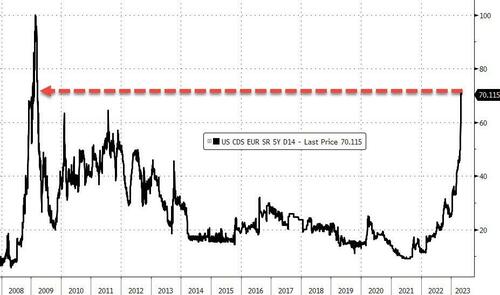

Debt ceiling anxiety remains extremely high…

Source: Bloomberg

And the regional bank crisis is spreading and accelerating…

Source: Bloomberg

Most notably WAL and PACW were clubbed like a baby seal…

Source: Bloomberg

And here is Goldman Sachs to destroy the constant theme from talking heads today that “this is all short-sellers fault”:

The most notable aspect of our fins flows today is that we are seeing mostly long selling (both HF and MF) vs the past few days where HF short pressing was the primary narrative.

Today’s long sales include higher quality stocks which suggests today is a manage exposures/cut risk session.

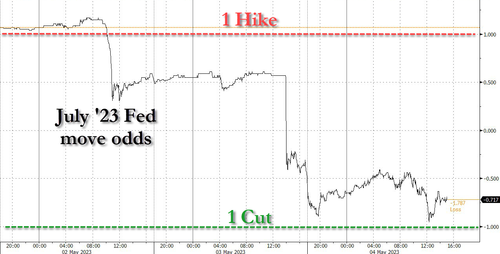

And the market is now pricing in a 60% chance of rate-cut in July!…

Source: Bloomberg

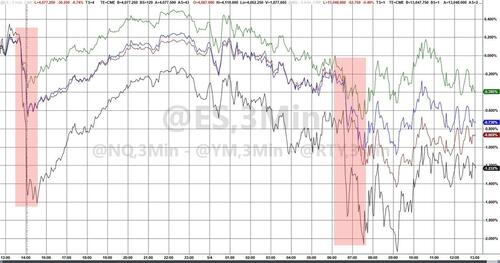

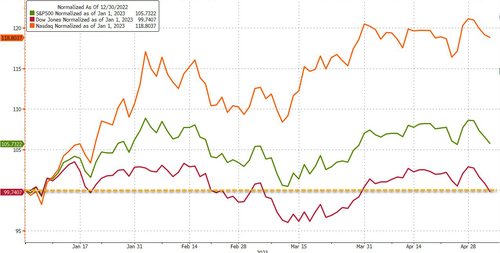

On the day, the broad US majors were all red, led by Small Caps. Nasdaq was the prettiest horse in the glue factory, still down 0.5% though…

No short squeeze triggered today as ‘most shorted’ stocks extended yesterday’s late lunge lower…

Source: Bloomberg

0-DTE traders aggressively bid against the opening plunge in stocks, and prompted

Source: SpotGamma

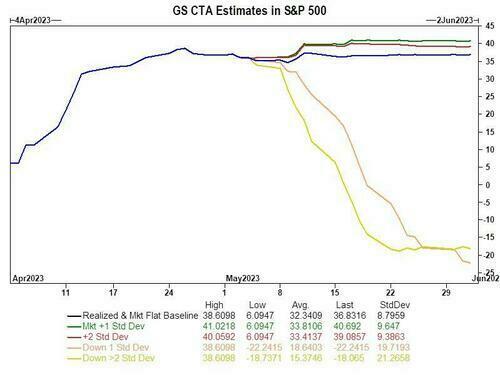

And it may be time to brace for more pain as Goldman warns that CTA Trigger levels are starting to flip today for SPX

-

Short Threshold: 4085

-

Medium Threshold: 4046

-

Long Threshold: 4133

Over 1 week:

-

Flat tape: -$7.8bn to sell (-$3.3bn to SELL in S&P)

-

Up tape: -$2.3bn to sell (-$0.7bn to SELL in S&P)

-

Down tape: -$50.5bn to sell (-$20.1bn to SELL in S&P)

Over 1 month:

-

Flat tape: -$25.6bn to sell (-$12.2bn to SELL in S&P)

-

Up tape: +$18.9bn to buy (+$3.1bn to BUY in S&P)

-

Down tape: -$218bn to sell (-$54.2bn to SELL in S&P)

All of which pushed The Dow into the red for the year…

Source: Bloomberg

As money fled stocks, it went into bonds and bullion.

Treasuries were mixed with the short-end outperforming (2Y -5bps, 30Y +4bps). On the week, the divergence between short- and long-bond yields is evident…

Source: Bloomberg

The 2Y Yield closed at its lowest since Sept ’22…

Source: Bloomberg

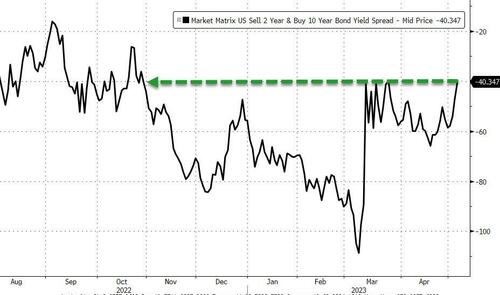

Interestingly, while Powell’s favorite signal is still inverting further, the 2s10s curve is steepening (just as it does ahead of every recession) to its least inverted since Oct ’22…

Source: Bloomberg

The dollar was choppy on the day but ended marginally lower…

Source: Bloomberg

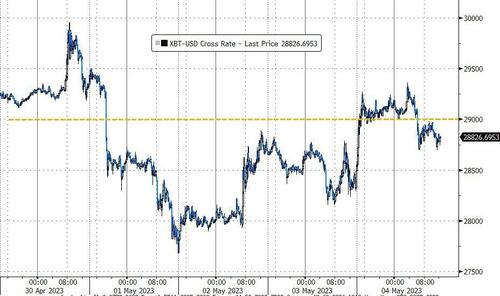

Bitcoin pushed back above $29,000 intraday, but was unable to hold it – but ended marginally higher on the day…

Source: Bloomberg

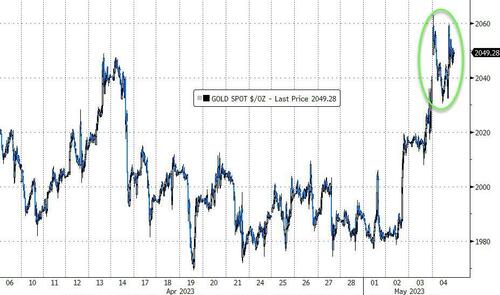

Gold was a beneficiary of the safe haven flows and spot prices tagged $2,060 intraday – within a few ticks of its all-time record high (the barbarous relic is screaming that The Fed has lost control)…

Source: Bloomberg

Oil prices ended marginally lower but the big news last night’s flash crash as clearly come fund liquidated bigly…

Some context for WTI…

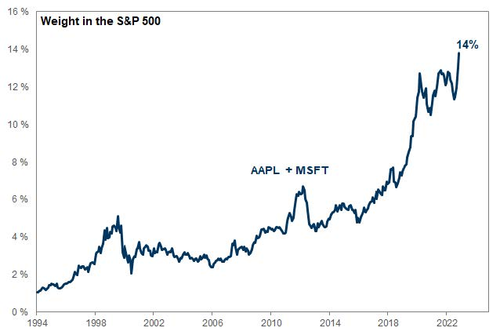

Finally, all eyes will be on AAPL earnings tonight… and rightly so given the following chart…

This won’t end well…

Loading…

https://www.zerohedge.com/markets/regional-bank-rout-stagflation-signals-spark-bond-bullion-bid