Authored by Simon White, Bloomberg macro strategist,

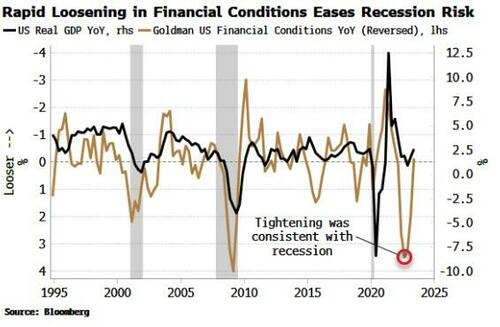

The stock rally has loosened financial conditions sufficiently to pare back a little near-term recession risk.

A recession in the US by the end of the year is still the base case.

The Recession Gauge, an indicator consisting of 14 recession sub-models, continues to infer a slump is more likely than not, with half the sub-models currently activated (the threshold for a recession is 40%).

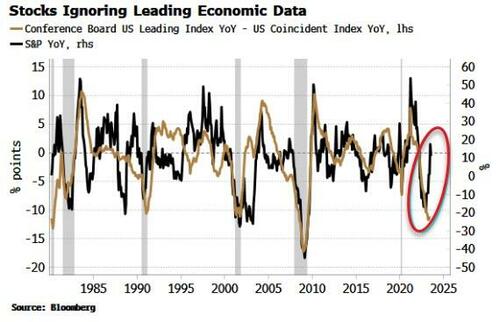

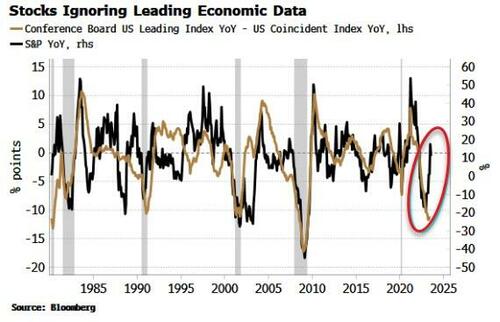

But the stock market has risen this year in defiance of weak data. As the chart below shows, the S&P normally has a very close relationship with the outperformance of leading versus coincident data. But this year stocks have rallied despite still-weak leading data (which includes the yield curve, building permits, average weekly hours worked, unemployment claims, etc).

George Soros’ reflexivity has played a part here. Markets and economies interact in myriad ways, sometimes reinforcing each other negatively, sometimes positively.

The stock market is the main driver of financial conditions (as conventionally measured). Thus the rally has loosened financial conditions that were at a tightness normally consistent with an oncoming recession. The easing in financial conditions has been sharp enough to reduce recession risk.

Thus an improvement in the financial economy may be having a material positive impact, through sentiment and the wealth effect, on the real economy.

These leaves two questions:

-

will a recession be averted altogether, and

-

what is the outlook for stocks?

As mentioned, a recession is still the base case. The job market continues to slow, and other markers of growth, such as retail sales, are also not in great shape, despite ebullient month-on-month data.

Such slowdown signs are likely to rein the Fed in, even as inflation begins to show signs of stickiness or a re-acceleration. Pressure would come off real rates after the sharp tightening they have seen, keeping stocks relatively supported (at least in nominal terms) despite the signs of economic slowing.

One risk factor to bear in mind is credit. All bets on a mild recession, or one being avoided altogether, would be off if the credit markets were to face serious turbulence.

Loading…

https://www.zerohedge.com/markets/looser-financial-conditions-take-edge-recession-risk