The panic that gripped financial markets in March over the regional bank bailout, which was in large part due to exposure to the foundering commercial real estate space in general and the office sector in particular, is all but forgotten even though in the six months since underlying fundamentals have only gotten worse, underlying cash flows in the CRE space have slowed further, and . In fact, the only thing that has changed is the record amount of “papering over” the Fed has enabled with the central bank’s BTFP facility hitting an all time high every week. Meanwhile, if one eliminates the impact of the BTFP program, which is scheduled to sunset in around 6 months, regional banks are effectively insolvent as the following chart showing large and small banks’ cash/assets with and without BTFP makes clear.

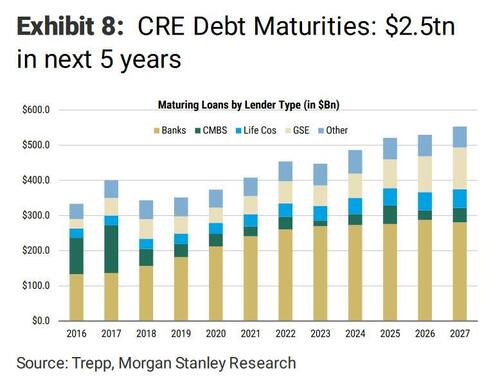

But not everyone has decided to just ignore the elephant in the room, which represents a staggering $2.5 trillion in debt maturities and rollovers at much higher rates, over the next five years:

Speaking to Bloomberg TV, Kyle Bass said the US banking industry will lose hundreds of billions of dollars from exposure to the office market amid shifting workplace trends and elevated interest rates.

“Banks in the US will lose $200, $250 billion in office over time here,” Bass, founder of Hayman Capital Management best known for correctly predicting and profiting from the bursting of the subprime housing bubble, said on Monday. “And there’s about $2 trillion of equity in the banks so it’s like a 10% hit to US banking equity.”

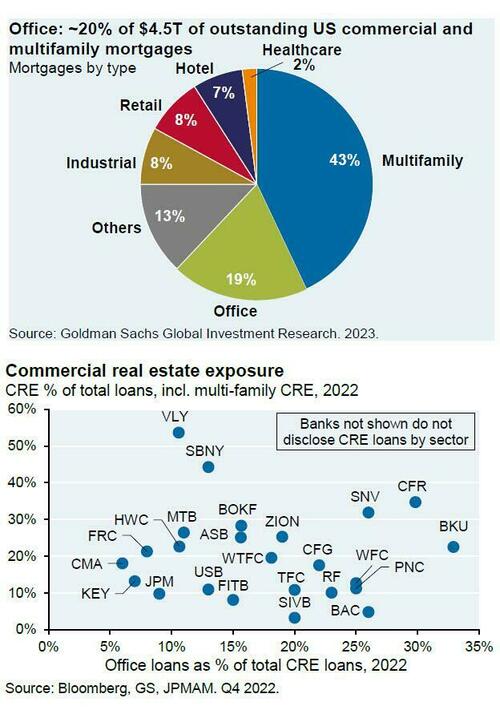

According to Bass, who echoes our views on CRE, office space is the main sector that will report losses in the commercial real estate market, while industrial and multi-family will remain strong.

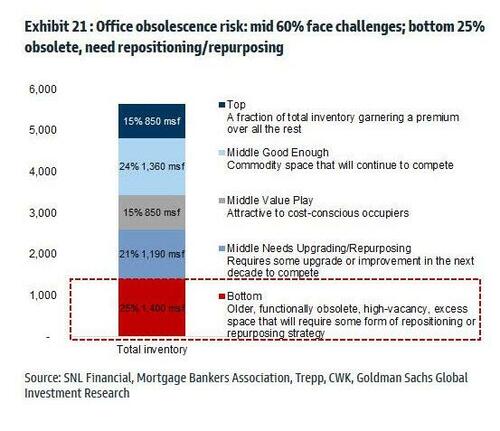

Bass previously predicted that older and lower-quality office buildings in the US will need to be razed to reset the market; as Bloomberg notes, he’s not alone in that view. Canadian investor Vincent Chia is buying up proprieties only to tear them down and profit from the land.

Elevated interest rates and tight lending conditions are making it even more difficult for property developers. While Bass doesn’t expect the Federal Reserve to raise interest rates much higher, he expects wages to remain strong.

“We are going to have a sticky situation with wages and we are going to see the economy coming down in the next six to eight months,” Bass said.

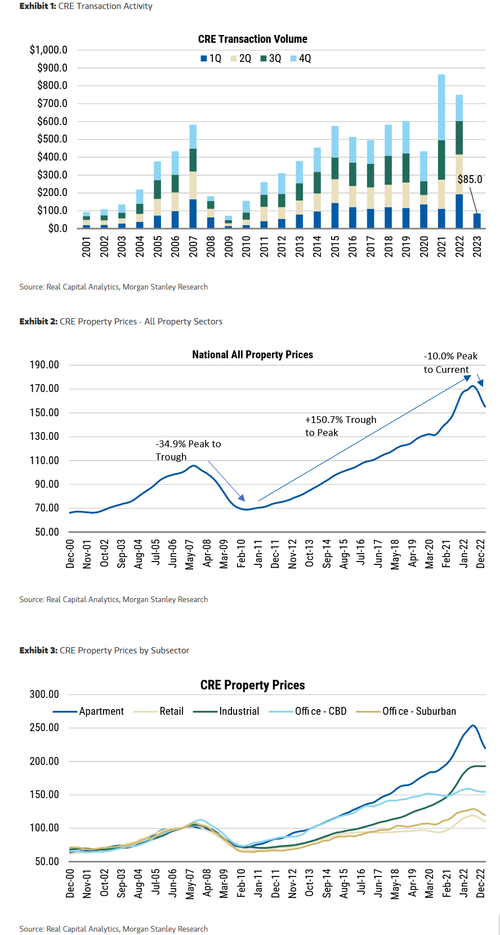

While some may call Bass’s view alarmist, there are even more draconian takes: in a report from the Morgan Stanley team published recently, the bank said that it expect CRE prices to be down – 27.4% from peak to trough in 18-24 months this cycle, not that far off from the -34.9% drop during the GFC in 34 months, which will range from -15% for apartments to a stunning -40% for office. That compares to just a CRE price decline of -12.1% (for the 10 months ending May 2023) ranging from -3.3% for industrial to -13.8% for apartments. For those who missed our report on the topic, here is where property price forecasts stand:

- (=) All CRE property types: peak to trough decline of -12.1% in 10 months. In-line with prior Morgan Stanley estimates (MSe) of -27.4% in 18-24 months.

- (-) Apartments: peak to trough decline of -13.8% in 10 months. Worse than MSe of -15% in 18 months and see downside risk to -20% in 18 months.

- (=) Office – suburban: peak to trough decline of -8.8% in 10 months. Better than MSe of -40% in 24-30 months. Majority of price decline still ahead as transaction activity and distress sales rise

- (=) Retail: peak to trough decline of -8.1% in 10 months. Better than MSe of – 30% in 24-30 months. Majority of price decline still ahead as transaction activity and distress sales rise.

- (=) Office – CBD: peak to trough decline of -7.3% in 14 months. Better than MSe of -40% in 24-30 months; the MS quant model sees upside risk to -28% on lack of distressed sales. Majority of price decline still ahead.

- (+) Industrial: peak to trough decline of -3.3% in 9 months. Better than MSe of -15% in 24-30 months. Majority of price decline still ahead as transaction activity and distress sales rise.

Furthermore, as of a month ago, Morgan Stanley maintained its -27.4% CRE property price forecasts and highlighed the following headwinds and tailwinds to property prices it is monitoring:

- (+) bank stress test and agencies guidance on loan workouts

- (+) soft landing in the economy

- (=) transaction volumes and distressed sales

- (=) fundamental occupancy and NOI growth

- (=) credit spreads below GFC levels

- (=) private capital on the sidelines

- (-) lending conditions

More in the full MS report available to pro subscribers.

Loading…

https://www.zerohedge.com/markets/kyle-bass-sees-banks-losing-quarter-trillion-dollars-coming-office-market-collapse-morgan