By Sagarika Jaisinghani, Bloomberg Markets Live reporter

Interest rates appear to have plateaued and Chinese data is stabilizing, yet investors’ skepticism over Europe’s stuttering economy and equity market shows little sign of ebbing.

The Stoxx 600 index did benefit from the European Central Bank’s suggestion that it may be done hiking rates for now, and from China’s unexpectedly strong industrial production and retail sales figures. Those two drivers helped the index notch its best weekly performance in two months.

But the momentum has since fizzled. European shares tumbled more than 1% on Monday, erasing much of last week’s advance, as worries about higher-for-longer interest rates again gripped markets.

Evgenia Molotova is among those who remains unconvinced of Europe making a comeback. Molotova’s team at Pictet Asset Management remains “slightly overweight” US stocks and “slightly underweight” Europe. Nor is she tempted by the near-record price discount the European market offers relative to its transatlantic peer.

“Europe is almost always cheaper versus America,” says Molotova, who expects the US to outperform Europe in the last quarter of 2023. “Economic data in Europe was quite weak lately and industrials also seem to be more affected by weakness in China.”

Molotova has plenty of company. There has been a record rotation into US stocks, according to BofA’s September fund manager survey. And its latest flows figures, based on EPFR Global data, show European equity funds have endured 27 straight weeks of outflows, with total redemptions of over $46 billion so far this year.

One reason is what BofA calls the “avoid-China” theme — European shares rely heavily on sales to China. But the main factor is America’s economic resilience, with latest data showing a rise in factory production, as well as a drop in inflation expectations. While the US economy chugs along at a robust 2% rate, the euro area is barely growing.

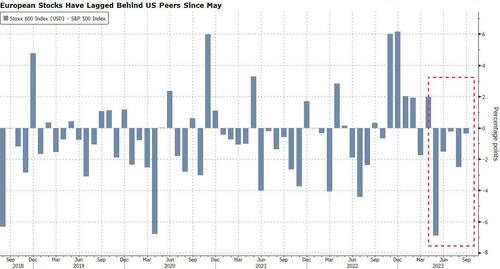

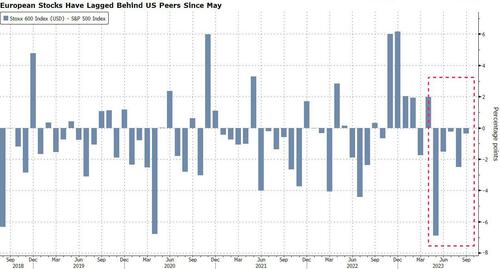

European shares have returned less than 8% this year, half what the S&P 500 has notched. Yet even those gains have overshot the dire macro outlook, JPMorgan strategists reckon. Their analysis suggests that in the past five downturns, euro-zone stocks lost an average 30% versus the US in dollar terms. This year, since May, they have lagged just 14%.

That means another round of underperformance is likely should Europe’s services sector weaken further and bond yields slide, JPMorgan warns.

Such is the gloom about Europe’s economic prospects that even the more bullish forecasters are turning cautious. A July Bloomberg poll showed Goldman Sachs with one of the highest end-2023 targets for the Stoxx 600, but last Friday, the bank trimmed its 3-, 6- and 12-month forecasts, citing rising interest rates, higher energy costs and a sputtering Chinese economy.

Oddo’s head of equity strategy, Thomas Zlowodzki, also returned last week to “a positive stance” on the US versus Europe, reversing a view he held since July. “The US economy is looking more solid in the slowdown that is becoming more evident every day,” Zlowodzki says.

On the corporate results front too, analysts expect earnings to drop 2.1% in Europe and 0.3% in the US in 2023, according to data compiled by Bloomberg Intelligence.

Still, a few lonely Europe bulls remain. Citigroup strategists Mihir Tirodkar and Beata Manthey remain overweight Europe, as they reckon the market already reflects a “fairly pessimistic” corporate earnings outlook and will be able to absorb any further downgrades. In the US, they warn, the market’s expectations of profits leave “little room for error.”

Loading…

https://www.zerohedge.com/markets/its-getting-hard-make-bull-case-europe